Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 11 April 2023 00:20 - - {{hitsCtrl.values.hits}}

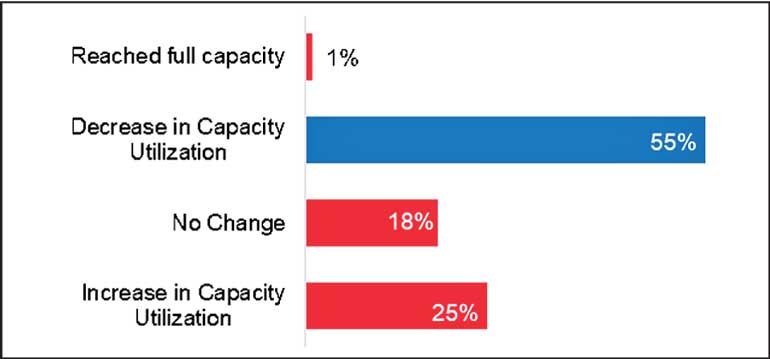

55% of exporters experienced a decrease in capacity utilisation during the second half of 2022. This is a significant fall compared to the first half of 2022

The outlook for the first half suggests that capacity will continue to be underutilised

|

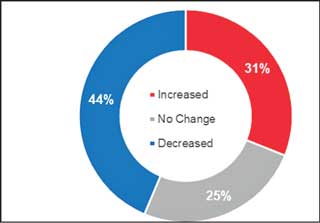

| 44% of firms saw a decline in export revenue during the second half of 2022 |

|

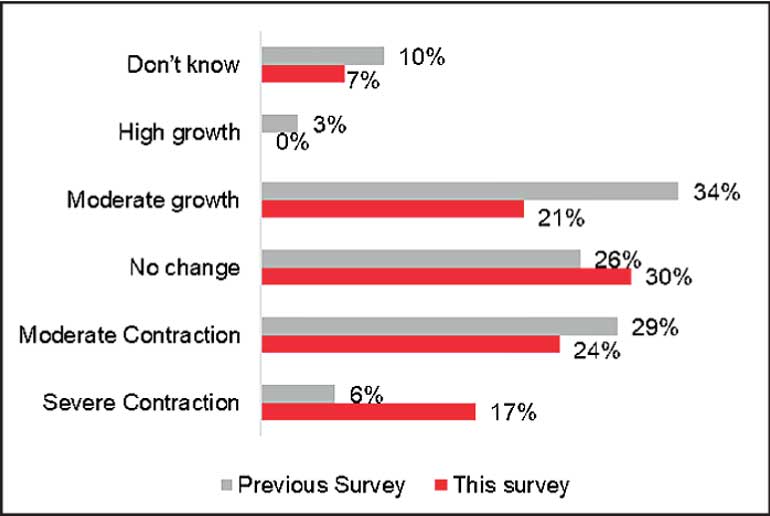

| Outlook for the economy has improved relative to the last survey |

Sri Lankan exporters stressed that the negative image of the country and domestic regulation were key challenges for them during the second half of 2022, the fourth Export Barometer Survey conducted by The Ceylon Chamber of Commerce made public yesterday. The survey, which covers the second half of 2022 and the outlook for the first half of 2023, revealed that the fall in export orders led to significant underutilisation of capacity within the export sector, which is expected to continue into 2023.

It also highlighted the fall in exports in the second half of 2022 was in line with the decline in national exports during the last quarter of the year. In terms of the outlook for 2023 and in particular the first half, export firms are more optimistic in their views on the economy relative to six months ago.

Firms had to focus their attention on retaining existing clients that were looking to move to competitor countries due to the negative perception of the country. As such, the thrust of finding new buyers and venturing into new products and services was limited.

Domestic regulations such as import restrictions and clearance delays at the port were cited as some of the domestic constraints. The most concerning factor however is related to labour, where higher labour attrition was recorded compared to the past survey due to migration could lead to skills shortage in the medium to long-term.

SMEs who were 71% of the respondent firms stated that the foreign exchange crisis hampered their ability to export, due to loss of suppliers or delays by suppliers. SMEs, which comprise the majority of respondent service exporters, noted a sharp fall in demand for services, which is likely to slow export growth during 2023. However, it was interesting to note that larger firms saw a greater decline in export revenue compared to SMEs.

However, their outlook on export orders remains the same, highlighting a likely slowdown in export growth during the first half of 2023. To counteract the slowdown in exports led by the global slowdown, it will be important to maintain economic and political stability, continue to provide uninterrupted power supply and assist firms with market access opportunities.

To access the full report please visit Trade Watch (https://www.chamber.lk/trade-watch/) or click

https://www.chamber.lk/trade watch/backend/public/uploads/attachments/article/ExportBarometerSurveyFebMarch2023_03April_1680505690.pdf. For more information on the survey findings, please email [email protected]