Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 13 June 2023 00:29 - - {{hitsCtrl.values.hits}}

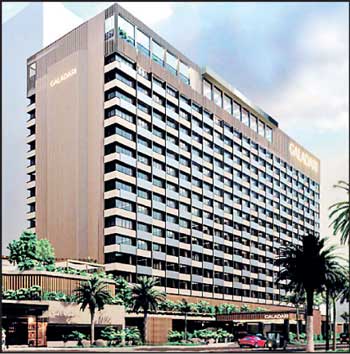

The Galadari Hotels (Lanka) PLC has entered into a Hotel Development Services Agreement (HDSA) and a Hotel Management Agreement (HMA) with multinational hospitality company, Radisson Hotels Asia Pacific Investments Ltd., concerning the five star 450-room property in Colombo.

The Galadari Hotels (Lanka) PLC has entered into a Hotel Development Services Agreement (HDSA) and a Hotel Management Agreement (HMA) with multinational hospitality company, Radisson Hotels Asia Pacific Investments Ltd., concerning the five star 450-room property in Colombo.

In a filing to the Colombo Stock Exchange (CSE) yesterday, Galadari Hotels (Lanka) PLC said it intends to engage with Radisson Hotels Asia Pacific Investments Ltd. and/or one or more of its affiliates (Radisson) to manage the Galadari Hotel Colombo under the name “Radisson Blu Hotel Galadari Colombo.”

In this regard, the company has undertaken to renovate Galadari Hotel Colombo in preparation of the management and operation of the same by Radisson.

The Daily FT in February 2020 exclusively reported about Galadari in talks with Radisson Blu to rebrand the Colombo hotel (https://www.ft.lk/Front-Page/Galadari-in-talks-with-Radisson-Blu-to-rebrand-Colombo-hotel/44-695470). Last month the Daily FT also reported the impending upgrade (https://www.ft.lk/front-page/Galadari-Brothers-to-give-45-m-facelift-to-Colombo-hotel/44-748381).

Galadari Brothers Co. LLC owns 63.57% stake in the 1984-established Galadari Hotels (Lanka) PLC.

Chairman M.A.I. Galadari in the FY22 Annual Report said that with the Government spearheading plans to revive the tourism industry, the company is also moving towards ensuring that the hotel’s renovation plans are set in motion.

“With the Board of Directors, it is my humble opinion that a new iconic Galadari Hotel will be brought to life with the renovation. This will give us the required leverage to compete on par with other city hotels in Colombo,” Galadari added.

Yesterday’s disclosure said the HMA provides for (both in form and content) a Licence Agreement and Management Consultancy Agreement which may be entered into on a future date, at the option of the company and subject to satisfaction of identified conditions.

This transaction has been determined by the Board to be a major transaction under and in terms of Section 185 of the Companies Act No. 7 of 2007 (as amended). The HDSA and HMA were executed on 1 May 2023 and shall be effective as at 1 May 2023, upon the passing of a special resolution by the shareholders of the company.

The Board of Directors have decided to convene an Extraordinary General Meeting (EGM) of the company on Thursday, 6 July 2023 immediately after the Annual General Meeting (AGM) scheduled at 4.30 p.m. as a Virtual Meeting emanating from the “Board Room” of Galadari Hotels (Lanka) PLC, No. 64, Lotus Road, Colombo 1, to consider and if deemed fit to pass the Special Resolutions in this regard.

As at 31 March 2023, Galadari Hotels Lanka PLC had 10,835 public shareholders holding 12.57% stake.

In the financial year ended on 31 December 2022 company’s profit before taxation has improved compared to last year.

“This impressive growth is a testament to our talented employees’ dedication and hard work, who consistently go above and beyond to meet and exceed our customers’ expectations,” the Chairman added. Galadari Colombo has been awarded the Hotel Brand of the Year for four consecutive years by SLIM-Kantar People’s Awards.

Revenue in FY22 amounted to Rs. 1.18 billion, up from Rs. 554 million in the previous year. Gross profit was Rs. 470 million as against Rs. 187 million. Operating loss was Rs. 265 million, down from Rs. 416 million in FY21. With Rs. 330 million finance income as against Rs. 135 million, the company posted a pre-tax profit of Rs. 65.5 million in comparison to a loss of Rs. 282 million in FY21.

In the first quarter of FY23, revenue rose to Rs. 345 million as against Rs. 295 million a year ago. Gross profit rose to Rs. 148 million from Rs. 136 million.

Operating loss rose to Rs. 73 million from Rs. 21 million in the 1Q of FY22.

Galadari enjoyed Rs. 159 million in finance income in 1Q of 2023 as against Rs. 41 million a year ago. This helped the company to achieve a pre-tax profit of Rs. 86 million up from Rs. 20 million in 1Q of FY22.

As at 31 March 2023 accumulated losses stood at 10 billion.