Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 3 January 2025 00:02 - - {{hitsCtrl.values.hits}}

Prices and sales of condominium property in the third quarter of 2024 had declined though enjoying increases year on year as per a survey and real estate market analysis done by the Central Bank of Sri Lanka.

Prices and sales of condominium property in the third quarter of 2024 had declined though enjoying increases year on year as per a survey and real estate market analysis done by the Central Bank of Sri Lanka.

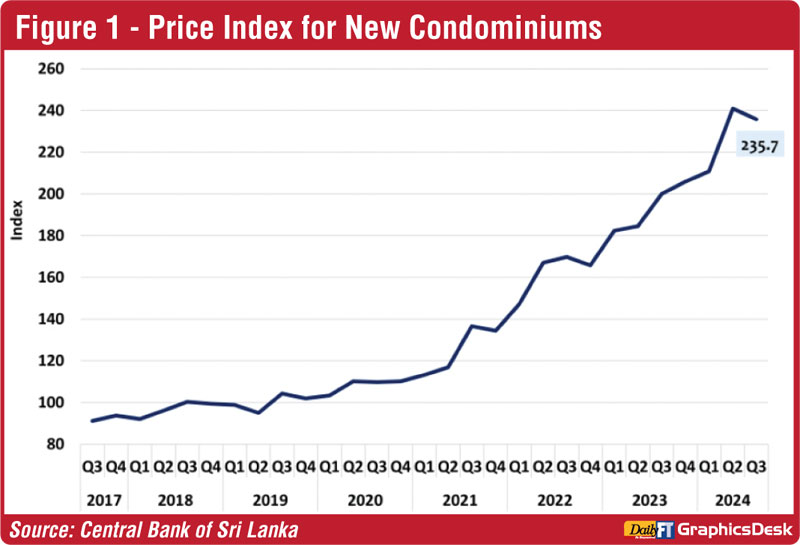

It said the Price Index for New Condominiums within the Colombo district stood at 235.7 during the 2024 Q3, recording a year-on-year increase of 17.8%, as per the information collected through the Condominium Market Survey conducted by the CBSL. However, on a quarter-on-quarter basis, the Index value shows a slight decrease of 2.2%.

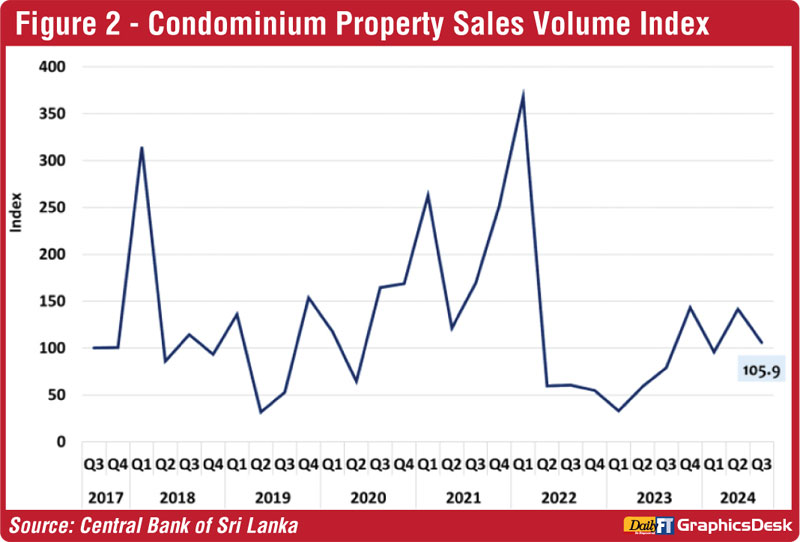

During 2024 Q3, the Condominium Property Sales Volume Index, which covers the Colombo district and other major cities, recorded a value of 105.9 with a decrease of 25.1% compared to the previous quarter. However, on a year-on-year basis, the sales volume Index shows an increase of 34.2%.

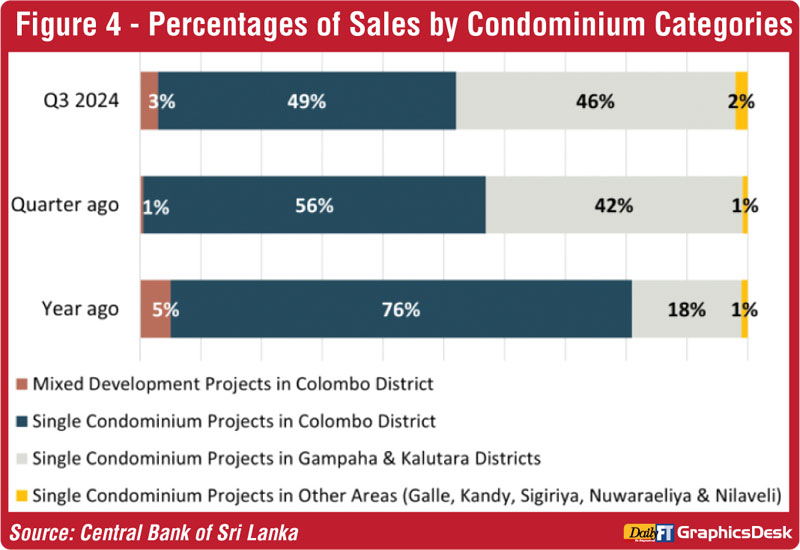

In 2024 Q3, the highest proportion of condominium sales was recorded from Colombo district, comprising 49% of the total, followed by the Gampaha and Kalutara districts. Only a few condominium sales were reported outside the Western Province during the quarter.

