Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 15 July 2021 02:07 - - {{hitsCtrl.values.hits}}

A scene at Pettah – the hub for import trade. Food and beverage imports in May declined by only 1%, but in the first five months they were up 10% to $ 750 million – Pic by Lasantha Kumara

Despite restrictions and forex crisis, imports remain substantial, ballooning the trade deficit sharply year-on-year (YOY) in May though month-on-month it was down.

Despite restrictions and forex crisis, imports remain substantial, ballooning the trade deficit sharply year-on-year (YOY) in May though month-on-month it was down.

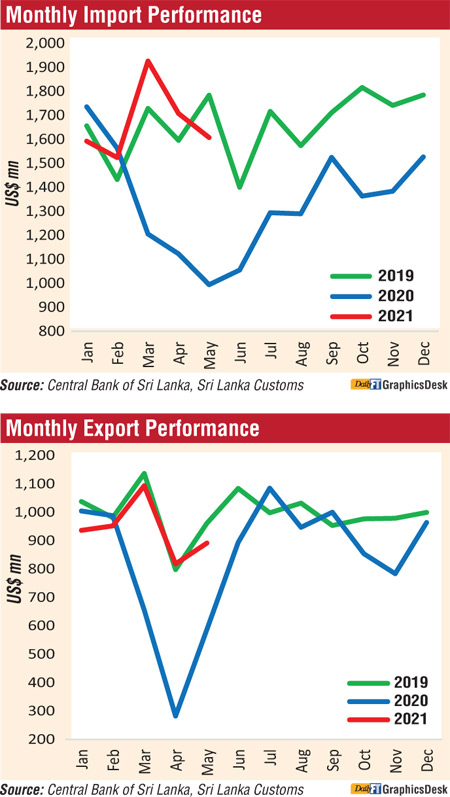

As per external trade data released by the Central Bank yesterday, imports in May rose YOY by 61.7% to $ 1.6 billion whilst the first five months figure was up 26% to $ 8.35 billion. However, in comparison to April’s $ 1.7 billion, May figure was lower.

Exports on the other hand, rose YOY by 52% to $ 892 million and by 33% to $ 4.69 billion in the first five months.

“Both exports and imports were significantly higher in May 2021 than in May 2020, mainly due to the statistical effect of pandemic-related disruptions a year ago,” the Central Bank said.

It said the trade deficit widened on a YOY basis for the third consecutive month in May 2021 to $ 716 million, compared to $ 407 million recorded in May 2020.

“Greater increase in import expenditure as against the increase in export earnings in May 2021 over May 2020 resulted in the widening of the trade deficit,” the Central Bank said. “However, the trade deficit showed a month-on-month improvement in May 2021 compared to $ 889 million in April 2021,” the Bank added.

The cumulative trade deficit widened to $ 3,663 million during the period from January to May 2021 from $ 3,101 million recorded in the corresponding period in 2020. The major contributory factors for this outcome were fuel imports soaring by 588%, textiles and textile articles imports up by 284%, machinery and equipment were higher by 252%, chemical products rose by 149% and base metals grew by 139%.

Terms of trade, i.e., the ratio of the price of exports to the price of imports, deteriorated by 11.5% in May 2021, compared to May 2020, with prices of imports having increased while prices of exports declining.

Earnings from merchandise exports increased to $ 892 million in May 2021, recording growth rates of 52% and 9% over May 2020 and April 2021, respectively, with higher earnings from all major sectors. Cumulative export earnings from January to May 2021 amounted to $ 4,692 million, a 33.3% increase compared to the corresponding period of 2020, which is largely attributable to lower statistical base during the islandwide lockdown in the early months of 2020.

Along with improvements in exports across all subcategories, earnings from the export of industrial goods registered a notable increase in May 2021 over May 2020. The month-on month increase in earnings from industrial exports in May 2021 was 6.2%, led by broad based improvement in most subcategories.

Rubber products (mainly rubber tires and gloves); machinery and mechanical appliances (mainly electronic equipment); textiles and garments (mainly garments exports to the EU); chemical products (mainly activated carbon) and base metals recorded increases in May 2021 compared to April 2021. However, the subsectors of printing industry products; gems, diamonds and jewellery; petroleum products; and leather, travel goods and footwear recorded declines over the same period. Despite the increased earnings from bunker and aviation fuel exports, earnings from the export of petroleum products declined in May 2021, on a month-on-month basis, mainly due to lower exports of other petroleum products such as naphtha.

