Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 28 May 2018 00:00 - - {{hitsCtrl.values.hits}}

Sri Lanka has been classified by Moody’s as being among countries which are at a greater risk of a negative impact following recent currency depreciations across Asia Pacific.

In a special report, Moody’s said given high external financing, Sri Lanka as a frontier market was one of the hardest hit by currency volatility and faced greater credit challenge.

“Sovereigns with high external debt obligations relative to foreign reserves like Sri Lanka (B1 negative) and Mongolia are particularly at risk,” it said.

“Prolonged currency depreciation also presents fiscal risks to those with substantial foreign currency debt by bloating debt servicing needs: Sri Lanka, Maldives and Mongolia are most at risk in this regard,” Moody’s added.

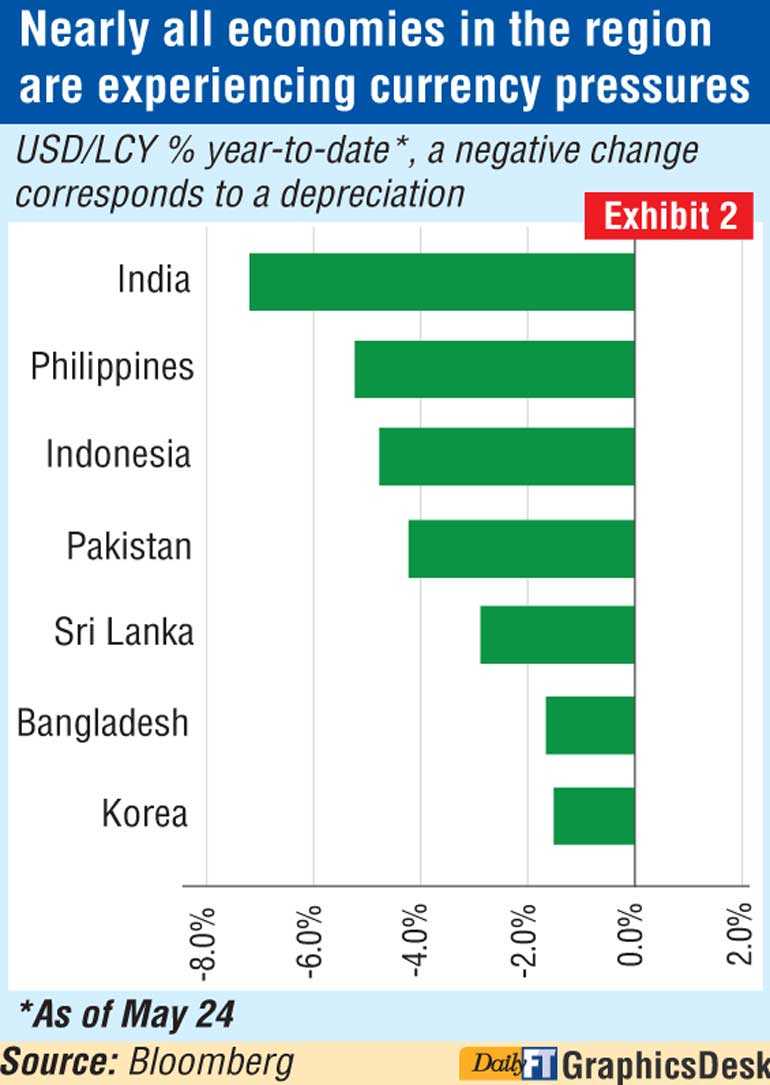

It said over recent months, countries in the APAC region have been particularly susceptible to currency depreciation against the dollar.

“To the extent that these pressures represent a fundamental weakening in capital flows, they are credit negative for those countries with large external funding needs,” Moody’s said.

“In Sri Lanka, dollar strengthening has combined with domestic political uncertainty, weighing on the rupee,” it said.

Apart from these emerging markets, there are several frontier market sovereigns that have a sizeable share of foreign currency funding, that are particularly at risk to weakening debt affordability, including Sri Lanka, Maldives, Vietnam and Mongolia.

A recent analysis, which takes into consideration the tenor, level and affordability of debt, finds that in the APAC region, Pakistan, Mongolia, Sri Lanka and the Maldives are the most exposed to a higher cost of debt that feeds mostly through weaker debt affordability.

Apart from the implications for the emerging markets, during times of weaker risk appetite, countries with large current account deficits are most vulnerable to capital outflows prompting such depreciation, and this could ultimately be reflected in lower foreign reserve positions.

Within the region, frontier markets such as Pakistan, Mongolia, the Maldives and Cambodia particularly stand out as those with wide current account deficits.

Moody’s said those countries with upcoming debt obligations are also particularly at risk, since this would exacerbate strains on foreign reserves that act as the buffer to meet these repayment needs. We measure such exposure in our External Vulnerability Indicator (EVI). In this regard, Sri Lanka and Mongolia have EVIs exceeding 100%, signaling low reserve adequacy.

Moody’s points out that the extent of depreciation seen this year has been less pronounced than during the taper tantrum in 2013. Also, ahead of the recent financial market volatility, most large emerging markets in APAC have accumulated sizeable reserve buffers, affording some policy space.

However, it said emerging markets and some frontier sovereigns were the hardest hit by currency volatility. India, the Philippines and Indonesia have experienced the most significant pressures, alongside a number of frontier markets.

These pressures reflect a fall in capital flows primarily driven by global factors like a strengthening US dollar and higher oil prices, but country-specific factors have also played a role.

According to Moody’s, some APAC emerging market sovereigns may face greater credit challenges.

For Indonesia and the Philippines, currency pressures will exacerbate already weak debt affordability metrics and, to the extent that they are accompanied by capital outflows, may have wider repercussions for the balance of payments.

Moody’s said tightening financing conditions are also reflected in slower capital flows. According to data from the Institute of International Finance (IIF), cumulative portfolio inflows to Emerging Asia amounted to $ 1.2 billion through April of this year — compared with $ 33 billion during the same period last year, with debt flows particularly affected. However, cumulative outflows will likely be upwards of $ 7.4 billion in May alone.

Tightening financing conditions reflect various factors, including the appreciation of the US dollar, with the dollar index rising 5.9% since February this year. Dollar strength has been driven by solid economic data in the US, leading financial markets to revise their expectations for US interest rates.

Another factor has been oil prices: geopolitical developments have contributed to higher oil prices in recent weeks. “Although we expect oil prices to stay in the $ 45-$ 65 per barrel range over the medium term, in the near term, higher oil prices are associated with weaker currencies for oil importers,” Moody’s said.