Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 10 April 2023 03:28 - - {{hitsCtrl.values.hits}}

President Ranil Wickremesinghe

Central Bank Governor Dr. Nandalal Weerasinghe

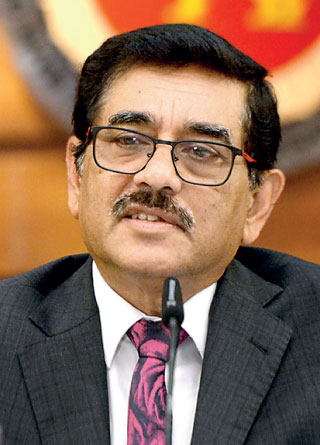

Treasury Secretary Mahinda Siriwardena

A United States District Court has denied Sri Lanka Government's motion to dismiss the case filed by Hamilton Reserve Bank on behalf of certain holders of International Sovereign Bonds (ISBs), a move which analysts viewed as a setback to the country's critical external debt restructuring.

Among other things Sri Lanka argued that the Cede Authorisation is defective on its face. “It is not,” the judgement issued by US District Judge Denise L, Cote on 24 March ruled. It added that the “language of the authorisation closely tracks Cede authorisations regularly accepted...As such, Sri Lanka's arguments fail.”

Hamilton Reserve Bank is the beneficial holder of bonds issued by Sri Lankan Government which according to the judgement, is currently experiencing an economic and humanitarian crisis –defaulted on the bonds and Hamilton brought this breach of contract action to recover the principal and accrued interest owed.

Sri Lanka moved to dismiss on the grounds that plaintiff lacks contractual standing.

Hamilton owns over $ 250 million in principal amount of the ISBs. Sri Lanka in mid-April announced a moratorium on foreign debt repayments including the Bonds and since then has made no payments on the Bonds.

The Bonds matured on 25 July 2022. Hamilton alleged that as a result of Sri Lanka's default, it is owed $ 250.19 million in principle and $ 7.349 million in accrued interest (before accounting for pre- and post-judgement interest).

Hamilton initiated this action on 21 June 2022 after which on 21 September Sri Lanka filed a motion to dismiss the complaint.

Cede and Company (Cede), nomine of the Depository Trust Company (DTC) is the registered holder of the Bonds. Hamilton conceded that it is a beneficial owner rather than the registered holder of the Bonds.

In a letter dated 23 September 2022, Cede authorised the plaintiff “to take any and all actions and exercise any and all rights and remedies that Cede & Co as the holder of record” is “entitled to take” (the Cede Authorisation").

On 22 September the Court gave Hamilton an opportunity to amend the complaint and warned that another opportunity to amend was unlikely. On 23 September Hamilton received the Cede Authorisation. Plaintiff filed its amended complaint on 13 October, alleging one count of breach of contract based on non-0payment of the Bonds at maturity. Sri Lanka then renewed its motion to dismiss on 4 October. The motion became fully submitted on 16 December.

The Judge said a claim has facial plausibility when the plaintiff pleads factual content that allows the court to draw the reasonable inference that the defendant is liable for the misconduct alleged. In determining if a claim is sufficiently plausible to withstand dismissal, a court accepts all factual allegations as true and draws all reasonable inferences in favour of the plaintiffs. Additionally, a court may consider extrinsic material that the complaint incorporates by reference that is integral to the complaint or of which courts can take judicial notice.

The judgement said the crux of this dispute is whether the Cede Authorisation confers upon Hamilton standing to sue given the absence of a contractual provision expressly allowing such authorisation and the presence of the negating clauses. Neither the Second Circuit nor the New York Court of Appeals has directly addressed this issue. Nonetheless, the Circuit's decision in Applestein Vs Province of Buenos Aires, and its progeny establish Hamilton's standing to sue.

As per Finance Ministry sources, Sri Lanka's ISBs account for a significant 66% share or $ 20.3 billion of commercial FX denominated public debt, excluding ECA-backed debt and SOEs' payables and including arrears, as at end-2022. Outstanding amount to bonded private creditors was $ 14.5 billion.

ISBs holders have organised around two committees. ISBs international bondholders have formed an ad-hoc creditor committee and this group is said to represent more than 55% of ISBs non-domestic holdings. The group is advised by Rothschild and White and Case.

Separately a consortium of local private banks holding ISBs has formed another group which has reported holdings in around $ 1.5 billion across all series of ISBs (around 12% of outstanding ISBs). The group is advised by Baker and Mckenzie.

As per Government's plans on external debt restructuring, next steps with private creditors included engaging on a technical basis with bondholder committees’ advisors and other private creditors to ensure further sharing of information and data, under NDAs; establish the required restructuring discussion channels with all private creditors and their advisors; reach agreements with private creditors and their advisors that are (i) compliant with the IMF DSA targets and (ii) comparable across different creditor categories and ensure the legal implementation of the agreements reached with all parties.