Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Saturday, 1 July 2023 00:13 - - {{hitsCtrl.values.hits}}

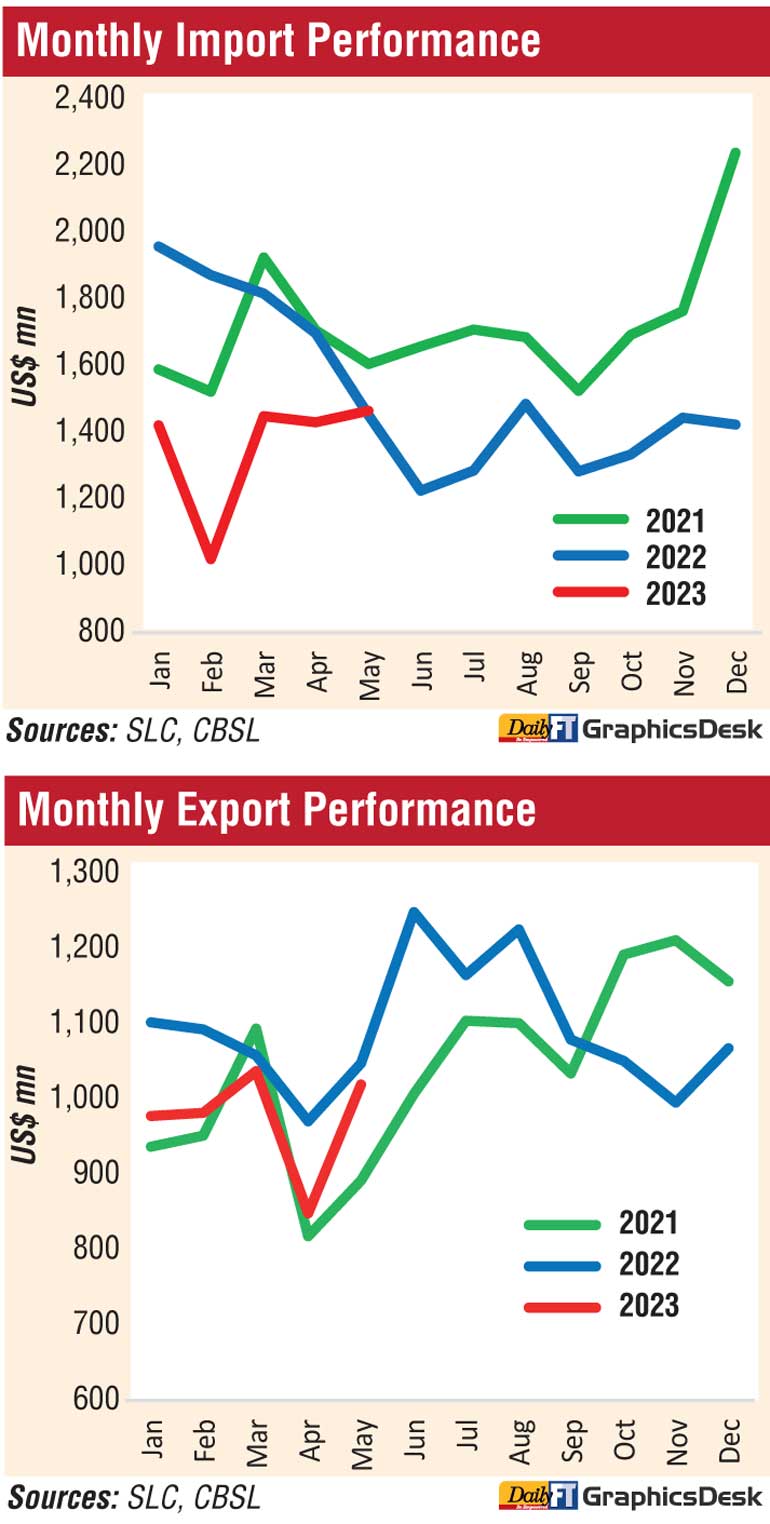

Reflecting the ongoing recovery in economic activities, Sri Lanka’s imports expanded moderately in May, marking the first year-on-year increase since February 2022.

As per the latest data from the Central Bank, imports in May increased to $ 1.46 billion, indicating the first increase in 15 months.

