Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 27 August 2024 02:48 - - {{hitsCtrl.values.hits}}

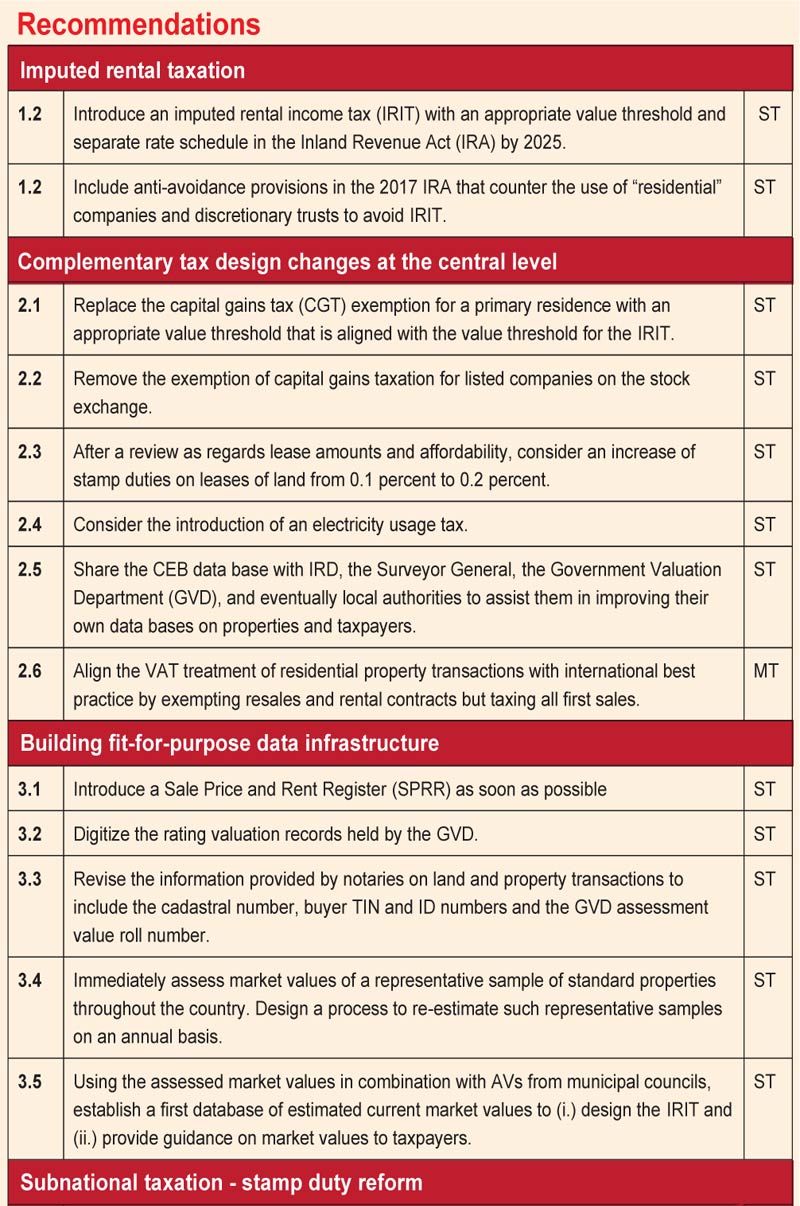

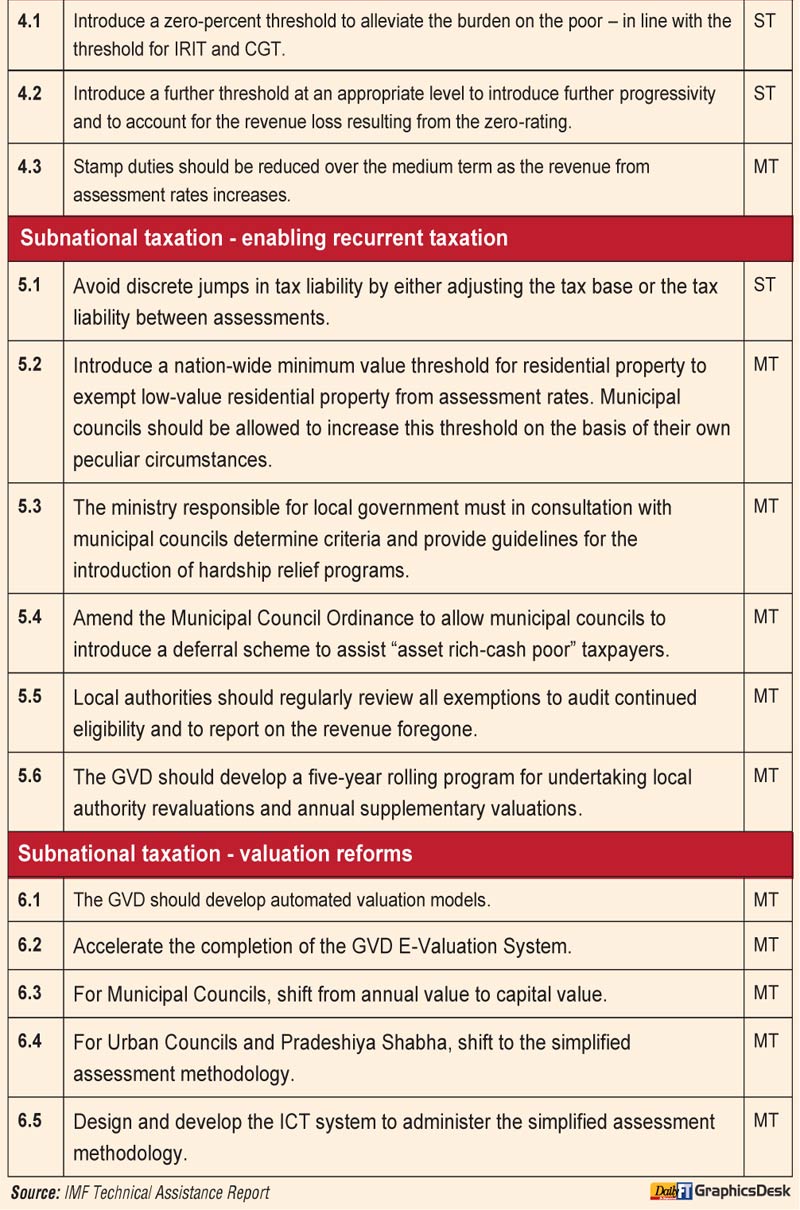

The International Monetary Fund (IMF) has insisted meeting the commitments made under the current Extended Fund Facility (EFF) program with Sri Lanka will require new central Government taxes. It said under the EFF arrangement, the authorities committed to revamping the property tax system and introducing a wealth transfer tax to support fiscal consolidation.

However, in accordance with Sri Lanka’s constitution, property-related tax revenue, currently amounting to around 0.2% of GDP, fully accrues to subnational Governments.

An increase in subnational property-related tax revenues could, in principle, reduce the need for transfers from the central Government somewhat. But the potential reduction in transfers that could be achieved is, at least in the short term, severely limited (less than 0.05% of GDP).

Taxing the imputed rental income from owner-occupied and vacant residential property, rather than taxing real property directly, would allow raising central government revenue, the IMF said in a recent Technical Assistance Report titled “Sri Lanka: Property taxation at the National and Sub-national level.”

It said imputed rental income is the deemed income that homeowners could earn if they rented out their homes. For tax purposes, such income can be defined as a fixed percentage of a property’s market value. The fundamental difference between an imputed rental income tax and a property tax is a legal interpretation of what constitutes the base: income or an asset. Imputed rental income is taxed under the Inland Revenue Act, thus raising central Government revenue while avoiding constitutional constraints of taxing property directly.

Economically, however, the taxes are both assessed with reference to the market value of real property, thus coming with similar difficulties (for instance, around valuation) and opportunities (such as increasing the progressivity of the tax system).

Given the paucity of information on market values, the revenue yield of such a tax is difficult to gauge but will likely fall short of expectations. In contrast to local property taxes, imputed rental income taxes are commonly not levied on commercial property, with beneficial effects on efficiency but reducing their revenue potential. Estimations leveraging municipal council information suggest that such a tax could be highly progressive and yield around 0.4 to 0.6% of GDP, depending on design aspects.

Data collection on market values needs to commence immediately. The valuation department has determined around 3.5 million Annual Values (AVs) – estimates of how much a property would yield if it were rented out for one year.

IMF said these valuations are largely not digitised, outdated, and unrelated to actual market rental values. Immediate priorities include:

Digitising AVs for all municipal councils

The Department of Fiscal Policy should collect information on all assessed AVs from municipal councils, together with information on the property type (residential, commercial, or government) and the ward number.

Determining capital values of standard properties

