Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 19 November 2021 00:30 - - {{hitsCtrl.values.hits}}

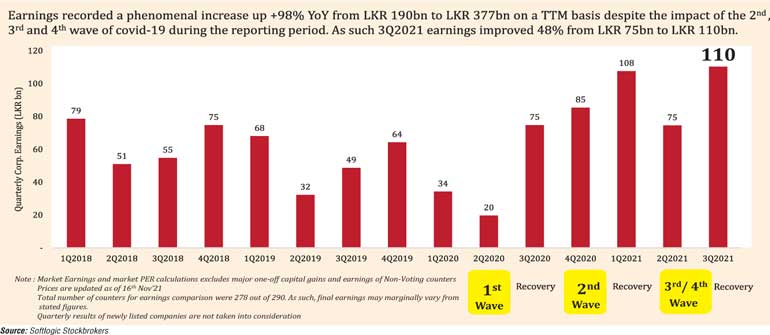

Listed companies have reinforced their resilience with combined profits in the quarter ended 30 September 2021, reaching an all-time high of Rs. 110 billion; thereby propelling nine-month earnings to Rs. 292 billion, surpassing all historical full year results.

The stellar performance of listed corporates, amidst the third and fourth waves of COVID-19, was revealed yesterday by Softlogic Stockbrokers, which analysed earnings of 278 companies which have announced their financial performance out of 290 counters.

The Rs. 110 billion combined September quarter earnings reflected a 48% growth year-on-year (YOY) from Rs. 75 billion. This performance propelled the nine-month combined cumulative earnings to a whopping Rs. 292 billion, prompting Softlogic Stockbrokers to describe the achievement as a “dream run” despite the pandemic during the period. It also said in just nine months, corporate earnings have far surpassed full year historical earnings in the Colombo Stock Exchange with the December quarter (historically being the best quarter) still to come.

Based on the nine-month performance, Softlogic forecast that 12-month earnings may hit the magical Rs. 400 billion mark.

Softlogic said the earnings growth so far was on the back of revenge spending, pent-up demand cycles, protectionist policies, import restrictions, loan moratoriums and expansionary monetary policies driving down interest rates, vis-à-vis lower financing costs.

It said the banking sector earnings shot up 48% YOY to Rs. 19.8 billion on the back of deposit repricing at lower interest rates, a rise in fee and commission income and lower impairments as the economic recovery got into gear.

“Prudent impairment provisioning was seen during the quarter, whilst a healthy growth of the loan book continued,” Softlogic added.

The Capital Goods and Manufacturing sector’s nine-month earnings grew by almost Rs. 50 billion or 332% on a YOY basis to Rs. 63 billion and quarter earnings by 115% to Rs. 18.3 billion, led by a growth in Hayleys, John Keells Holdings, Vallibel One and the tile industry, on the back of import protectionism, USD depreciation and a revival in overall activity levels, despite the delta impact.

It said the Consumer Sector saw marginal growth of 3% to Rs. 17.9 billion as delta-driven lockdowns hampered profitability.

“Food Beverage and Tobacco’s earnings grew marginally, growing at +3% YOY, whilst TTM growth stood at a stronger 84% as the sporadic lockdowns severely impacted the alcohol and tobacco industry, which had almost 30 days of zero sales,” Softlogic said.

It said the materials sector’s earnings declined by 36% YOY to Rs. 4.5 billion whilst maintaining a growth of over 55% on a TTM basis amidst an economic recovery, whilst individual companies and industries faced external pressures on margins.

The Healthcare Equipment and Services sector’s earnings, according to Softlogic, improved significantly, growing by 115% YOY to Rs. 2.4 billion during the quarter and 426% YOY to Rs. 8.3 billion on a TTM basis.

“It is a segment that may continue to thrive in the event of a long-drawn recovery,” the stock broking firm added.

The telecommunication sector’s earnings grew by 24% YOY to Rs. 8.6 billion during the quarter and 37% on a TTM basis on the back of improved data consumption, longer call durations, cost-saving initiatives and lower forex losses.

The transportation sector’s TTM earnings spiked a further 343% YOY to Rs. 26.8 billion and 92% QOQ to Rs. 12 billion on the back of the extraordinary earnings of EXPO for the quarter.

Softlogic said the retailing sector with earnings flat at Rs. 1.79 billion faced a volatile period during the past 12 months due to the sporadic lockdowns and economic conditions, which continued during this quarter owing to the delta variant.

“However, an improvement may be due,” it added.

The Utilities Sector’s earnings grew 18% YOY to Rs. 1.8 billion due to the cyclical weather conditions, whilst growing by 113% YOY to Rs. 5 billion on a TTM basis due to the sector›s constant capacity additions.