Thursday Feb 19, 2026

Thursday Feb 19, 2026

Friday, 17 January 2025 00:32 - - {{hitsCtrl.values.hits}}

The Finance Ministry yesterday announced wider relief measures to troubled small and medium enterprises and entrepreneurs (SMEs).

It said SME sector has been identified as the most crucial sector of strategic importance to re-orient the country’s economy considering the sectorial contribution to the economy which is more than 50% to the country’s Gross Domestic Production. Nevertheless, the recent upheavals experienced by the country during last few years, following the 2019 Easter Sunday Attack, the COVID-19 pandemic, 2022 economic collapse and other external impacts, have severely affected the SMEs, hindering their capacity significantly, grappling to conduct business as usual. This affected their prompt repayment behaviour and led to take legal actions by banks and threat of confiscation their securities/assets by the banks due to default.

For the period of 01.04.2019 to 30.09.2024, approximately 494,000 loans amounting to Rs. 886 billion have been classified as stage 3 loans (Non-performing Loan – NPL) in the banking industry. It is noted that 99% of number of loans categorised under stage 3 are below Rs. 25 million.

Considering all the factors, a relief package was designed by the Government to support the SMEs who faced difficulties in servicing their debt due to the adverse impact experienced during the recent past.

The relief package was developed in collaboration with the Central Bank of Sri Lanka (CBSL), the Sri Lanka Banks’ Association Ltd. (SLBA), SME sector representatives, applicable government agencies and the relevant measures have been prepared with a long term insight to provide a breathing space for the affected SMEs while ensuring the stability of the banking sector.

As per the Finance Ministry statement, the SMEs which meet the below mentioned criteria are eligible to enter the proposed relief package.

i. SME borrowers obtained credit facilities from a licensed bank that have been classified as stage 3 (NPL) on or after 01.04.2019.

ii. SMEs which commence discussions with the respective Relief Banking Unit on or before 31.03.2025, subject to submission of all required documents.

(A) Specific reliefs

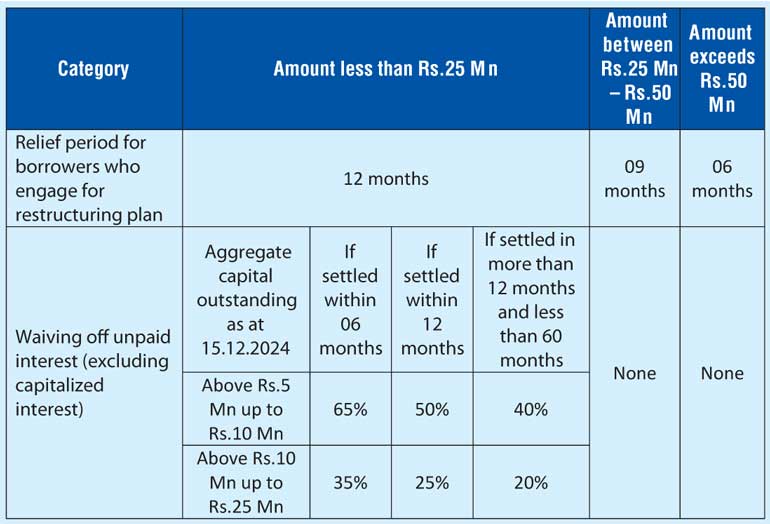

1. Specific relief measures have been proposed under three categories based on the aggregate capital outstanding of credit facilities available as of 15.12.2024 and each category is entitled to specific benefits which are shown in the table.

(B) General reliefs

1. Suspension of Parate Execution until 31.03.2025 making room for SMEs to enter a revival plan by amending the Recovery Loans by Banks (Special Provisions) Act No.4 of 1990.

2. If required, grant a working capital loan for eligible SMEs, subject to repayment capacity and submission of credible business revival plan on a case by case basis to re-boost them to their pre-crisis operating status.

3. An adverse ‘CRIB report’ shall not be the only reason for decline loan applications from eligible borrowers under this.

4. Licensed banks in consultation with the Credit Information Bureau of Sri Lanka may develop an appropriate reporting modality to report restructured credit facilities under this reliefs.

5. SMEs on their request to be provided with a breakdown of the capital, interest and other charges of their credit facilities from their bank.

(C) Additional relief measures

In addition to the aforesaid specific and general relief measures, the Ministry of Finance, Planning and Economic Development has requested the CBSL to explore the possibility to incorporate the following additional relief measures to the relief package in order to ensure the smooth implementation and the maximum benefit to the SME sector.

1. Introduction of a reasonable interest rate for restructured loans less than Rs.50 million category subject to maximum of Average Weighted Prime Lending Rate (AWPR) plus (+) reasonable margin (Ex: Maximum 2%).

2. Maximum loan repayment period is 10 years (unless original agreement has provided a period longer than 10 years) subject to grievance handling process for aggrieved parties.

3. Rename ‘Business Revival Units’ of the respective banks as the ‘Relief Banking Units’.

4. Suspend all legal actions for cases during the proposed relief period i.e.12 months for loans less than Rs. 25 million, nine months for loans between Rs. 25 million and Rs. 50 million and six months for loans above Rs. 50 million, including a complete freeze on legal proceedings related to NPL loans in the relevant categories, other than dates already scheduled.

5. Establish a transparent mechanism to grievance handling in the event of a dispute over the valuation for auctioning a property between banks and the defaulter which ensures the borrower’s property is auctioned at the highest possible rate to maximise its value.

(D) Additional policy measures to assist SME sector

1. Establish an Advisory Committee for SMEs under the leadership of Ministry of Industries as a prime arm for SME policy development, to provide guidance and coordinate all the relevant stakeholders’ work under different institutions for SME sector developments, gathering under one umbrella.

2. Introducing a scorecard/rating mechanism in collaboration with the Institute of Chartered Accountants of Sri Lanka and other professional accountant bodies to support SMEs to increase their ability to access finance.

3. Providing backup support by offering credit guarantees for bank loans of SMEs alleviating collateral issues in obtaining bank loans in collaboration with the National Credit Guarantee Institution Limited (NCGIL) which is to be commenced its operation from January 2025.