Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 24 July 2023 02:59 - - {{hitsCtrl.values.hits}}

Under the current FTA, Sri Lanka is permitted to export 8 million pieces of ready-made apparel to India without applicable duties. The JAAF (Joint Apparel Association Forum), the apex body of Sri Lanka apparel is hopeful to move beyond this quota, as FTAs carry the propensity to offer immense trade opportunities for both countries.

As Sri Lanka recovers from the worst economic crisis since independence, the role of the merchandise export sector has never been more important. Unfortunately, the apparel industry is showing a decline of 20% in exports of textiles and apparel, driven mainly by a reduction in demand in the primary apparel export markets. We believe that India, as our closest trading partner, could offer a lifeline to the country, whilst also benefiting Indian fabric manufacturers.

A brief history of Indo-Sri Lanka trade relations under the ISFTA

The ISFTA which came into operation on 1 March 2000, has built a vibrant history between the two South Asian nations in both trade and investments for more than two decades. Since the operationalisation of the ISFTA, Sri Lanka’s export trade has multiplied 18 folds from $ 47 million in 1999 to $ 815 million in 2021. Sri Lanka has also been able to promote a diverse range of products under the ISFTA. Moreover, nearly 70% of Sri Lanka’s exports to India use FTA provisions.

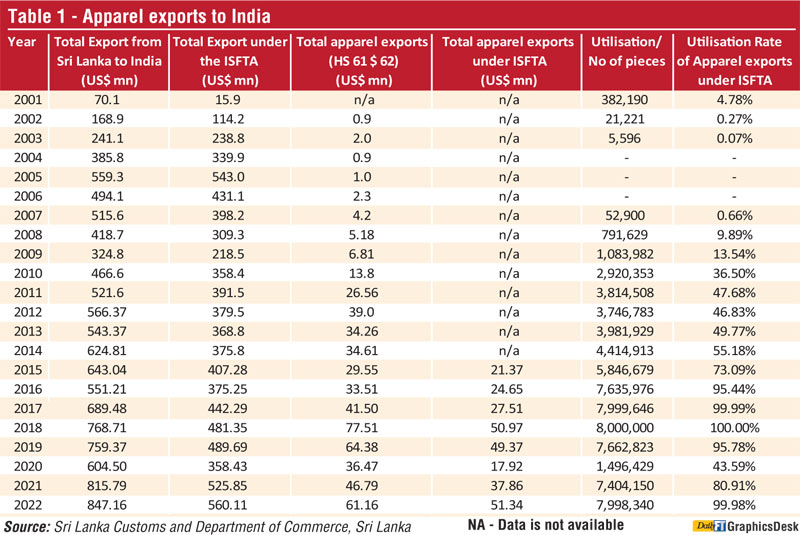

With the removal of port restrictions and fabric requirements in 2013, Sri Lankan exporters were encouraged to utilise this quota despite apparel items being on India’s negative list. With this, total earnings from apparel exports to India which stood at $ 5.18 million in 2008 and increased to $ 77.51 million in 2018 indicating impressive growth. (Refer Table 1 below which charts the industry’s growth under the ISFTA).

India as of now is the second largest supplier of fabric to Sri Lanka (a share of 26%) for both domestic and export industry. Sri Lanka’s apparel industry consistently imports intermediary goods including Indian yarn and fabric. Total imports from India to Sri Lanka stood at $ 4,421.35 million in 2021, of which goods worth $ 208.94 million were imported to Sri Lanka under the ISFTA.1

Industry concerns and calls for improvement

However, despite these many successes, the aforementioned 8 million export quota acts as a hindrance to the apparel industry’s ability to reap the full benefits of the ISFTA.

