Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 15 June 2022 00:25 - - {{hitsCtrl.values.hits}}

|

| Chairman Mohan Pandithage

|

The country’s most diversified blue chip Hayleys PLC has doubled its Group after-tax profit to an all-time high of Rs. 28.1 billion in FY22.

Chairman and Chief Executive Mohan Pandithage says FY22 set a new record for the highest profit in the 144-year history of Hayleys as the Group surpassed the record set in the previous year with a 100% increase.

“Members of the World of Hayleys came together, maximising synergies through Group-wide initiatives to identify early warning signs and overcome the converging challenges that gained momentum as the year progressed,” Pandithage added.

Hayleys’ profit attributable to owners of the parent rose by 139% to Rs. 18.25 billion. Results from operating activities (EBIT) grew by 29.4% to Rs. 33.6 billion and pre-tax profit was up 86% to Rs. 35.7 billion.

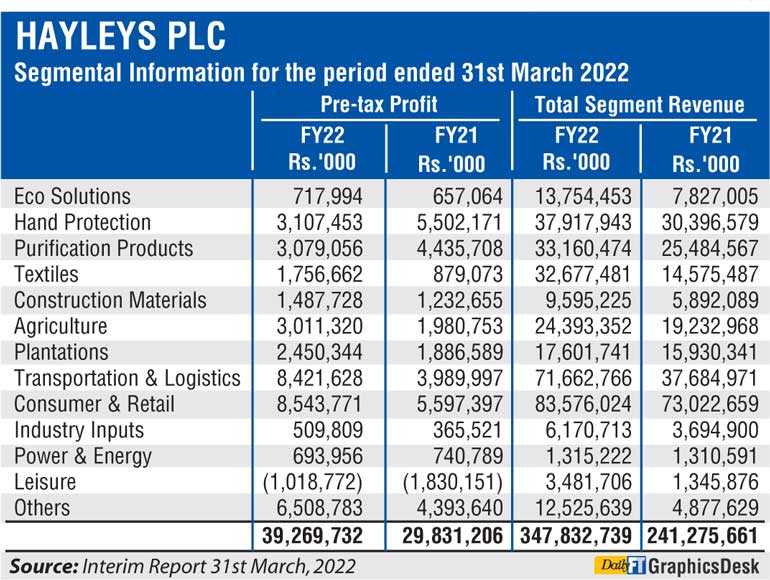

Transportation and Logistics contributed 30% to Group pre-tax profit figure while Consumer and Retail and Hand Protection contributed 16% and 14% respectively. “All sectors recorded increased Profit Before Tax except for the Leisure sector,” Pandithage said in the Hayleys’ Annual Report for FY22. Textiles, Transportation and Logistics, and Eco Solutions recorded increases of 337%, 238% and 132% respectively.

Group turnover grew by 40% to a record Rs. 338 billion. The Transportation and Logistics sector recorded a strong growth of 84% to Rs. 69.27 billion and accounted for 20% of Group revenue. Consumer and Retail recorded 14% growth to Rs. 83.54 billion becoming the highest contributor to Group revenue.

The main contributors to both EBITDA and EBIT were Consumer and Retail and Transportation and Logistics who contributed to almost 50% of the total for both, reflecting the key role played by these two sectors in the cashflows of the Group. Hayleys Group’s total debt rose by 50% to Rs. 172 billion during the year.

Finance income increased by 430% to Rs.16.83 b as we recorded exceptional exchange gains during March 2022. Hand Protection, Purification, Textiles and Transportation and Logistics, made significant contributions, accounting for 69% of the total. Finance costs increased by 48% to Rs.14.88 bn which is attributable to increased borrowings to finance working capital.

Total assets saw a 44% increase to top the Rs. 400 billion mark to Rs. 403 billion as at 31 March largely due to increased receivables, inventory and property, plant and equipment. Pandithage said this reflects the increased earnings capacity of the Group and the acquisition of South Asia Textiles Ltd. in April 2021 which has turned around during the year to make a positive contribution to the Group.

Notably, this makes Hayleys Fabric PLC the largest fabric manufacturer in the country with bright prospects as the industry looks to shorten its supply chain by reducing the import of fabric. Pandithage said Transportation and Logistics increased their floating crafts with the acquisition of another container ship, making it the largest fleet in Sri Lanka and enhancing its earnings capacity. Additionally, most sectors invested in increasing their capacity, although in a limited manner due to the paucity of dollars in the market.

The Chairman also said it was noteworthy that the significant increases in capacity strengthen the Group’s foreign exchange earnings. Inventory grew by 55% as the Group increased stocks of raw materials and finished goods to accommodate the increased lead times due to shipping delays. The increase in receivables is largely due to the Transport and Logistics and Consumer and Retail sectors which accounted for 16% and 41% respectively.

Pandithage said Hayleys Group resilience is underpinned by 52% of revenue through exports generating $ 615.98 up by 45% from FY21 and accounted for 4.2% of the country’s total exports. Hayleys’ globally leading market positions in several sectors Industry and geographical diversification and long-term, mutually beneficial relationships nurtured across ecosystem are the other factors strengthening its resilience.

Consumer and Retail Sector recorded profit after tax of Rs. 4.30 billion, the highest in its 145-year history, raising the bar on its previous record last year by 59%. Sustained demand for electrical and electronic items supported top line growth of 14% to Rs. 83.54 billion. Demand coupled with its island wide network and aftersales service enabled Singer to retain the number one position amongst Sri Lanka’s consumer and commercial retailers.

Advantis Group which delivered its highest Profit After Tax of Rs. 8.61 billion, accounting for 30% of Group Profit After Tax which is the highest contribution by any sector. Restructuring of the sector into six verticals last year enhanced the customer value proposition and maximised synergies across the verticals, strengthening its position as the leading logistics provider in the country.

