Thursday Feb 19, 2026

Thursday Feb 19, 2026

Tuesday, 7 January 2025 02:57 - - {{hitsCtrl.values.hits}}

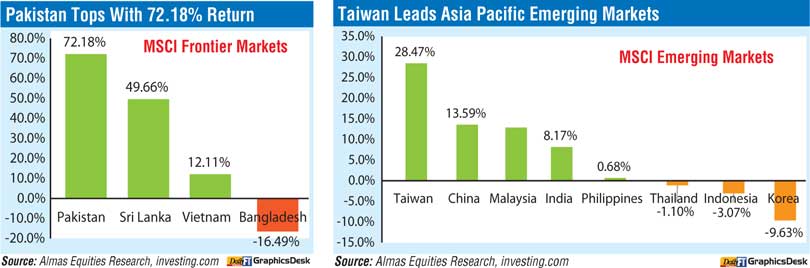

Frontier markets in the Asia Pacific, including Pakistan and Sri Lanka, have outperformed emerging markets in 2024.

Pakistan led the highest gainers with 72%, followed by Sri Lanka with 49.6% as the second best performer, Almas Equities Research said.

Factors that helped frontier markets include aggressive interest rate cuts – such as Pakistan’s 900 basis points reduction – boosted investor confidence and market returns, and strong GDP growth and improved corporate earnings driven by factors like tourism in Sri Lanka and export rebounds in Vietnam which revitalised these markets. Low price-to-earnings ratios, which attracted investors seeking high-growth opportunities, was another reason.

Bangladesh’s stock market fell 16.49% amid political instability, 11.38% inflation, currency depreciation, and regulatory issues like floor price policies and mutual fund extensions, denting investor confidence.

In Asia Pacific emerging markets, Taiwan led with 28.47%, China 13.59%, Malaysia 12.90%, India 8.17%, Philippines 0.68%, Thailand -1.10%, Indonesia -3.07%, and Korea -9.63%.

Taiwan and China outperformed due to strong demand for semiconductors and tech exports, and higher interest rates in developed markets led to outflows from weaker markets like Korea and Indonesia.

Additionally, Chinese Government stimulus and stabilisation policies boosted its markets, unlike politically strained markets like Thailand and Malaysia which benefitted from a rebound in commodity prices, while Indonesia faced pressures from volatile energy markets.