Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 10 March 2021 00:00 - - {{hitsCtrl.values.hits}}

HNB Assistant General Manager- Corporate Banking Majella Rodrigo, Aitken Spence PLC Group Chief Financial Officer Nilanthi Sivapragasam, Aitken Spence PLC Director J M S Brito, HNB Deputy General Manager – Wholesale Banking Group Damith Pallewatte and HNB Deputy Head – Corporate Banking Vijaya Vidyasagara at the opening ceremony for the first of its kind waste to energy plant in Sri Lanka by the Western Power Company.

|

| HNB Deputy General Manager – Wholesale Banking Group Damith Pallewatte |

|

| HNB Assistant General Manager – Corporate Banking Majella Rodrigo

|

Sri Lanka is among the top three Asian countries with the highest share of renewable energy sources according to a study carried out by REN21 (international policy network which supports sustainable

energy future with renewables) in cooperation with the Asian Development Bank (ADB) in 2019. While this is a positive sign, the impact of global warming requires a immediate transformation of global energy use from the non-renewable sources to renewable if the world is to successfully tackle climate change.

This is crucial given that two-thirds of global greenhouse gas (GHG) emissions originate from energy sector1.If Sri Lanka is to meet its commitments in this space, further rapid development of renewable energy capacity is still urgently required.

HNB takes pride in being the pioneering financial institution to embark on a journey towards enhancing sustainable renewable energy generation capacity. In recent years, the bank has facilitated numerous noteworthy investments into the renewable energy sector in Sri Lanka.

Over the past two and half decades HNB has introduced and promoted Environmental, Social and Governance (ESG) compliant investment opportunities in the country as well as in other parts of the world by financing off-shore renewable power projects promoted by local investors.

“Throughout the contemporary development of renewable energy in Sri Lanka, HNB has served as an active partner. This has been a conscious decision on the part of the bank, as part of our own commitments to ensuring a sustainable energy future for our nation.

“As a result of our enduring presence in this field, we have gained vital technical expertise, which has enabled the bank to not only provide funding, but also function in an advisory capacity on such projects – both at the commercial level, and for retail investors installing rooftop solar capacity in their homes. This experience has ensured that we are now strongly positioned to support the rapid implementation of much more renewable energy capacity moving forward,” HNB Deputy General Manager – Wholesale Banking Group Damith Pallewatte said.

HNB’s leadership in the renewable power sector evolves together with several “firsts” under its belt. The Bank was among the first financial institutions in the country to syndicate the first locally funded wind power project (10 MW) and the first commercial scale solar power project (10 MW). More recently, HNB also served as the lead arranger on a syndicated facility arranged for the establishment of Sri Lanka’s first ever Waste-to-Energy project with a capacity of 10 MW, where we were also able to encourage other banks to come on board and benefit from our experience in structuring and supporting projects of such scale and value.

HNB was also the first bank to extend financial assistance to Sri Lankan promoters in their maiden overseas hydro power project back in early 2010 and first overseas solar power project in 2019. All of these projects are of immense national significance, but for HNB these were well thought through opening steps of a longer journey towards sustainability and prosperity of our nation.

As of today, HNB had rendered its support to 52 large scale renewable power projects and close to 1,000 rooftop solar power projects with a total renewable energy generation capacity of approx. 260 MW by deploying funds up to a total value of approximately$ 115 million.

At present, out of the total energy requirement of Sri Lanka, approx. 52% is generated as thermal energy whilst the balance 48% is supplied by renewable energy sources. Currently hydro energy plays a key role in renewable energy segment in Sri Lanka with a share of 89% out of total renewable energy supply whilst wind, solar and biomass contributing to the balance 11% (Source:CEB).

HNB’s renewable energy portfolio spans both local and overseas projects. In Sri Lanka these include a wide range of clean energy sources with a notable presence in hydro power generation. In total HNB funding has supported 37 mini hydro power plants, followed by six wind power plants, three commercial scale solar power plants, two biomass power plants and one waste-to-energy plant. At present, HNB’s contribution to the national power supply, through renewable energy sources has been approx. 12% of the entire on-grid renewable energy capacity of the island.