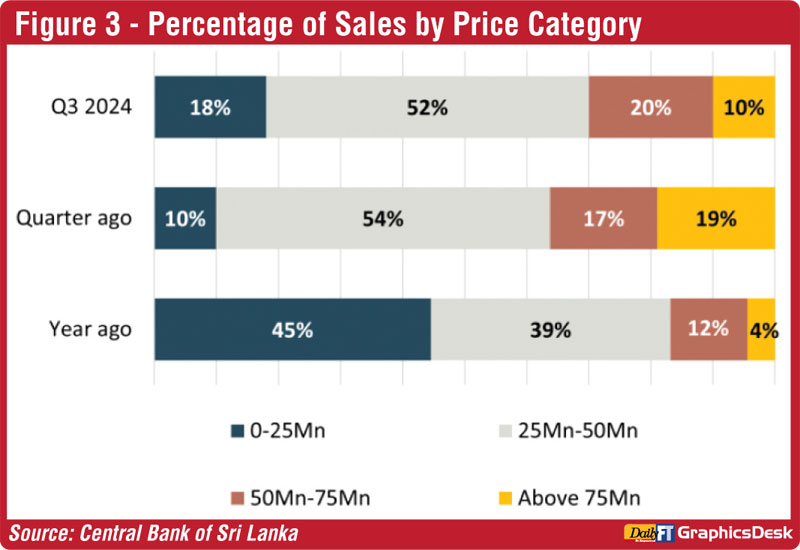

During 2024 Q3, the largest proportion of transactions, accounting for 52%, occurred in the Rs. 25 million to Rs. 50 million price range. When the percentage of price categories are compared with the previous quarter, transactions below Rs. 25 million and transactions between Rs. 50 million—Rs. 75 million showed increases while transactions above Rs. 75 million showed a decrease.

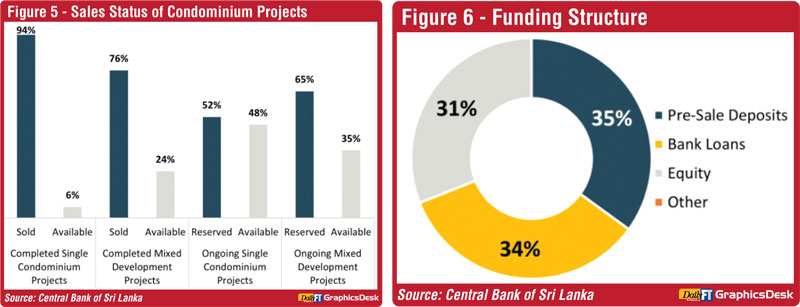

The primary funding sources for condominium developments were pre-sale deposits, bank loans, and equity. In the 2024 Q3, pre-sale deposits accounted for the largest share of 35% followed by bank loans and equity.

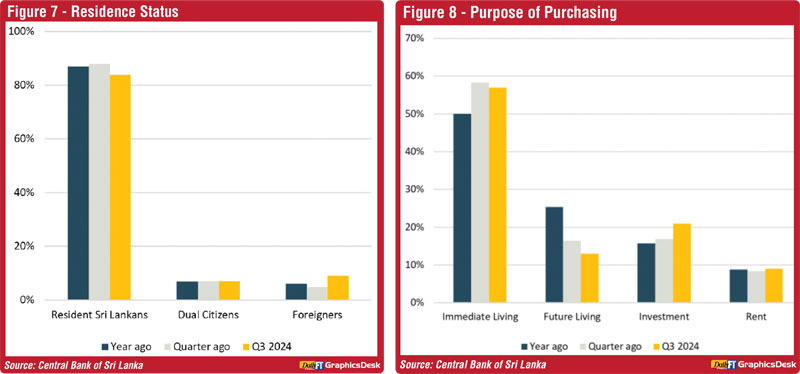

During 2024 Q3 as well, the majority of condominium purchases were made by residents of Sri Lanka, with a slight decrease in this category compared to the previous quarter. Meanwhile, purchases by foreigners showed a slight increase during the same period. In 2024 Q3, most condominium purchases were made for immediate occupancy, while purchases intended for future residence showed a decline.

In addition, there were increases in purchases for investment and rental purposes. The majority of buyers relied on personal funds to finance their condominium acquisitions.

