Monday Feb 23, 2026

Monday Feb 23, 2026

Monday, 2 September 2024 02:17 - - {{hitsCtrl.values.hits}}

The depressing performance of the Colombo bourse worsened in August as the market has seen Rs. 273 billion in value wiped off since the 26 July announcement of the Presidential poll date.

The depressing performance of the Colombo bourse worsened in August as the market has seen Rs. 273 billion in value wiped off since the 26 July announcement of the Presidential poll date.

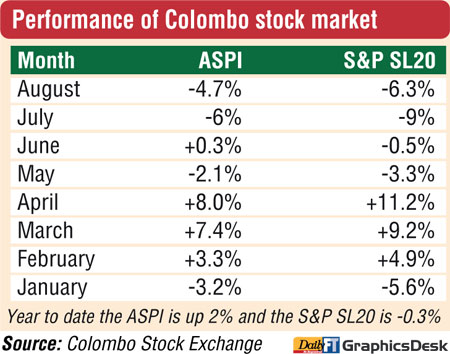

August also saw the second consecutive month of losses at the Colombo Stock Exchange (CSE), and the indices run the risk of turning negative year-to-date for the first time this week if sentiments don’t improve.

The market dipped by 6.3% (207 points) in terms of the active S&P SL20 in August, whilst the benchmark ASPI declined by 4.2% or 537 points. This was on the back of 9% and 6% loss respectively in July, resulting in the last two months combined suffering a double digit decline – S&P SL20 by 15% and ASPI by 11%. Year-to-date ASPI return has been reduced to 2.2% whilst S&P SL20 turned a negative of 0.3%.

The loss of value in August was Rs. 184 billion, and since the Presidential poll date was announced on 26 July, the wipe out was Rs. 273 billion. Foreigners too have been net sellers to the tune of Rs. 5.3 billion.

The main reason for weak investor sentiment is the 21 September election of the 9th Executive President, with no clear signs of who it will be.

None of the investors convinced of victory and supportive of incumbent Ranil Wickremesinghe, Opposition and SJB Leader Sajith Premadasa, and NPP Leader Anura Kumara Dissanayake have stepped up buying given the fact that stocks are available at bargain prices. The argument is that, if confident of their candidate winning, then such investors would pick up shares at depressed prices in anticipation of post-election upside. Most of the investors have turned cautious, maintaining a wait and see attitude.

The overall capital market is split on the three leading candidates, whilst the general consensus that 40% of the voting population is still undecided has added further concern and uncertainty.