Bridging the gap to a sustainable future

Bridging the gap to a sustainable future

In the longer term, possible accelerated development of non-conventional renewable energy forms,is likely to make a significant change in Sri Lanka’s mix of primary energy resources raising the contribution of renewable energy to 70% of the country’s energy mix by 2030. Considering the importance of fulfilling the sustainable energy requirement in future, which promotes green energy by reducing carbon footprint, HNB is well geared to extend its unstinted support as in the past to the independent power producers to achieve this paramount national objective.

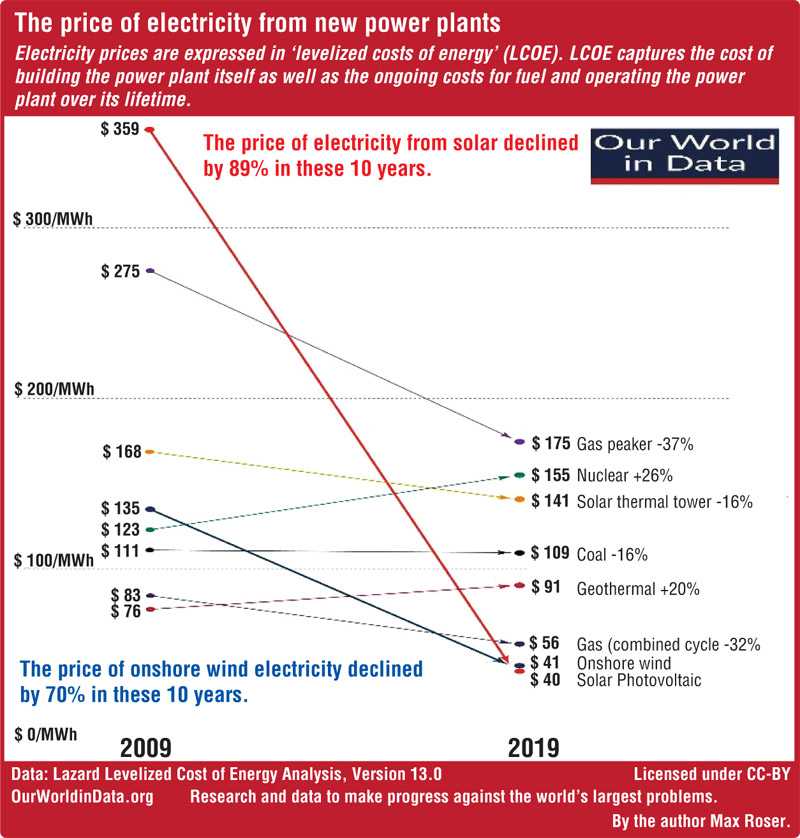

To achieve this target, Sri Lanka would require the production of additional stock of over 2,000 MWs of renewable energy within the next decade. The national requirement is hence approximately to double the existing capacity. While this may appear to be a monumental task, especially given the limitations faced by our economy at present, a critical factor which works in favour of this vision is the fact that over the past decade alone, solar energy costs have fallen by over 80%, now making it one of the cheapest green sources of energy in the entire world ahead of only wind power which also recorded a similar drop in prices by as much as 70% during the same period.

Predominantly there are two key technologies in harnessing solar energy, photovoltaics (PV) and concentrated solar-thermal power (CSP). Solar PV technology is relatively newer and has a longer life span than solar CSP. Solar CSP is primarily used for heating water whilst solar PV is considered to be more versatile and could cover the entire energy requirement of a particular consumption unit. The only reason for solar PV to be less attractive could be the high initial investment and large space requirement as opposed to solar CSP. Nevertheless, the technology advancement has resulted in low-cost solar PV panels at present with higher energy efficiency.

Over the last decade, solar PV technology has acquired the potential to become a major source of renewable energy for power generation in the world. By end of 2019, total solar capacity went up to 578 GW globally, a 20% increase YoY and the total power generated per annum increased to 549 TWh. This is about 5% of the global electricity demand (Source: International Energy Agency) as opposed to solar energy being 1% of the electricity demand in 2015. Supply of renewable power capacity is set to expand by 50% between 2020 and 2026 globally, led by solar PV.

