Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 21 January 2020 00:20 - - {{hitsCtrl.values.hits}}

Moody’s Investor Services yesterday warned that the Government’s debt moratorium for Small and Medium Enterprises (SMEs) would be credit negative for banks and was unlikely to support economic recovery as it would not significantly boost demand. On 13 January, Sri Lanka's (B2 stable) Central Bank issued guidelines on the debt moratorium for SMEs, which the Government announced in December last year.

The debt moratorium is credit negative for Sri Lankan banks and the sovereign because it risks increasing SMEs' risk appetite and relaxing their attitude toward debt repayments. This in turn will undermine banks' asset quality and constrain the sovereign’s credit profile, the international rating agency warned in its latest report. SMEs in the manufacturing, services, agriculture and construction sectors with an annual turnover of Rs. 16 million-Rs. 750 million ($ 88,000-$ 4.1 million) and outstanding loans of up to Rs. 300 million ($ 1.7 million) are eligible to apply for a moratorium on their principal repayments, with a grace period up to a year.

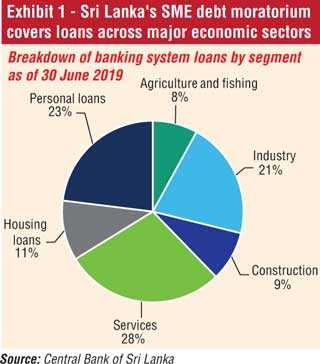

The moratorium also applies to SMEs with poor credit bureau records and nonperforming loans. Import credit facilities for items other than machinery and equipment are not included in this moratorium. The scope of this debt moratorium is much wider than last year's moratorium for the tourism sector given that SME loans constitute a significant part of the banking system's gross loans.

“Among the banks we rate, we expect the moratorium will most affect Hatton National Bank Ltd. (B3 stable, b22) and Sampath Bank Plc (B3 stable, b2) given that SME banking is one of their core businesses. Meanwhile, Bank of Ceylon (B3 stable, b2) will be least affected because its loan book is largely exposed to State-owned entities and large domestic corporates,” Moody’s said.

“The asset quality of Sri Lankan banks has deteriorated in recent years as a result of a weak domestic economy and excessive loan growth prior to 2017. The debt moratorium will help slow the banks' non-performing loan formation this year, but we anticipate an increase in bad debt when the grace period ends, especially if the domestic economic conditions remain weak.”

These latest SME relief measures are the second major set of economic stimulus measures announced by the current administration since it took office at the end of last year. However, Moody’s said, similar to their expectation of any macroeconomic benefits from the tax cuts announced for businesses and households, the moratorium is similarly unlikely to lead to significant and sustained acceleration in economic activity, despite SME activity across various sectors comprising around half of Sri Lanka’s gross domestic product and employment.

Any short-term boost to economic activity will depend jointly on SMEs’ uptake for working capital support and banks' additional lending because of the aggregate measures, Moody’s warned.

“We expect a strengthening tourism sector to drive continuing and gradual economic recovery in 2020, with real GDP growth picking up to 3.4% from the 2.6% we expect for 2019. We do not expect the SME debt relief package or the broad-based tax cuts to significantly boost demand.”

According to the Central Bank's guidance, the moratorium will not apply to import credit facilities, with the exception of those for machinery and equipment. As such, Moody’s does not expect that most export-oriented SMEs will receive a significant benefit from this relief package because of the weak external environment. Through the first 11 months of 2019, Sri Lanka's exports grew just 0.8% year-on-year in US dollar terms, a significant deceleration from 5% in the corresponding period of 2018.

The SME debt relief package will also include a joint credit guarantee scheme formed by the Government and Central Bank, which will provide guarantees up to 75% of the gross loan amount for those SMEs with nonperforming loans. Due to the fact that banks will be charged a 1% per annum guarantee fee, Moody’s said it did not expect this guarantee program to result in any fiscal cost for the Government.