Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 10 November 2021 03:10 - - {{hitsCtrl.values.hits}}

The financial sector’s support for the COVID-hit businesses and individuals has exceeded Rs. 4 trillion, the Central Bank of Sri Lanka (CBSL) revealed this week.

The support comprises of Rs. 4.08 trillion by way of debt moratorium and Rs. 179.2 billion in concessionary working capital via the Saubagya COVID-19 Renaissance Loan Scheme Facility (SCRF).

It is the first time that the CBSL has collated all the support extended by financial institutions (FIs) since the onset of COVID-19 pandemic in March last year.

The update also comes ahead of the expiry of the debt moratorium on 31 December 2021 to all sectors, except those engaged in tourism and passenger transport, by banks, and on 31 March 2022 by Non-Bank Financial Institutions (NBFIs).

CBSL-supervised schemes included extended repayment periods, concessionary rates of interest, working capital loans, debt moratoriums and restructuring/rescheduling of credit facilities for affected borrowers.

It said these concessions greatly assisted the small and medium enterprises of many affected sectors: tourism, apparel, plantation, information technology, logistic service providers, three-wheeler owners, operators of school vans, lorries, small goods transport vehicles and buses, and private sector employees.

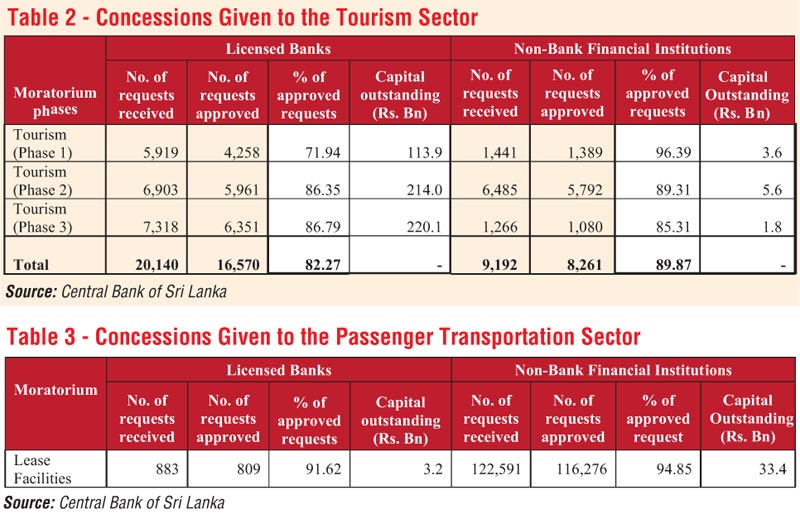

In line with the concessionary schemes implemented by CBSL, FIs have approved over 2.9 million requests for concessions amounting to a total of Rs. 4,083.8 billion, prioritising the micro, small and medium enterprises (Table1). These concessions, which were extended until 31.12.2021 by licensed banks and until 31.03.2022 by non-bank financial institutions, have helped to support the above groups, who faced financial difficulties due to loss of jobs, reduction of incomes, contraction of business operations, closure of businesses etc.

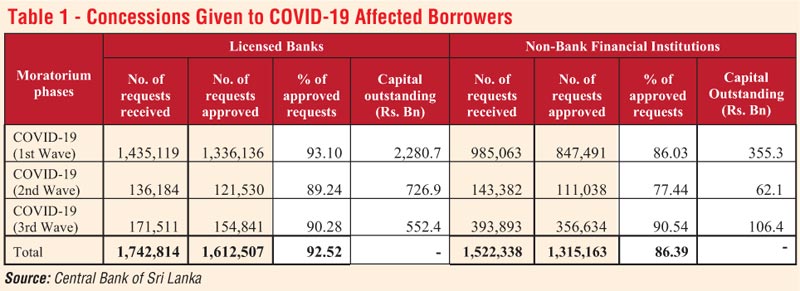

Considering that the tourism sector has been affected since 2019, special concessionary schemes for affected borrowers in the tourism sector continued to be granted from time to time and extended until 30.06.2022 by licensed banks and until 31.03.2022 by non-bank financial institutions. Accordingly, FIs have so far approved 24,831 requests for such concessions (Table 2).

Specific concessions, such as moratoriums for lease facilities, granted to COVID-19-affected businesses and individuals in the passenger transportation sector, were initially up to 30.09.2021, and extended further until 31.12.2021 by licensed banks and 31.03.2022 by non-bank financial institutions. FIs have approved 117,085 requests for such concessions (Table 3).

In addition to debt moratoria, affected borrowers of the NBFI sector have been provided with the option to either restructure existing credit facilities for a longer term (subject to furnishing an agreeable revival plan) or to settle existing credit facilities early, where such requests are to be facilitated by waiving future interest, fees and applicable charges. These options have been made available for borrowers of non-bank FIs up to 31.03.2022.

CBSL has also requested FIs to grant further concessions, including the waiver of accrued penal interest, restructuring of existing credit facilities, provision of interest rebates, waiver of early settlement fees and other charges, suspension of legal action on loan recoveries, extension of the validity period of cheques valued below Rs. 500,000, discontinuation of certain charges usually made by FIs (for cheque returns, stop payment, etc.) and suspension of late payment fees applicable on credit cards during the concessionary period. FIs have also been requested to refrain from declining loan applications from eligible borrowers, solely based on unfavourable Credit Information Bureau (CRIB) records.

CBSL has further facilitated the revival of COVID-19-affected businesses through the introduction of the Saubagya COVID-19 Renaissance Loan Scheme Facility (SCRF) in three phases to provide working capital loans at an interest rate of 4% per annum, with a repayment period of 24-months, including a grace period of six months. Through this scheme, CBSL processed 62,574 applications, leading to the release of Rs. 179.2 billion under the SCRF, of which, licensed banks have disbursed Rs. 165.5 billion among 53,152 affected businesses island wide. Considering the subsequent waves of COVID-19, grace periods and loan repayment periods applicable to SCRF loans have also been extended several times. Accordingly, a debt moratorium has been granted up to 31.12.2021 while the repayment period has been extended by 12 months to 36 months. In addition, beneficiaries of the other loan schemes implemented by CBSL, such as Saubagya and Swashakthi Loan Schemes, have been provided with further relief at this crucial juncture, by the reduction of the interest rates and the introduction of the debt moratorium.

As announced recently by the CBSL in its six-month Road Map for ensuring macro-economic and financial system stability, a liquidity support grant of Rs. 15 billion is to be provided to FIs supervised by CBSL to compensate a part of the cost of the interest charged by them from affected borrowers during the moratorium, with a view to providing further relief to borrowers.

In the meantime, the CBSL has established the Financial Consumer Relations Department (FCRD) in August 2020 to handle complaints by financial consumers and borrowers who are able to submit complaints to FCRD using the forms available in the CBSL website.