Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 18 December 2017 00:25 - - {{hitsCtrl.values.hits}}

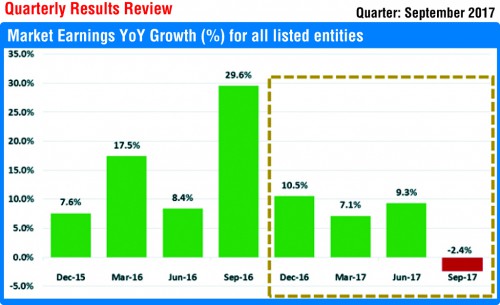

Earnings of listed companies in the September quarter have declined marginally by 2% to Rs. 60.1 billion largely owing to a weaker performance by diversified financials and energy sector firms.

Analysing interim financials reported by 275 companies, First Capital Research revealed that September quarter earnings marginally dipped 2% YoY to Rs. 60.1 billion (Sep 2016 - Rs. 61.6 billion) driven by the adverse performance of the Energy (-108%YoY), Diversified Financials (-18%YoY) and Consumer Services (-54%YoY) sectors.

“The dip in earnings diminished the effect of positive earnings growth in the Food, Beverage and Tobacco (+9%YoY) and Banks (+6%YoY) sectors and one-off gains in the Food, Staples and Retailing (+178%YoY) sector,” First Capital said. It said the primary source of decline in September earnings was the Energy Sector (-108%YoY) which saw a loss of Rs. 137 million (September 2016 = Rs. 1,731 million), driven by LIOC (-112%YoY) and LGL (-85%YoY) attributable to higher oils prices and LP Gas prices that drove costs while the selling price remained fixed.

The Diversified Financials sector (-18%YoY) also almost equally contributed to an earnings dip where profits declined to Rs. 8.3 billion (September 2016 = Rs. 10.1 billion) driven by LOLC (-23%YoY).

Most finance companies in the sector saw higher net impairment losses as the effects of floods spilled over to the September quarter.

Consumer Services sector (-54%YoY) earnings dipped to Rs. 744 million (Sep 2016 = Rs. 1,613 million) driven by KHL (-71%YoY) which saw several hotels closing for refurbishment.

The negative effect was partially diluted by the positive earnings growth in the Food, Beverage and Tobacco sector (+9%YoY) to Rs. 12.5 billion (September 2016 - Rs. 11.5 billion) driven by BUKI (+788%YoY) and CARS (+2,419%YoY) which saw a dramatic increase in its gross margins while also being supported by plantation companies amidst higher tea prices.

The Banks sector (+6%YoY) reported earnings of Rs. 15.5 billion (Sep 2016 = Rs. 14.6 billion) driven by COMB (+11%YoY) which saw a healthy growth in net interest income.

However, First Capital Research said the largest positive effect on earnings came from the Food and Staples Retailing sector (+178%YoY) which recorded earnings of Rs. 2.7 billion (September 2016 = Rs. 960 million) driven by CARG (+189%YoY) which included a one-off non-operating gain of Rs. 1,012 million from the sale of its properties in Colombo 2. Having adjusted this one-off gain, the sector’s earnings dipped 33%YoY to Rs. 645 million while the quarter’s overall earnings dipped 6% to Rs. 58 billion.