Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 19 April 2019 00:19 - - {{hitsCtrl.values.hits}}

The Central Bank of Sri Lanka on Wednesday said loan inflows to the Government have increased significantly, following the end of political uncertainty.

“Loan inflows to the Government increased significantly in January 2019, with loan inflows to major infrastructure projects resuming with the end of political uncertainty,” the Bank said.

Long-term loans to the Government recorded a net inflow of $ 78 million in January. Gross inflows to the Government amounted to $ 281 million, though down from $ 293 million a year earlier. Long-term loans rose to $ 209 million, as against $ 123 million in January last year. In whole of 2018, the amount was $ 1.33 billion.

In its release on the latest external sector data, the Central Bank said foreign investments in the government securities market and the CSE witnessed reduced net outflows in January. The government securities market recorded a net outflow of $ 29 million, a notable reduction compared to a net outflow of $ 188 million in December 2018. CSE recorded a net outflow of $ 14 million as against $ 26 million in December 2018.

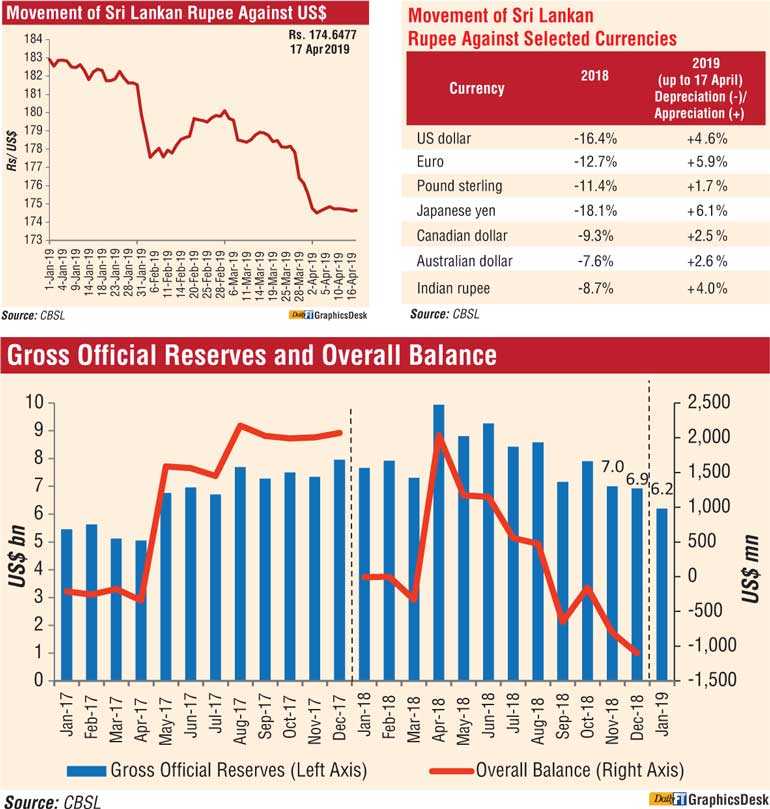

As at end January, gross official reserves were estimated at $ 6.2 billion, which was equivalent to 3.4 months of imports. Total foreign assets which consist of gross official reserves and foreign assets of the banking sector, amounted to $ 8.7 billion by end January and was equivalent to 4.8 months of imports. With the issuance of International Sovereign Bonds worth $ 2.4 billion, gross official reserves increased to $ 7.6 billion by end March equivalent to 4.3 months.

The Central Bank also said the significant pressure on the exchange rate that was witnessed in the latter part of 2018 eased with a notable reversal during January 2019. Accordingly, the Sri Lankan rupee appreciated by 1.6% in January 2019 from Rs. 182.75 per US dollar at end December 2018 to Rs. 179.88 by end January 2019. The exchange rate appreciated to Rs. 174.65 per US dollar by 17 April 2019, recording an appreciation of 4.6%.