Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 27 December 2021 03:53 - - {{hitsCtrl.values.hits}}

In a bid to rein in plunging workers’ remittances via official channels, the Central Bank (CBSL) has decided to extend the incentive of additional Rs. 10 per dollar by a month whilst absorbing transactional cost.

In a bid to rein in plunging workers’ remittances via official channels, the Central Bank (CBSL) has decided to extend the incentive of additional Rs. 10 per dollar by a month whilst absorbing transactional cost.

The CBSL said having considered the requests made by Sri Lankans working abroad, it has decided to continue the payment of additional Rs. 8 per dollar for worker remittances, paid in addition to the incentive of Rs. 2 per dollar under the ‘Incentive Scheme on Inward Workers’ Remittances’.

The incentive is for workers’ remittances channelled through Licensed Banks and other formal channels and converted into rupees until 31 January 2022.

“The decision to continue this additional incentive of Rs. 10 per dollar is in response to the favourable developments observed in workers’ remittances so far during December 2021,” CBSL said.

It has also decided to bear the transaction cost incurred by Sri Lankans working abroad up to a defined limit when remitting their money to Sri Lanka through exchange houses and or banks.

CBSL said a large segment of Sri Lankans working abroad would now be able to remit their money without any charges.

The operating instructions in this regard including the date of commencement will be issued by CBSL in due course.

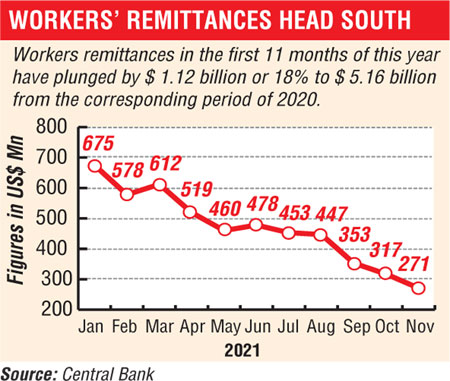

Renewing fresh concerns among stakeholders, workers’ remittances in the first 11 months of this year have plunged by $ 1.12 billion or 18% to $ 5.16 billion from the corresponding period of 2020.

November saw an inflow of only $ 271 million, the lowest for a month in recent history, and reinforced the acceleration of the decline. From a year earlier, the November 2021 figure is down by 56% or $ 341 million.

Remittances by Sri Lankans employed abroad have been an important flow of foreign exchange into the country, with an annual average value of over $ 7 billion in the past few years.

What the CBSL data reflects however is the inflows via banking channels and the $ 1 billion plunge despite multiple incentives offered. It also points to the fact that inflows continue to increase via unofficial channels fetching a higher conversion rate as opposed to caps fixed by the CBSL.

Analysts said dollars, via illegal grey channels, fetch Rs. 230 each or more, hence the upward revision in the incentive and bearing the transaction cost may encourage inflows via banking channels as CBSL tightens surveillance to curb unofficial inflows.

Since mid-last month CBSL has issued a plethora of public notices cautioning against the use of illegal channels for remittances.

CBSL said it has received information that some Sri Lankans residing abroad send remittances to their dependents in Sri Lanka, knowingly or unknowingly, through various racketeers. CBSL said it was aware that there had been instances where certain brokers collect foreign currency from Sri Lankan employees in other countries and credit the accounts of their dependents in rupees by way of cash or transfers through the financial system.

“The public may not be aware that they are committing offences punishable in terms of law for the violation of the provisions of the Prevention of Money Laundering Act. Further, available information indicates that these transactions could be linked to drug trafficking and other illegal activities,” one of the earlier public notices said.

“Hence, the CBSL hereby informs all Sri Lankans residing abroad and their dependents not to be victims of such illegal activities, knowingly or unknowingly,” it added.

The CBSL emphasised the need for all concerned parties not to become victims of illegal operators and to ensure that they remit their foreign remittances to Sri Lanka only through banks and through financial institutions which are supervised by the CBSL or other international banks and financial institutions.

Subsequent notices issued by the Financial Intelligence Unit of the CBSL were more emphatic. One notice said: “By using informal money transferring mechanisms, you could unknowingly become a part of a money laundering or a terrorist financing ring.”

Another warned migrant workers to safeguard hard-earned money in foreign countries by not falling victim to scammers by sending money through brokers. “By sending money through informal methods, you will lose hard-earned money and assets. Not only you, but also your loved ones who receive money through informal methods, could become victims of a criminal network punishable by law,” it said.

Another notice highlighted the benefits of sending remittances through banking channels qualify for lifetime benefits such as pension scheme, accident and or life insurance cover, low-interest housing loan, low-interest self-employment loans, enhanced duty-free concessions apart from additional incentive of Rs. 10 per dollar.

In tandem, banks have stepped up advertising to convey the same message in a coordinated effort.

In recent months, the CBSL has stepped up measures to address this, as well as increase facilitation of workers remittances. Recently, it established a new department named the Foreign Remittances Facilitation Department (FRFD) to facilitate and streamline workers’ remittance inflows to the country, under the provisions of the Monetary Law Act No. 58 of 1949.

The CBSL also appointed a working committee to study and suggest new remittance channels for Sri Lanka and to make recommendations on reducing the cost of remitting money, having identified the need to introduce new and low-cost remittance channels with the objective of increasing the inflows of foreign remittances while discouraging the use of informal channels.

The Working Committee comprises experienced professionals from Bank of Ceylon, People’s Bank, Sampath Bank PLC, Commercial Bank of Ceylon PLC, Hatton National Bank PLC, The Hongkong and Shanghai Banking Corporation Ltd., Cargills Bank Ltd., Dialog Axiata PLC, Mobitel Ltd., and CBSL.

The recent implementation of a national remittance mobile application titled ‘SL-Remit’ to attract more remittances to Sri Lanka with features such as user self-registration, the ability to link to global money transfer operators, and global fin-techs to facilitate remittances from any country, and instant fund transfers to any bank account or mobile wallet in Sri Lanka was following the recommendation of the Working Committee.