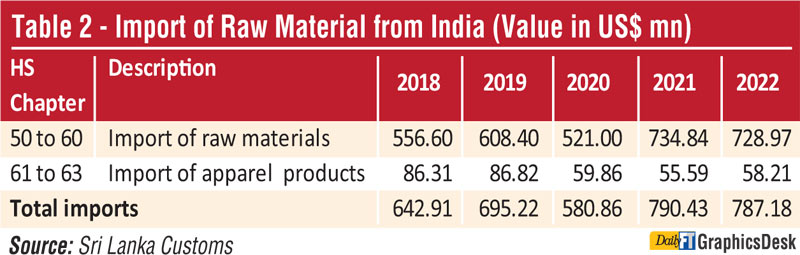

For instance, Sri Lanka imports more from India, than it exports. In 2022 alone, while total earnings from apparel exports to India stood at just $ 149.28 million, yarn worth $ 146.47 million, knitted fabrics worth $ 311.78 million, and woven fabrics worth $ 278.38 million were imported from India.

Refer Table 2 below for an annual breakdown of raw material and apparel product imports from India.

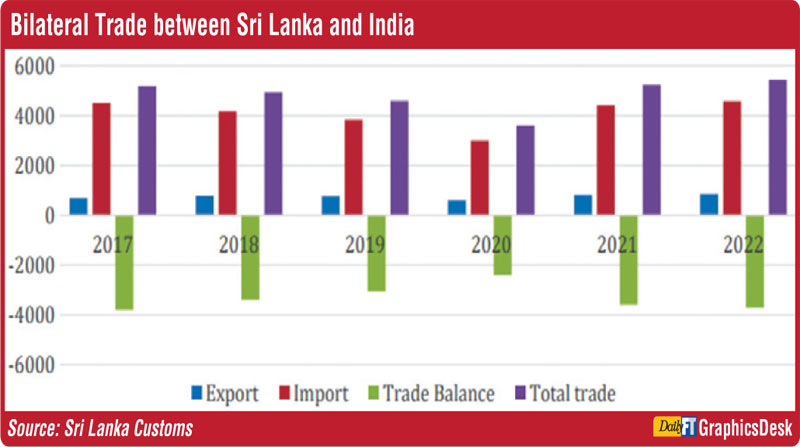

This highlights a serious sectoral imbalance of trade between India and Sri Lanka with the overall balance of trade continuously favouring India, allowing Indian companies to grow their footprint on the island with greater access for Indian mills to the Sri Lankan market.

Refer Chart 1 below.

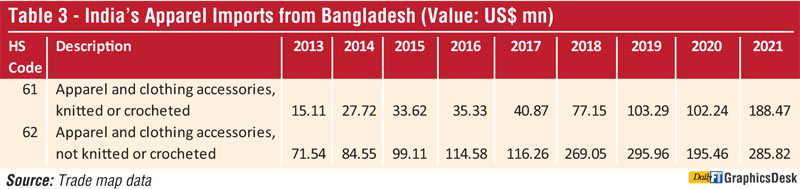

Moreover, the Indian Government’s customs notifications No. 80/2017 dated 27 October 2017 and Notification No. 58/2018 dated 7 August 2018 have revised their (MFN) tariffs on apparel and textile products under HS chapters 50-63. This resulted in MFN tariffs applicable to HS Chapters 61 and 62 which cover apparel products being increased from 10% to 25%. The 8 million export quota and MFN duty increases have shifted Sri Lanka apparel’s business opportunities to other competing nations in the region. For example, Bangladesh enjoys zero-duty concessions from India under the South Asian Free Trade Area (SAFTA) agreement for LDCs, a clear competitive advantage over Sri Lanka. Table 3 illustrates the growth of Bangladesh’s textile exports to India from 2017-2021.

Refer Table 3 below

It is also important to note that the limited 8 million quota has to be shared by all Sri Lankan exporters, leaving exporters compromised to negotiate any meaningful orders with Indian buyers under the current restrictions.

However, JAAF is happy to note that talks between India and Sri Lanka on an FTA are ongoing and are confident that this will bring benefits to both countries. Pending the finalising of the FTA, JAAF requests that the quota of 8 million pieces is removed to give Sri Lanka an opportunity to use this as an avenue to increase its exports of apparel to India. Under these circumstances, JAAF seeks assistance from the Indian Government to remove the limit of 8 million pieces. Sri Lanka requires such flexible trade arrangements now more than ever given the state of current global market conditions, the resulting drop in demand for the apparel industry, and the country’s prevalent economic crisis.