The valuation department needs to assess the capital value of a representative sample of standard properties in all municipal councils. Around 50 valuations per council may suffice to estimate all capital values by applying simple adjustment coefficients to AVs. The estimated data can be used to design the imputed rental income tax and to provide guidance to taxpayers, as the tax will need to be self-assessed in the medium term.

Introducing a digital sales price and rents register (SPRR)

A digital SPRR is the key resource for the assessment of property values and hence the basis for several taxes, including imputed rental income taxation, capital gains taxation, stamp duties, and local recurrent property taxes.

The lower-than-expected revenue from nationwide property taxation will require additional tax changes at the central level. The capital gains tax is an important complement to imputed rental income taxation. It should be reformed to replace the exemption of the first home with a value threshold. As previously recommended, the exemption of capital gains from the sale of listed shares should be removed and the VAT treatment of owner-occupied housing should be aligned with international best practice, including by taxing the first sale of residential property. Finally, to reduce transfers to local governments, stamp duties on lease contracts and vehicle registration fees could be increased.

In the medium term, the reliance on stamp duties (both centrally and locally) should be reduced. In case the improvement of the main taxes is insufficient to meet the revenue goals, an electricity surcharge would be an easily administered approach to support central Government revenue, but it would be weakly targeted and less equitable.

Subnational property taxation

The reliance on recurrent taxation should increase over the medium term. Stamp duties are a volatile revenue source and can induce under-declaration of market transactions. Local recurrent property taxes are more stable and more efficient. Unlocking the potential from recurrent property taxation will require fundamental reforms that will take five to seven years.

In the short term, local authorities should be encouraged to adjust recurrent property tax liabilities more continuously and introduce hardship relief mechanisms. A major problem is the combination of constant tax rates, outdated AV assessments, and the lack of mechanisms to provide relief. Re-valuations directly increase tax liabilities, creating downward pressure on the reassessed amount. Such pressure can be reduced by adjusting tax rates or the tax base on a yearly basis, for instance, by leveraging information that is captured for the imputed rental income tax.

In the medium term, the tax base for recurrent property taxes should change. Residential property in municipal councils should be taxed based on the property’s market values while commercial property can retain the current rental values. Property in Urban Councils and Pradeshiya Sabhas should be taxed using a simple formulaic assessment approach. This reform will reduce pressure from the valuation department and enable more accurate and timely assessments. The move towards a new assessment basis should be accompanied by transferring the authority for the timing of valuations to the central Government, the IMF emphasised.