Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 17 October 2023 01:45 - - {{hitsCtrl.values.hits}}

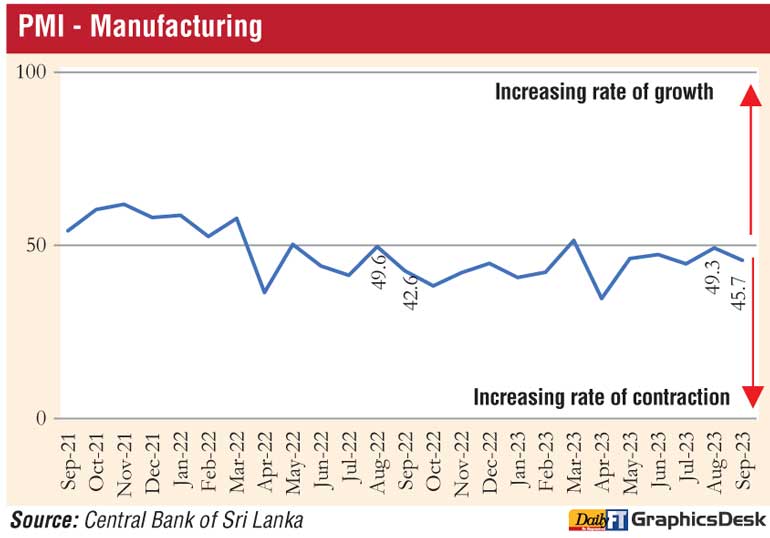

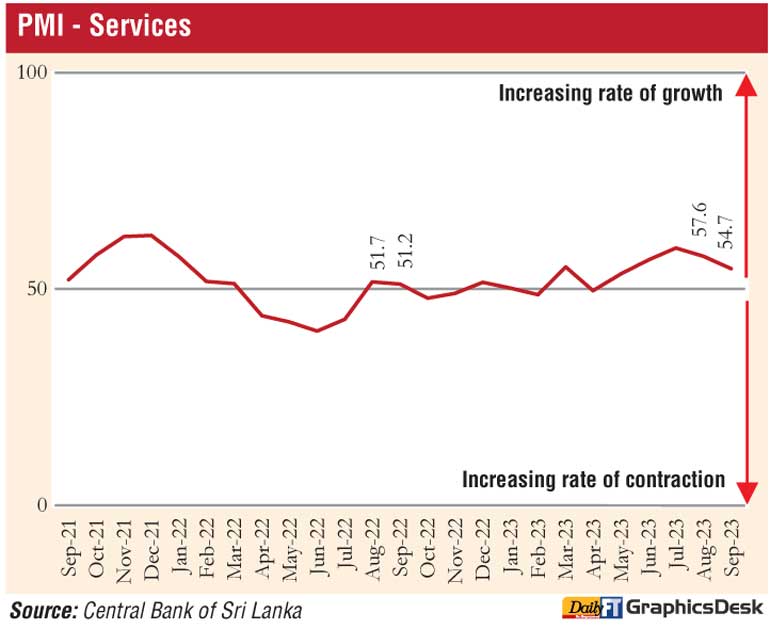

The downturn for the manufacturing sector continues whilst the services sector managed to post a small rebound in September as per the Central Bank-compiled Purchasing Managers Index (MPI).

It said the Manufacturing PMI recorded an index value of 45.7 in September 2023, indicating a contraction in manufacturing activities. This setback was contributed by the subdued performance observed in all the sub-indices.

The decrease in new orders and production was mainly driven by the manufacture of food and beverages and textiles and wearing apparel sectors. Many manufacturers highlighted the challenging business conditions due to the lacklustre consumer demand and the increased availability of imported goods in the market at competitive prices.

Further, the manufacture of textiles and the wearing apparel sector continued to contract due to the ongoing sluggish global demand.

Employment and stock of purchases also decreased in line with the decline in new orders and production. Meanwhile, suppliers’ delivery time shortened during September compared to the previous month.

However, the outlook for manufacturing activities for the next three months remained positive, mainly due to the anticipated increase in demand in the upcoming festive season.

CBSL said the services sector PMI recorded an index value of 54.7 in September 2023, indicating an expansion in the services activities at a slower pace compared to the previous month.

This was led by the increases observed in new businesses, business activities, employment and expectations for activity. Nevertheless, backlogs of works remained contracted during the month.

New businesses increased in September 2023, yet at a slower pace, compared to August 2023, particularly with the increases observed in financial services, wholesale and retail trade, real estate, insurance and education sub-sectors.

CBSL said business activities also expanded in September 2023 showing positive developments in several sub-sectors. Accordingly, business activities in the financial services sub-sector improved further attributed to the gradual increase in credit demand in line with declining lending rates. Further, some positive developments were seen in education and transportation sub-sectors during the month. The accommodation, food and beverage sub-sector also continued to increase, yet at a slower pace, following the slight decline in tourist arrivals observed during the month.

Employment increased compared to the previous month owing to recruitments that took place in several companies, while backlogs of work decreased at a higher pace.

Expectations for business activities for the next three months continued to increase at a higher pace in September led by the expected seasonal demand and improvements in economic activities amid relaxed monetary conditions.