Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 6 October 2020 01:17 - - {{hitsCtrl.values.hits}}

A spate of local COVID-19 positive cases inflicted investor sentiments and triggered panic selling yesterday at the Colombo stock market which suffered its worst day plunge and wiped off over Rs. 200 billion in value.

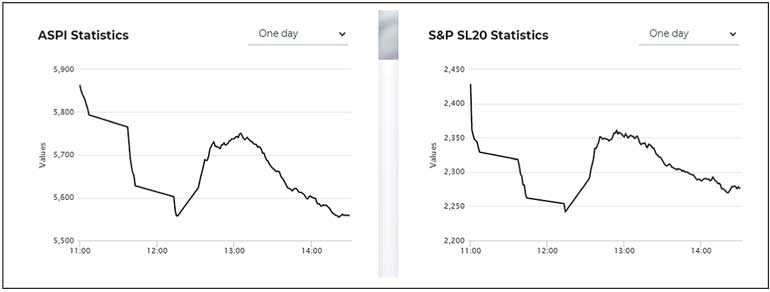

The benchmark All Share Price Index (ASPI) dropped by 463 points or 7.65% and the more active S&P SL 20 Index declined by 166 points or 6.7%. The previous lowest daily dip of ASPI was 303 points on 20 March when the country resorted to a partial shutdown owing to the COVID-19 pandemic.

The panic at the Colombo Bourse was over Sunday’s discovery of two local cases, the first in two months, followed by another 69 from an apparel factory in Minuwangoda. At the time this edition went to press the total COVID-19 confirmed cases from the Minuwangoda apparel factory cluster had risen to 101 with thousands of more in the trace undergoing PCR tests.

On a roller coaster day which saw market halted twice after S&P SL20 Index dipped beyond the suspension trigger threshold, and investors frustrated with technical glitches to trading, turnover rose to near Rs. 4 billion, up 18% from Friday. The biggest contributors to the collapse of ASPI were Carson (25%), Distilleries (22%), Bukit (16.6%), Nestle (*15.6%) and CTC (15%).

First Capital said the Bourse crashed due to panic selling on the back of fear of another COVID-19 wave, reverting the direction of the market to negative.

“Index plunged within the early hours of trading recording two market halts due to the S&P SL20 index falling below 5% & 7.5%. Market experienced a short-lived bounce back within mid-day, thereafter witnessed a downtrend and closed at 5,587 with a massive dip of 463 points,” it added.

Turnover of Rs. 3.8 billion recorded was a one and a half month high led by Capital Goods counters, closely followed by Material counters, making a joint contribution of 39%.

Acuity Stockbrokers said foreign investors recorded a net outflow of Rs. 142.76 million compared to a net outflow of Rs. 662.37 million on Friday.

NDB Securities said due to the discovery of a new cluster of COVID-19 cases after two and a half months, both the ASPI and S&P SL20 closed in red, while the ASPI recorded its single largest drop in index points during the day.

The drop in ASPI was mainly attributable to price losses in counters such as Carson Cumberbatch, Distilleries and Bukit Darah.

High net worth and institutional investor participation was noted in John Keells Holdings and DFCC Bank.

Mixed interest was observed in Expolanka Holdings, Tokyo Cement Company voting and non-voting, whilst retail interest was noted in Access Engineering, Royal Ceramics and RIL Property.

During the day, the S&P SL20 triggered two circuit breakers, of which the first was within the first 10 minutes of the market opening. After the 30 minute trading halt, the second was triggered six minutes later, after which the S&P SL20 marginally recovered from the bottom-most point, to close with only a 6.76% drop.

Capital Goods sector was the top contributor to the market turnover (due to John Keells Holdings), whilst the sector index lost 6.88%. The share price of John Keells Holdings lost Rs 3.40 (2.54%) closing at Rs 130.60, whilst foreign holdings decreased by 1,270,751 shares.

Materials sector was the second highest contributor to the market turnover (due to Tokyo Cement Company voting and non-voting), whilst the sector index decreased by 9.92%. The share price of Tokyo Cement Company non-voting moved down by Rs 4.90 (10.58%) to close at Rs 41.40. The share price of Tokyo Cement Company recorded a loss of Rs 7.10 (12.43%) to close at Rs 50.00. Expolanka Holdings and Hayleys Fabric were also included amongst the top turnover contributors.

Share price of Expolanka Holdings decreased by Rs 1.60 (11.85%) to close at Rs 11.90 whilst, the share price of Hayleys Fabric declined by Rs 4.00 (14.76%) to close at Rs 23.10.

Spreading cheer on a negative day, Laxapana Batteries and Lanka Aluminium Industries announced their first and final dividends of Rs 1.00 per share respectively.