Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 4 February 2025 04:05 - - {{hitsCtrl.values.hits}}

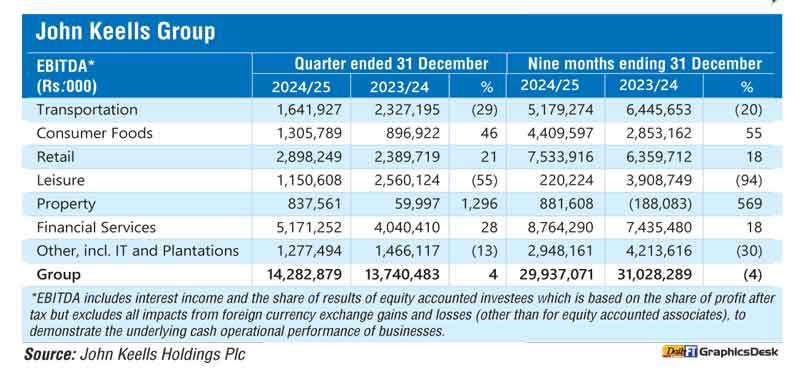

Top blue chip John Keells Holdings PLC (JKH) yesterday announced it has achieved Group EBITDA of Rs. 14.28 billion in the third quarter of the financial year 2024/25, reflecting a 4% year-on-year (YoY) increase.

Group EBITDA includes substantial costs pertaining to the pre-opening and operations of the ‘Cinnamon Life’ hotel. Group EBITDA for the quarter under review includes fair value gains on investment property, while Group EBITDA in the third quarter of the previous year includes a deferred tax credit at South Asia Gateway Terminals (SAGT). Excluding these impacts, Group EBITDA for the third quarter of 2024/25 recorded an increase of 10% to Rs. 14.89 billion. Separately, JKH also announced a second interim dividend of Rs. 0.05 per share.

JKH said the 687-key ‘Cinnamon Life’ hotel, restaurants, and banquet facilities commenced operations on 15 October 2024. All the food and beverage offerings, including the unique outdoor locations and wellness centre, were progressively launched over the last few months with all outlets and spaces at the hotel now operational. Demand and bookings for the various event spaces at the property have exceeded expectations. The integrated resort’s residential and office towers have witnessed a resurgence in interest in the recent months.

Fit-out work of the gaming space is progressing well and is expected to be operational along with the retail mall in the third quarter of FY2025.

The construction and installation work on the West Container Terminal at the Port of Colombo is progressing well, with all civil works pertaining to the first phase of the project being completed. All operating equipment relating to the first phase have been received and is being commissioned. The terminal will be completed by February 2025 and is expected to receive its inaugural test vessel thereafter, signalling the commencement of its first phase of operations.

The profitability of SAGT recorded an increase driven by a growth in volumes and an improvement in the mix. While Lanka Marine Services recorded a volume growth, profitability was impacted due to a contraction in margins on account of intensified local competition and the temporary oversupply of inventory and the appreciation of the Rupee.

The Beverages and Frozen Confectionery businesses recorded a strong growth in profitability driven by double-digit volume growth and a sustained improvement in margins. The Supermarket business recorded a strong performance during the quarter, with same store sales recording a growth of 14%, resulting in growth in profitability and margins.

The performance of the Leisure industry group was impacted by the pre-opening and operating costs pertaining to the ‘Cinnamon Life’ hotel, together with the decline in profitability mainly attributable to the Colombo Hotels and the Maldivian Resorts segments, due to the translation impact of a stronger Rupee as compared to the corresponding period in the previous financial year.

Nations Trust Bank recorded a strong growth in profitability aided by a net gain on the disposal of international sovereign bonds, steady margins, asset growth, impairment reversals, and gains on Government securities. Union Assurance maintained a steady profitability, recording double digit growth in both first year premiums and renewal premiums.

In January 2025, the HWIC Asia Fund exercised its option to convert the final remaining balance debentures and, accordingly, JKH issued and listed 1,079,375,000 new ordinary voting shares of the company.