Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 31 July 2024 00:24 - - {{hitsCtrl.values.hits}}

Chairperson

Krishan Balendra

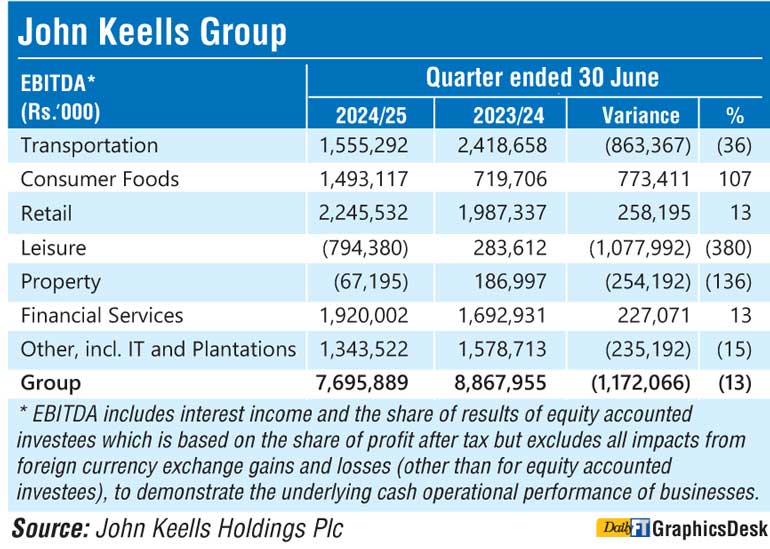

Top blue chip John Keells Holdings Plc (JKH) yesterday announced a Rs. 7.7 billion EBITDA for the first quarter of FY25 down by 13% from a year ago whilst its bottom line saw a negative Rs. 868 million.

JKH said Group EBITDA included substantial pre-opening costs pertaining to the ramp-up associated with the opening of the ‘Cinnamon Life’ hotel at ‘City of Dreams Sri Lanka’, whilst the first quarter of the previous year included a deferred tax credit at the Group’s Ports and Shipping business, South Asia Gateway Terminals (SAGT).

Excluding these impacts, Group EBITDA for the first quarter of 2024/25 recorded an increase of 2% to Rs.8.47 billion from a year ago.

Gross profit rose by 15% to Rs. 12.7 billion whilst operating profit had declined by 20% to Rs. 1.3 billion. At pre-tax level there was a Rs. 204 million loss as against Rs. 1.4 billion profit a year ago and post-tax loss was Rs. 967 million in 1Q of FY25 in comparison to Rs. 1.2 billion profit. Net profit attributable to equity holders of parent was a negative Rs. 868 million as against Rs. 1.24 billion in 1Q of FY24.

Group’s sectors such as consumer foods, retail, financial services showed better performance whilst transportation, leisure and property lagged.

In its statement JKH said the finishing works at the ‘City of Dreams Sri Lanka’ integrated resort is progressing well, with the 687-key ‘Cinnamon Life’ hotel, restaurants and banquet facilities being in the final stages of fit-out to commence operations in October 2024. The remainder of the project comprising the 113-key ‘Nuwa’ hotel, gaming operations and retail mall, will be operational, in a phased manner, with overall completion of these elements scheduled for mid-CY2025.

Subsequent to the 20-year lease agreement for the demarcated gaming space at the ‘City of Dreams Sri Lanka’ being executed between Waterfront Properties Ltd., and the locally incorporated subsidiary of Melco Resorts and Entertainment Ltd., Melco has mobilised the teams to commence the fit-out work of the gaming space.

The work on the West Container Terminal (WCT-1) at the Port of Colombo is progressing well. The first batch of quay and yard cranes will arrive in August 2024, following which the commissioning and automation is expected to be completed by the third quarter of 2024/25. The first phase of the terminal is slated to be operational in the fourth quarter of 2024/25.

Profitability at SAGT recorded an increase driven by double-digit growth in throughput, on account of both domestic and transhipment volumes.

The Group’s Bunkering business, Lanka Marine Services (LMS) recorded double-digit volume growth during the quarter although profitability was impacted due a contraction in margins on account of volatile global fuel oil prices and intensified competition from local and regional players.

Both the Beverages and the Frozen Confectionery businesses recorded an increase in EBITDA driven by a significant growth in margins and volumes.

The Supermarket business recorded a strong performance during the quarter, with same store sales recording encouraging growth of 12%, driven by customer footfall growth of 12%, resulting in growth in profitability and margins.

The performance of the Leisure industry group was impacted by the pre-opening costs pertaining to the ‘Cinnamon Life’ hotel, as stated before, together with the decline in profitability in the Group’s Maldivian resorts on account of lower occupancy. Occupancies in Maldivian Resorts are expected to increase for the upcoming peak season based on current forward bookings and a normalised mix in arrivals.

Nations Trust Bank PLC recorded a strong growth in profitability aided by loan growth, lower impairments and increased trading and fee income while Union Assurance PLC recorded encouraging double-digit growth in gross written premiums, driven by renewal premiums and regular new business premiums.