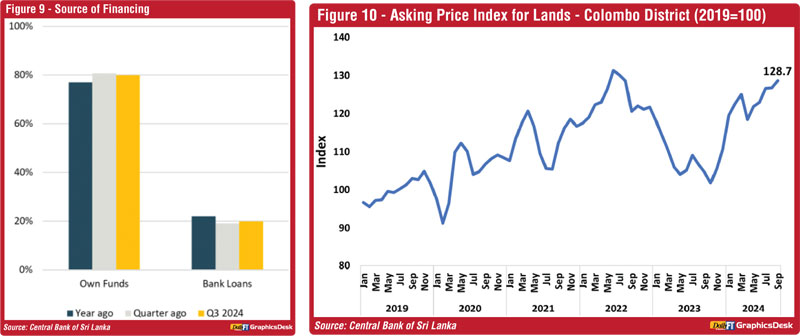

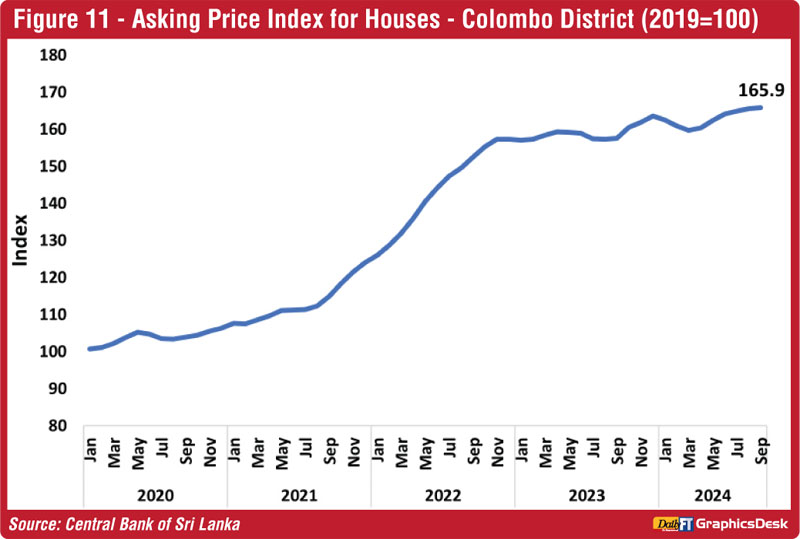

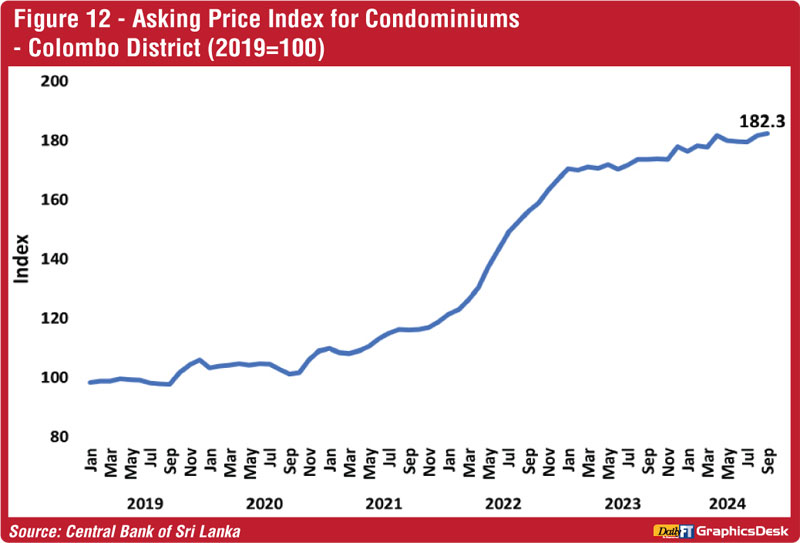

The Asking Price Indices covering the Colombo district, indicated an increase in the prices of lands, houses and condominiums both on a year‐on‐year basis and quarter-on-quarter basis at the end of 2024 Q3.

The Asking Price Index for land prices in the Colombo district showed a significant year-on-year increase of 23.0% during 2024 Q3. Additionally, on a quarter-on-quarter basis, land prices rose by 4.6% within this quarter compared to 2024 Q2.

As denoted by the Asking Price Indices for houses, the house prices in the Colombo district increased at a rate of 5.3% on a year-on-year basis during 2024 Q3. Also, the prices showed a marginal increase of 1.1% compared to the previous quarter.

In 2024 Q3, condominium prices in the Colombo district increased at a rate of 5.0% on a year-on-year basis, as indicated by the Asking Price Index. The condominium prices showed a marginal increase of 1.5% compared to the previous quarter.

The Index was compiled following the hedonic regression based rolling window time dummy method. The base period of the Index is 2019=100. The Index covers the Colombo district during Q3, 2024 and 14 condominium property developers participated in the survey.

Condominium Property Volume Index is compiled to capture the variations in market activities by way of number of sales transactions reported for the reference period.

(Base period: Q3, 2017 = 100).

The proportions were calculated to get an overall understanding about the funding structure of condominium developments by averaging the percentages of funds received through different funding sources provided by each developer.

Asking price indices for lands, houses and condominiums are compiled following the hedonic regression based rolling window time dummy method. (Base period: 2019 = 100).