Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 7 November 2024 02:16 - - {{hitsCtrl.values.hits}}

Acting CEO Ravi Jayasekera

Hemas Holdings PLC yesterday reported a net profit of Rs. 2.6 billion in the first half of FY25 reflecting a 7.8% increase from a year ago.

Hemas Holdings PLC yesterday reported a net profit of Rs. 2.6 billion in the first half of FY25 reflecting a 7.8% increase from a year ago.

In 2Q the figure was Rs. 1.68 billion, an increase of 24%.

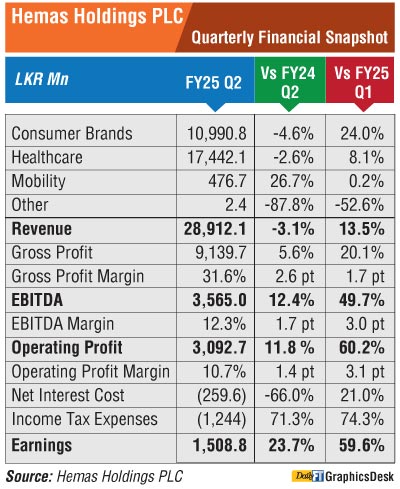

1H revenue saw a 7.7% decline to Rs. 54.3 billion whilst in 2Q it dipped by 3% to Rs. 29 billion. Operating profit in 1H improved by 2% to Rs. 5 billion and in 2Q by 12% to Rs. 3 billion.

Hemas Acting CEO Ravi Jayasekera said the decrease in revenue compared to same period last year was a result of cautious consumer spending accompanied by several strategic downward price adjustments, particularly in the Consumer Brands segment.

“However, the Group’s ongoing commitment to efficiency improvements alongside favourable foreign exchange movements, contributed to enhanced profitability margins. Additionally, the initiatives aimed at optimising working capital combined with the advantages of a declining interest rate environment, led to a further reduction in finance costs thereby boosting earnings,” he added.

The Consumer Brands Sector reported a cumulative revenue of Rs. 19.9 billion while the operating profit and earnings Rs. 2.5 billion and Rs. 1.8 billion for the year respectively. The Sector reported a revenue of Rs. 11.0 billion for the quarter, while the operating profits and earnings increased to Rs. 1.7 billion and Rs. 1.2 billion respectively due to the improved profitability margins compared to the last year.

During the quarter, a stronger domestic currency and falling global commodity prices prompted aggressive pricing and promotions, intensifying competition across key categories. Despite a decline in overall industry demand, the company saw improvements in market share, consumer reach, and product availability, driven by a focus on value-for-money options and enhanced supply chain efficiency. Increased emphasis on personal and beauty care contributed to higher profitability margins, while successful new product launches, including the re-launch of Vivya, boosted brand visibility and consumer engagement.

The stationery market faced heightened competition as new brands emerged, driving some players to lower prices, often sacrificing quality. Consumers, prioritising affordability, increasingly favoured value-for-money (VFM) options. Despite this, the company maintained its leadership position by offering high-quality products at competitive prices. It expanded its ‘Homerun’ stationery line to include books and launched its first range of educational toys, diversifying its portfolio and reinforcing its commitment to enhancing children’s learning experiences.

The healthcare sector achieved a cumulative revenue of Rs. 33.6 billion, with operating profits totalling Rs 2.8 billion and earnings of Rs. 1.8 billion. The increase in operating margins was driven mainly by the portfolio mix and initiatives focused on optimising overhead cost. Additionally, strategic management of working capital, along with declining interest rates, reduced finance costs and enhanced sector earnings.

The Sector posted a revenue of Rs. 17.4 billion for the quarter, while the operating profits increased to Rs. 1.6 billion. In addition, the benefit of lower finance costs contributed to achieving earnings of Rs. 1.0 billion for the quarter.

The Distribution business maintained its market-leading position this quarter, while both the Distribution and Manufacturing divisions focused on optimising overheads, improving margins, and leveraging synergies for better performance. The Pharmaceutical Manufacturing segment expanded its Morison branded portfolio with new product launches, including BisoMor for hypertension and SalMor for respiratory conditions.

Hospital admissions declined due to fewer communicable diseases compared to last year, while outpatient volumes increased, driven by more medical screenings. Additionally, targeted efficiency initiatives helped reduce administrative costs, improving the overall operational effectiveness of the hospitals.

The Mobility Sector posted a cumulative revenue of Rs. 941.4 million while the earnings were reported at Rs. 378.1 million. Accordingly, the quarter witnessed Rs. 476.7 million in revenue and Rs. 108.4 million in earnings.

The maritime sector experienced growth in volume and freight rates, with improved market share in the Gulf and increased volumes to the Far East after the resumption of the CEM/E service. In aviation, cargo volume rose year-on-year, driven by higher sea-air movements related to the Red Sea situation and increased demand for shipments to Europe and the USA, which also led to improved cargo yields due to higher rates.

In terms of the economic outlook, Acting CEO Ravi Jayasekera said, “Sri Lanka shows signs of recovery, but consumer disposable income remains under pressure. With policy stability and upcoming reforms, there is cautious optimism for consumption growth. The Group will focus on consumer and patient needs to drive sustainable growth in the coming quarters.”