Friday Feb 27, 2026

Friday Feb 27, 2026

Thursday, 23 May 2024 03:01 - - {{hitsCtrl.values.hits}}

Hemas Holdings PLC yesterday reported record earnings for the financial year ended on 31 March 2024.

Hemas Holdings PLC yesterday reported record earnings for the financial year ended on 31 March 2024.

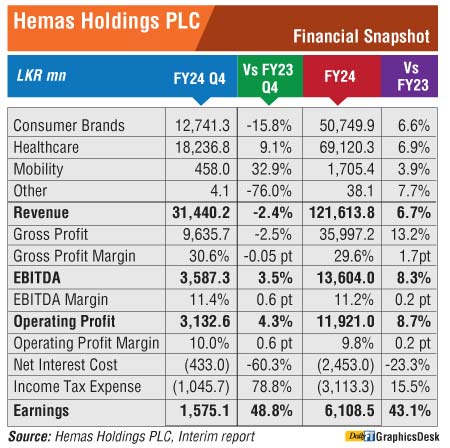

Driven by strong performance of the core businesses and reduced finance costs, the earnings demonstrated a significant 43.1% growth, reaching Rs. 6.1 billion, the highest ever by the Group in a single year.

Group revenue grew by 6.7% to Rs. 121.6 billion driven by the improvements in all key business units amidst adverse impact of the macro-economic challenges.

Hemas also announced a final dividend of Rs. 3 per share for FY24.

In 4Q, the Group reported a marginal decline of 2.4% in revenue to Rs. 31.4 billion mainly due to the change in seasonality of the Learning Segment, resulting in a timing difference in the consumer sector.

Despite the decline in revenue, the positive impact of efficiency improvement initiatives resulted in operating profit to increase by 4.3% while the earnings improved by 49% to Rs. 1.6 billion.

Hemas said the resilient performance of the core operations, coupled with successful initiatives aimed at optimising working capital, led to a significant improvement of Rs. 23.2 billion in operating cash flow compared to the financial year 2022/23. Additionally, the transition from a net debt position to a net cash position resulted in a net gearing ratio of minus 1.2%.

Strong financial position of the Group was verified by Fitch with the reaffirmation of the AAA (lka) Stable Outlook Rating for the fifth consecutive year is a testament to the Group’s resilience and financial strength.

Despite the volume contractions in all industries across Hemas said it managed to outperform the market with market share increases in key segments.

Consumer brands: The cumulative revenue for the Sector posted a growth of 6.6% to reach Rs. 50.7 billion while the operating profit of Rs. 7.6 billion reported a growth of 28.9%. Despite the modest growth in revenue, multiple efficiency improvement initiatives and productivity enhancement measures coupled with supply chain efficiencies resulted in margin improvements for the businesses. Over 50% reduction in finance cost, lower working capital base and reduced cost of borrowing coupled with improved operating profit resulted in the earnings growing by 56.2% reaching Rs. 5.1 billion for the year.

During the quarter, the sector witnessed a contraction of 15.8% in revenue due to the shift in back-to-school season from fourth quarter to third quarter. In line with the revenue decline, the operating profit of Rs. 1.8 billion witnessed a 15.1% de-growth, while the earnings witnessed a 27.2% contraction to reach Rs. 1.0 billion in comparison to Rs.1.4 billion witnessed last year.

Healthcare: The Healthcare Sector reported a revenue of Rs. 69.1 billion, a growth of 6.9% while the operating profit for the period witnessed a decline of 7.6% against last year due to increase in overheads, inventory provisions and one-off stock adjustments attributable to price revisions for regulated medicines. Despite the contraction in operating profit, the earnings for the year Rs. 2.3 billion, posted a growth of 12.3% due to reduction in finance costs and lower taxes.

During the quarter, Healthcare Sector revenue increased by 9.1%, to close at Rs.18.2 billion mainly due to the improved contribution from the Pharmaceutical Manufacturing segment. The growth was driven by the notable growth in Morison branded portfolio and Government orders. The increase in revenue was not translated to operating profits mainly due to adjustments made to the inventory provisions related to slow moving items in the Pharmaceutical Segment.

While the operating profit contracted by 21.9%, lower finance costs and positive deferred tax position resulted in an increase in earnings by over 100% to reach Rs. 573.3 million.

In the Home and Personal Care Sri Lanka business segment, Hemas increased focus on high margin personal care segment and ‘value for money’ offerings and providing innovative solutions and new product developments.

In Home and personal care international segment, Hemas efforts focussed on increasing footprint in key markets East Africa and Middle East. It also launched new variants in those markets.

Hemas’ Learning Segment had a good back to school season and entered the value for money segment with Homerun whilst in Pharmaceuticals there was increased focus on Morison branded generics. Hemas Hospitals introduced Ambulatory care and focused on improving home care and drove key anchor specialty revenues. Hemas said the Healthcare Sector particularly remained challenged amidst instability and delays in Government regulatory bodies and procurement authorities.