“The significance of these developments for a nation like Sri Lanka being located close to the equator which receives a daily average solar irradiation from 4.5 to 6 kWh/m2 per day, around the year without much seasonal variation cannot be understated. With the government introducing visionary ‘Suryabala Sangramaya’ initiative, HNB is expected finance the journey of converting more rooftops to solar power farms in future supported by the cost competitiveness in the solar PV technology.

“If we pursue these opportunities strategically and sustainably, our nation will be well on its way leading the South Asian region on renewable energy, and on the path to lasting energy security, and with it, untold economic opportunity,” HNB Assistant General Manager – Corporate Banking Majella Rodrigo having over a decade of overseas experience in Project Finance and Loan syndication.

HNB’s expertise to accelerate renewable energy

HNB’s expertise to accelerate renewable energy

Over the past two and half decades, HNB has gained invaluable experience and knowledge on renewable power projects. Apart from comprehensive feasibility studies and Environmental Impact Assessments, one of the most crucial elements in successful commissioning of renewable power projects along with a healthy Return on Investment is the possession of unbeatable know-how that HNB brings in structuring financial packages for these projects. More often than not, this can either make or break the financial viability of a project. For an enthusiastic promoter, HNB is able to link project investors to concessionary lines of funding – both locally and globally – in order to ensure that capital expenditure for the projects is made available at the lowest possible interest rates. Given the unparalleled expertise of our dedicated Project Finance Team, we are also able to engage from the design phase itself and provide our insights, network, and experience towards getting the project off the drawing board.

Once development work commences, our team conducts regular site visits in order to ascertain that the project is on track from start to finish. The result of this end-to-end engagement is amply demonstrated in the success of every single commercial project HNB has supported as they have been carried until completion and continue to operate efficiently to date.

If it were easy, everyone would be doing it

While there are positive factors in favour of renewable energy in Sri Lanka, there are many challenges associated with the process of setting up a renewable project as well, be it a commercial scale or a domestic project.

From a financing perspective, only large-sized commercial banks are financially positioned to participate in funding these projects given that returns are recorded many years later, making such investments significant long-term commitments. Hence, it is essential that every project is meticulously planned and structured from the very beginning.

Every project must be evaluated on its merit on a standalone basis and financing should be structured accordingly. For HNB, this means that we will structure loan repayments in such a way that it matches the cash inflow of the project. In doing so, it is critical to factor the seasonal changes in weather patterns as most of the renewable energy sources are vulnerable to the changing weather patterns. For example, the wet and dry periods of the respective catchment area of a mini hydro power project is a vital piece of information in structuring the tenure and monthly loan commitment in order to ensure the project remains viable on a financial basis.

Similarly, the weather patterns are closely scrutinised for wind power projects and some instances for solar power projects as well. This attention to detail and flexible approach represents an unprecedented level of customisation of funding structure and it is one of the many reasons why HNB continues to raise the bar in the space of renewable energy funding.

We have also built up extensive partnerships with leading suppliers for such projects, which enables HNB to ensure that our clients get the best possible deals and best quality equipment. Given the major advances in technology that have been realised in recent years, HNB aims to consolidate our existing presence in renewable energy project financing and build a strong partnership with the industry stakeholders in a manner which benefits all Sri Lankans for generations to come.

As a bank with a 132 years history fully aligned with the Sri Lankan economy and its development and one that has partnered the progress of several generations of Sri Lankans, we look forward to the opportunities as a responsible corporate citizen in planet Earth to be a part of the international course of combating climate change through our endless efforts to promote cleaner green energy. HNB whilst embracing its journey to be future ready to become the beacon in Sri Lanka’s financial services industry, profoundly envisions a low carbon future with sustainable green/renewable energy solutions that will bring an inclusive global economic growth.

Waste to energy plant - Kerawalapitiya

Wind power project - Kalpitiya

Biomass plant - Dehiaththakandiya

Solar power project – Vavuniya