Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 4 February 2021 02:33 - - {{hitsCtrl.values.hits}}

The Colombo Stock Market bounced back yesterday to close on a positive note after the worst crash in terms of loss of value on Tuesday.

The All Share Price Index (ASPI) closed up 3% or 239 points and the S&P SL20 Index gained by over 3% or 106 points. Turnover was a healthy Rs. 6.2 billion.

On Tuesday, ASPI fell by 6.5% and the S&P SL20 by 7%, partly owning to profit taking and concerns over regulatory action, which since has been clarified. Around Rs. 245 billion of market value was wiped off on Tuesday.

According to SC Securities, LOLC Holdings PLC topped the turnover league with Rs. 898 million worth of shares traded followed by Expolanka Holdings (Rs. 599.6 million), Royal Ceramics (Rs. 550.4 million) Vallibel One (Rs. 506 million) and Dipped Products (Rs. 363 million). Volume-wise, Industrial Asphalts (56 million shares), Browns Investments (32.5 million shares) and Expolanka (12 million shares) figured in top three.

First Capital said market rebounded from a two-week low, reverting the direction back to positive, amidst heavy retail buying interest.

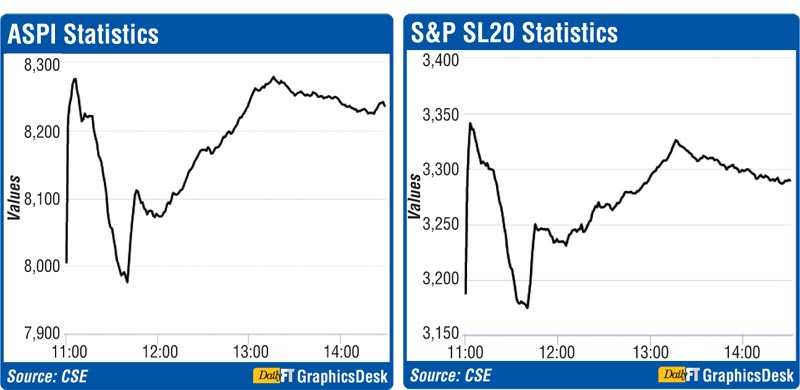

“Index spiked within the first few minutes of trading, followed by a steep fall hitting the intraday low of 7,970. Subsequently, market experienced a strong recovery as it reached its intraday high of 8,291. Later, market moved slightly downwards and closed at 8,245 gaining 239 points,” First Capital added.

The Capital Goods sector continued to lead the turnover for the session followed by Diversified Financials making a joint contribution of 50%, it said.

NDB Securities said equities retracted from its “three-day” losing streak today to close 2.99% higher with renewed investor confidence.

“The market saw sharp swings reaching an intraday high of 8,275 a few minutes after the opening bell, followed by an intraday low in the first hour itself (-3.5% lower from the day’s high),” it added.

NDB Securities said price gains in LOLC Holdings, Expolanka and John Keells Holdings (JKH) aided to 20% of benchmark index gains. Price gainers outperformed losers by 176 to 37.

It said in the initial trading hours, panic selling was seen in the tile sector with fears of increased competition from import relaxation as indicated by Tuesday’s gazette. However, with the news that the gazette has been repealed, the three tile sector stocks recovering to end the day higher.

Royal Ceramics rose +4.85%, Lanka Walltiles by + 6.88% and Lanka Tiles +4.02%. Experts said even if the import controls were removed as per the gazette yesterday, the near-term downside risks for local tile manufactures remain low due to increased financing cost from extended credit period coupled with FX volatilities.

High net worth and institutional investor participation was noted in Softlogic Holdings. Mixed interest was observed in LOLC Holdings, Royal Ceramics and Dipped Products, whilst retail interest was noted in Expolanka Holdings, Vallibel One and Sampath Bank. Foreign participation in the market remained at subdued levels with foreigners closing as net sellers.

The Capital Goods sector was the top contributor to the market turnover (due to Royal Ceramics and Vallibel One), whilst the sector index gained 3.33%. The share price of Royal Ceramics moved up by Rs. 15.50 (4.85%) closing at Rs. 335.25, whilst foreign holdings decreased by 260,889 shares. The share price of Vallibel One recorded a gain of Rs. 3.20 (4.83%) to close at Rs. 69.50.

Diversified Financials sector was the second highest contributor to the market turnover (due to LOLC Holdings), whilst the sector index increased by 3.83%. The share price of LOLC Holdings increased by Rs. 19.25 (4.13%) to close at Rs. 485.75.

Expolanka Holdings and Dipped Products were also included amongst the top turnover contributors. The share price of Expolanka Holdings gained Rs. 3.60 (7.78%) to close at Rs. 49.90. The share price of Dipped Products appreciated by Rs. 51.25 (8.36%) to close at Rs. 664.50.

Separately, Ceylon Cold Stores announced an interim dividend of Rs. 8.50 per share.

Net foreign selling amounted to Rs. 285 million, up from Rs. 179 million and brought the year-to-date figure to Rs. 9.35 billion.

“Investors were seen taking positions in the market today ahead of earnings, following a sentiment-driven dip yesterday. The sharp fall yesterday opened attractive opportunities for investors to position themselves as company fundamental and earnings potential remained unchanged,” Asia Securities said.

“However, turnover was moderate compared to the last few sessions as a few investors took a ‘wait-and-see’ approach. Volatility was noted in early trading, however stabilised towards the latter end of the day,” it added.

Asia Securities said estimated net foreign buying topped in LB Finance at Rs. 13.4 million and net foreign selling topped in SAMP at Rs. 92 million.