Thursday Feb 19, 2026

Thursday Feb 19, 2026

Wednesday, 6 November 2024 00:30 - - {{hitsCtrl.values.hits}}

|

| Chairperson Krishan Balendra

|

Top blue chip John Keells Holdings PLC (JKH) yesterday reported continued growth momentum across all businesses in the second quarter except the leisure segment.

“During the quarter under review, Sri Lanka continued to witness a stable macroeconomic environment with all key indicators supporting a sustained growth trajectory,” noted JKH Chairperson Krishan Balendra.

Group revenue in 2Q rose by 20% to Rs.76.96 billion with increases across all businesses, particularly the Bunkering and Supermarket businesses. The figure in 1H of FY25 rose by 15% to Rs.146.61 billion.

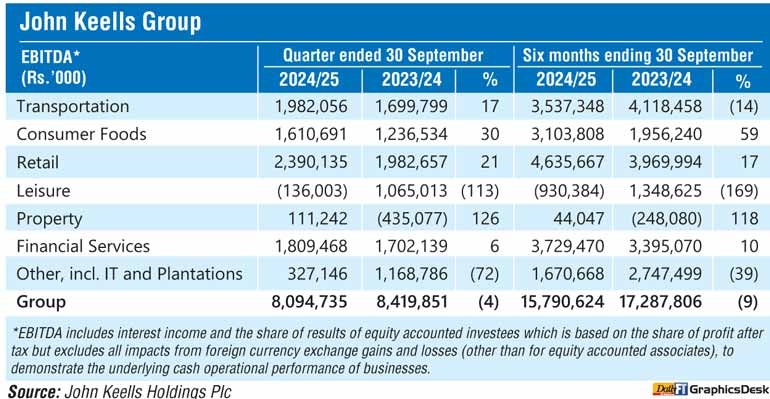

Group earnings before interest expense, tax, depreciation and amortisation (EBITDA) at Rs. 8.09 billion in 2Q was down by 4% year on year.

JKH said Group EBITDA for 2Q included substantial pre-opening costs pertaining to the ramp-up associated with the opening of the ‘Cinnamon Life’ hotel at the ‘City of Dreams Sri Lanka’. Excluding

‘City of Dreams Sri Lanka’, Group EBITDA for the 2Q of FY25 rose by 8% to Rs. 9.28 billion. Cumulative Group EBITDA in 1H including ‘City of Dreams Sri Lanka’ declined by 9% to Rs. 15.79 billion. Excluding ‘City of Dreams Sri Lanka’ the figure was unchanged at Rs. 17.75 billion.

JKH said Group PBT improved as a result of a decrease in finance expenses in comparison to the same quarter of the previous year and on account of a non-cash exchange gain of Rs. 1.94 billion on the outstanding $ 213 million term loan at Waterfront Properties Ltd. (WPL). Given the partial conversion of the convertible debentures issued to HWIC Asia Fund (HWIC) in February 2024, the interest cost recorded on the debentures declined to Rs. 550 million during 2Q.

The notional non-cash interest on the debentures, in line with the accounting treatment, approximates to Rs. 460 million [2023/24 Q2: approximately Rs. 800 million] due to the significant difference between the market interest rates and the 3% interest rate accrued on the instrument.

Excluding the impact of the exchange gain on the $ 213 million term loan facility at WPL, Group PBT stood at Rs. 335 million, as against Rs. 1.99 billion a year ago. Cumulative Group PBT for 1H rose by 67% to Rs. 2.07 billion.

Group profit before tax (PBT) at Rs. 2.27 billion in 2Q as against a negative Rs. 154 million a year ago.

Cumulative Group PBT for the first half of FY25 rose by 67% to Rs. 2.07 billion.

The profit attributable to equity holders of the parent in 2Q was Rs. 1.37 billion in comparison to negative Rs. 574 million a year ago. In the 1H, it amounted to Rs. 500 million down from Rs. 829 million in 1H of FY24.

JKH Board also declared a first interim dividend of 5 cents per share to be paid on or before 4 December 2024. The dividend will be subsequent to the Sub-division of shares in the ratio of one existing share into ten Ordinary Shares.

JKH said the 687-key ‘Cinnamon Life’ hotel, restaurants and banquet facilities commenced operations on 15 October 2024. While operations have commenced and continued for only a few weeks, the feedback received to date from our customers have exceeded expectations. Fit-out works relating to the remainder of the project comprising of the 113-key ‘Nuwa’ hotel and gaming operations are progressing well and expected to be operational along with the retail mall, with overall completion of these elements scheduled for mid-CY2025.

It also said the construction and installation works on the West Container Terminal (WCT-1) at the Port of Colombo is progressing well. The first batch of quay and yard cranes arrived in September 2024, following which the commissioning is expected to be completed by the third quarter of 2024/25. The first phase of the terminal is slated to be operational in the fourth quarter of 2024/25.

The Transportation industry group recorded an increase in profitability, driven by both the Group’s Ports and Shipping business and the Bunkering business.

Both the Beverages (carbonated soft drinks segment) and the Frozen Confectionery businesses recorded an increase in EBITDA driven by a significant growth in margins and volumes.

The Supermarket business recorded a strong performance during the quarter, with same store sales recording encouraging growth of 14%, driven by customer footfall growth of 12%, resulting in growth in profitability and margins.

The performance of the Leisure industry group was impacted by the pre-opening costs pertaining to the ‘Cinnamon Life’ hotel, together with the decline in profitability mainly attributable to the Maldivian Resorts due to the translation impact of a stronger rupee as compared to the corresponding period in the previous financial year.

The property industry group recorded a growth in profitability driven by profit recognition from residential apartment unit sales at ‘City of Dreams Sri Lanka’, real estate sales in Digana, through Rajawella Holdings Ltd., and revenue recognition at the ‘TRI-ZEN’ residential project.

Nations Trust Bank PLC recorded a strong growth in profitability aided by loan growth, higher fee income and lower impairment while Union Assurance PLC recorded encouraging double-digit growth in gross written premiums, driven by renewal premiums and regular new business premiums.