Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 9 October 2020 00:08 - - {{hitsCtrl.values.hits}}

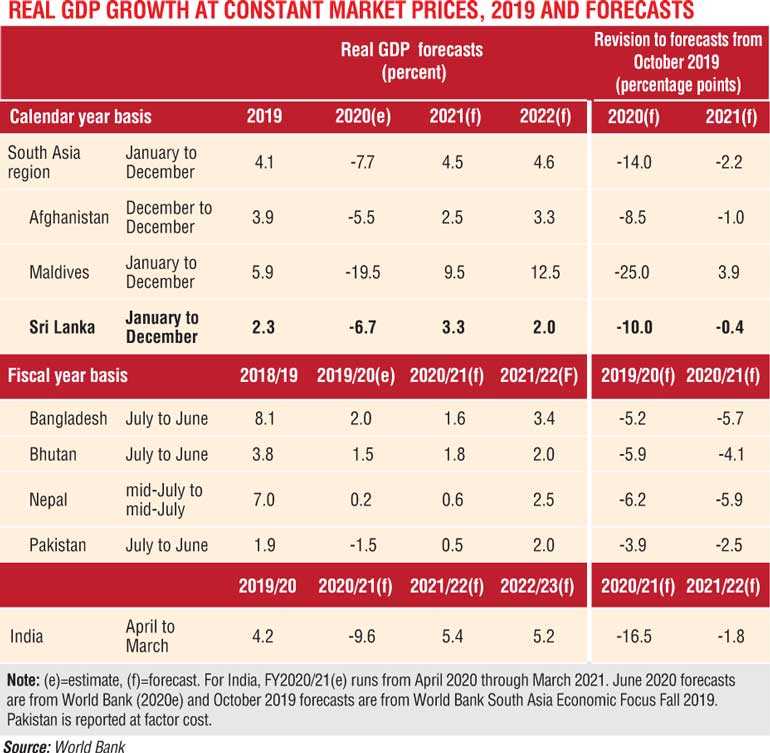

Sri Lanka’s Government will need to strike a balance between supporting the COVID-19 hit economy and ensuring fiscal sustainability in the coming months, a World Bank report said yesterday, warning the budget deficit will expand to 11% of GDP and the economy will contract by 6.7% in 2020, worsening debt refinancing prospects next year.

The latest South Asian Outlook report titled ‘Beaten or Broken? Informality and COVID-19’ released in Washington this week paints a bleak picture of Sri Lanka’s challenges. Recalling that the country was facing fiscal and growth challenges well before the virus hit, it reiterated that the global pandemic remained the biggest risk to Sri Lanka’s growth prospects.

“The COVID-19 crisis has substantially clouded the outlook and exacerbated an already challenging macroeconomic situation. The economy is expected to contract by 6.7% in 2020, with all key drivers of demand affected: exports, private consumption and investment,” the outlook report said.

COVID-19 will also have an impact on Sri Lanka’s poverty line, driving down both earnings and consumption.

The report projected that Sri Lanka’s growth is expected to contract by a worrying 6.7% in 2020 before managing a modest recovery of 3.3% in 2021.

Private consumption is also expected to reduce by 6.7%, exports 34.8%, imports 29.2% and capital investment by 15.1%. In terms of growth the industry sector is estimated to contract by 6.1% and services by 6.3% with only agriculture growing by 1%.

“Refinancing requirements will be high, with annual foreign exchange debt service requirements estimated at 7%-8% of GDP over 2020-2022. The fiscal deficit is projected to expand further to over 11% of GDP in 2020, driving an increase in debt levels.”

Inflation is expected to remain anchored at 4.9% and the current account balance is projected to be 2.2% of GDP by year end, helped largely by restricted imports and a sizeable reduction in Sri Lanka’s fuel bill. More worrying is that debt as a percentage of GDP will grow to 102% and the primary balance will grow to 4.3% of GDP from 0.8% in 2019.

“A longer-than-expected outbreak of COVID-19, that would extend the horizon and depth of related economic disruptions, is a key risk to the baseline,” the report said. “In turn, a longer downturn could push many small and medium enterprises from illiquidity to insolvency, and the poverty rate could rise even higher as more people suffer income losses. Low growth would also put additional strain on public finances.”

“Sri Lanka is also highly exposed to global financial conditions, as the repayment profile of its debt requires the country to access financial markets frequently. A high deficit and rising debt levels could further deteriorate debt dynamics and negatively impact market sentiment. Thus, Sri Lanka will need to strike a balance between supporting the economy amid COVID-19 and ensuring fiscal sustainability,” the report added.

The World Bank report warned that reflecting these challenges, the $ 3.20 poverty headcount is projected to increase from 8.9% in 2019 to 13% in 2020.

“During the lockdown, the Government extended temporary cash support to Samurdhi households, including a large number of which were on the waitlist. But the program is not well targeted and benefit amounts are inadequate. Construction and services sectors, including tourism, have been important sources of jobs growth in recent years and the outbreak will likely harm the prospects of many low-skilled workers.”

The report also said that even though the Government had employed 60,000 graduates and planned to absorb 100,000 individuals from low income families to support livelihoods, such measures “will remain insufficient and add further strain on public finances. A fall in remittances could adversely impact some poor households that rely on them as an important source of income.”