Noting that the ongoing recovery in economic activities played a crucial role in driving the increase in import expenditure, the Central Bank said the rise in import expenditure was primarily driven by higher spending on consumer goods, offsetting the decline in expenditure on intermediate and investment goods imports.

The import volume index improved by 14.3% YoY, while unit value index declined by 11.6% YoY, indicating that the increase in import expenditure was resulted by the increase in import volumes.

However, cumulative import expenditure from January to May plunged by 22.8% YoY to $ 6.79 billion from the corresponding period in 2022. The Central Bank the biggest intermediate goods category of imports in May saw a dip of 6.3% YoY to $ 970.5 million, which also includes fuel bill plunging by 6.9% YoY to $ 429.8 million and investment goods declined by 15.4% YoY to $ 201.5 million. In contrast, consumer goods imports increased significantly by 65% YoY to $ 292.9 million.

Reinforcing the struggle to recover, the exports experienced a dip of 2.7% YoY to $ 1.12 billion, but this figure marked a notable increase on a month-to-month comparison. The cumulative export earnings from January to May 2023 reached $ 4.86 billion, indicating a decline of 7.7% compared to the same period last year.

The Central Bank said the decline in export earnings was primarily driven by a decrease in earnings from industrial exports, although agricultural exports showed improvement.

The trade deficit for May widened from $ 403 million in May 2022 to $ 447 million in May 2023, marking a year-on-year expansion not seen since February 2022. However, the cumulative trade account deficit saw a significant plunge of 45% YoY to $ 1.92 in the first five months of 2023.

Detailing May imports, the Central Bank said import expenditure on consumer goods increased, driven by higher spending on both food and non-food consumer goods.

Expenditure on food and beverages also escalated due to increased import volumes of sugar and confectionery by 367.7% YoY to $ 59.8 million, dairy products particularly milk powder by 100.8% YoY to $ 44.2 million, vegetables, oils, and fats. Similarly, the increase in expenditure on non-food consumer goods was broad-based, with notable increases in imports of medical and pharmaceutical products especially medicaments by 52.2% YoY to $ 52.2 million and telecommunication devices mainly mobile phones by 164.9% YoY to $ 6.6 million.

In contrast, expenditure on the importation of intermediate goods decreased in May 2023 compared to the previous year. This decline was mainly driven by lower imports of fuel, primarily refined petroleum, although expenditure on crude oil notably increased.

Further, sizeable declines were observed in the importation of non-fuel intermediate goods, such as textiles and textile articles (primarily fabrics), plastics, rubber, chemical products, mineral products, and paper and paperboard.

However, some categories of intermediate goods saw an increase, including wheat, fertilisers, diamonds, precious stones and metals, base metals, and unmanufactured tobacco, compared to the previous year.

Import expenditure on investment goods decreased in May compared to the same period a year earlier. All three main categories of investment goods, namely machinery and equipment, building materials, and transport equipment, recorded declines.

Describing May earnings from the exports, the Central Bank said industrial goods declined in May, compared to the same period last year, mainly due to the lower exports of garments to most of the major markets (the USA, the EU, and the UK).

Similarly, a sizeable decline was recorded in the exports of petroleum products (led by lower export volumes and prices of bunker fuel exports), textiles (primarily, cotton fabric), printing industry products and transport equipment. However, earnings from animal fodder (mainly, wheat residues); machinery and mechanical appliances (mainly, mechanical appliances parts); food, beverages and tobacco; and gems, diamonds and jewellery increased in May 2023.

Earnings from the exports of agricultural goods increased in May, compared to a year ago, with a substantial share of the increase being contributed by tea (led by higher average export prices and volumes). Meanwhile, an increase in earnings was reported in seafood (mainly, processed fish), spices (mainly, higher volumes of nutmeg and mace, and cinnamon), minor agricultural products (mainly fruits and areca nuts), unmanufactured tobacco, and vegetables. However, the export of subcategories of coconut (primarily, fibres, desiccated coconut and coconut oil) and natural rubber recorded a decline in May 2023, compared to the previous year.

However, earnings from mineral exports declined in May compared to the corresponding period of 2022 mainly due to the decline in exports of ores, slag, and ash.

The export volume index improved by 3.6% YoY, while unit value index declined by 6.1% implying that the decline in export earnings in May 2023 was driven by lower export prices.