Performance of the sector was boosted by strong growth in exports and transhipment business, gains in currency translations and increased demand for logistics and warehouse operations as supply chain management became a critical operation due to global issues. The increase in freight rates also supported profitability of the sector.

Top line growth for the Hand Protection sector was 25% supported by volume growth and customer acquisition in selected markets. Overall, the first half of the year saw the market normalising after the surge in demand with the onset of the pandemic in the previous year.

Consequently, sales were slow due to overstocking in the previous year by customers initially but picked up pace in the last two quarters. Increased rubber prices proved to be another challenge, exerting pressure on margins. Profit After Tax dipped by 8% to Rs. 4 billion, accounting for 14% of Group’s Profit After Tax.

The sector focused on increasing capacity in all 5 manufacturing facilities and moved to higher value-added products in the premium and supported gloves categories. Supply chains were strengthened with the addition of over 2,000 new farmers to the First Light program while the program itself was strengthened to address the concerns of farmers.

Over 20 new products were introduced to the market including a premium sports glove which presents a potential area of growth. Additionally, five new patents have been applied for, including one at the World Intellectual Property Office. Pandithage said the Group is well positioned for growth in the year ahead, maintaining the momentum of the last two quarters.

Positioned as the world’s largest producer of activated coconut shell carbon, Haycarb saw a top line growth of 29% to Rs. 32.75 billion was driven by increased focus on high value-added products in the sales mix, market development and buoyant gold prices. Increased freight costs and raw material prices dampened margins.

The Chairman said additionally, it was necessary to build up both raw materials and finished goods inventory resulting in increased finance costs for working capital. However, the steep devaluation of the rupee in March boosted finance income which increased Profit Before Tax and Profit After Tax to Rs. 4.64 billion and Rs. 3.71 billion, respectively, recording the highest profit recorded since inception for the second consecutive year.

Hayleys Agriculture managed several challenges during the year to record its highest profit for the second consecutive year with Profit After Tax of Rs. 1.71 billion, a growth of 41% over the previous year. The Plantations sector delivered a solid performance amidst significant challenges recording Profit After Tax growth of 69% to Rs. 2.62 billion.

Hayleys’ Industry Inputs, Power and Energy sector expanded its product portfolios and geographical markets to deliver Rs. 1.05 billion as Profit After Tax, recording an increase of 32% over the previous year. Lifesciences also expanded its product portfolio to introduce DNA testing machines and moved into Maldives as well.

Power and Energy followed a similar strategy, moving into small-scale generators which were distributed through the Singer network while also exporting to the Maldives. Pandithage said the Power business applied for five renewable power projects in solar and wind and aspires to increase its current capacity of 100 MW to 500 MW.

Eco Solutions delivered a strong performance during the year with an increase of 42% in revenue and an increase of 127% on Profit After Tax, reaching Rs. 1.50 billion for the first time in the history of the company

The Construction Materials sector delivered strong top line and bottom line growth of 62% and 37% respectively to record Profit After Tax of Rs. 1.15 billion. Export volume growth was encouraging with volumes and values increasing by multiples of 2.8 and 3 respectively.

“We moved to a new factory to manufacture value added products with light engineering solutions, moving away from basic extrusions. Further, Alumex Building Systems, our proprietary window and door solutions and façade systems were introduced to local and global markets with certification of their ability to withstand wind, water, acoustic and dynamic pressure,” Pandithage added.

Hayleys Fabric PLC took a giant stride forward to its next era of growth with the acquisition of South Asia Textiles Ltd. in April 2021 having turned in a solid year in 2020/21 to reach maximum capacity utilisation at its existing plant.

Pandithage said the acquisition was timely and financed in the right currency. The leadership team harmonised strategy, policies and processes with the existing plant and turned around its operations in record time to become the largest fabric manufacturer in the country.

The financial performance reflects the effective capacity utilisation of the new acquisition as revenue increased by 117% to Rs. 31.67 billion. Hayleys Fabric was unswerving in its long-term strategy and aligned operations of the new plant to work with strategic partners on its own branded portfolio of high value synthetic fabrics which has yielded dividends in the past three years. Profit After Tax recorded 270% growth to Rs. 2.69 billion accounting for 10% of Group profits.

Pandithage said the recovery of the Hayleys’ Leisure sector gathered momentum from November 2021 until March 2022 as over 70% of countries opened borders for vaccinated tourists. While the sector is able to recover quickly, sustained growth momentum is required to set it back on an even keel.

Amaya Kuda Rah, the resort in the Maldives, turned around and is making money while the outstation resorts also managed to break even. The Kingsbury and Amaya Beach are still making losses although these have reduced.

“The sector needs a strong and sustained recovery to regain its vibrancy and contribute positively to the inflow of foreign exchange and the country’s progress as it has been three years since the sector experienced a good year. Economic and political stability will be key to the renaissance of the sector and we look forward to a promising season in the year ahead,” Hayleys Chief Pandithage emphasised.

Other business of Hayleys including operations of the holding company, BPO operations, and Fentons Ltd. Expansion of activities by Fentons and dividends received by Hayleys PLC supported the growth of Profit After Tax of this sector by 165% to Rs. 4.49 billion, contributing 16% of the Group’s total.

Pandithage also told shareholders in the Company’s FY22 Annual Report that the share price of Hayleys PLC increased from Rs. 60.80 share to Rs. 76.90, providing shareholders a return of 26% for the financial year from capital appreciation.

Value to shareholders increased considerably during the year with Earnings per share moving up from Rs. 10.18 to Rs. 24.34 and an increase of 125%. Hayleys also distributed an interim dividend of Rs. 4 per share in March 2022, the Chairman added.