In May 2021, earnings from the export of agricultural goods increased by 8.9% compared to May 2020. On a month-on-month basis, earnings from all the subcategories of agricultural exports increased, except seafood, natural rubber and unmanufactured tobacco. Despite the marginal decline in average export prices, earnings from tea exports increased notably in May 2021 over April 2021 due to higher export volumes. In addition, earnings from exports of spices (mainly cinnamon, nutmeg and mace), coconut (both kernel and non-kernel products) and minor agricultural products improved in May 2021 on a month-month basis.

Earnings from mineral exports were higher in May 2021 than in May 2020 and April 2021. The month-on-month increase in earnings from mineral exports in May 2021 was led by higher earnings from earths and stone (mainly granite and graphite powder).

The export volume index increased by 54.7% while the unit value index declined by 1.8% on a YOY basis, in May 2021. This indicates that the increase in export earnings, on a YOY basis, was due to the impact of higher export volumes.

Expenditure on merchandise imports in May 2021 increased notably by 61.7% to $ 1,607 million from import expenditure of $ 994 million in May 2020. However, import expenditure in May 2021 was lower when compared to the imports of $ 1,707 million in April 2021, supported by lower expenditure in all major import sectors. Meanwhile, the cumulative export earnings during January to May 2021 amounted to $ 8,356 million, recording an increase of 26.2% over the same period in 2020.

Expenditure on the importation of both food and beverages and non-food consumer good categories declined in May 2021 on both YOY (by 4.1%) and month-on-month (by 9%) bases. Under food and beverages, items such as sugar and confectionery (mainly cane sugar); fruits (mainly apples and dried fruits); and dairy products (mainly milk powder and cheese) recorded lower import expenditure in May 2021 compared to a month ago. However, import expenditure on vegetables (mainly lentils and onions); oils and fats (mainly coconut oil); spices (mainly chilies and coriander seeds); and seafood (mainly preserved fish) increased in May 2021 on a month-on-month basis. Import expenditure on almost all subcategories of non-food consumer goods declined in May 2021 compared to April 2021, led by lower expenditure on home appliances (mainly refrigerators and televisions); medical and pharmaceuticals and clothing and accessories.

Expenditure on intermediate goods increased by 115.0% in May 2021, compared to a year ago, but declined by 2.8% over the previous month. In May 2021, import expenditure on fuel; fertiliser (mainly urea); wheat and maize; vehicle and machinery parts (mainly motor vehicle parts); and rubber and articles thereof declined, while import expenditure on base metals (mainly iron and steel); chemical products; plastics and articles thereof; and textiles and textile articles increased, on a month-on-month basis.

Import expenditure on fuel, which consists of crude oil, refined petroleum and coal, declined in May 2021 compared to April 2021 and the decline was attributed to lower import volumes despite the increase in import prices. The average import price of crude oil increased to $ 68.47 per barrel in May 2021 compared to $ 66.44 per barrel in April 2021 ($ 25.44 per barrel in May 2020). Similarly, the average import price of refined petroleum increased to $ 593.83 per metric ton in May 2021 from $ 571.23 per metric ton in April 2021 ($ 291.38 per metric ton in May 2020).

Expenditure on investment goods increased by 27.9% in May 2021 on a YOY basis, although declined by 12.7% on a month-on-month basis. The month-on-month decline in May 2021 was driven by lower expenditure in machinery and equipment (mainly machinery and equipment parts, pumps, engineering equipment) and transport equipment (mainly lorries). However, expenditure on building material, such as iron, steel and articles thereof as well as expenditure on transmission apparatus; electronic integrated circuits; and medical and laboratory equipment that are categorised under machinery and equipment, increased in May 2021 compared to April 2021.

The import volume index and unit value index increased by 45.7% and 11.0%, respectively, on YOY basis in May 2021. This indicates that the increase in import expenditure, on a YOY basis, was attributable to the combined impact of higher import volumes and prices.