Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 17 January 2023 01:10 - - {{hitsCtrl.values.hits}}

The share price of Softlogic Life Insurance PLC has shot up by a whopping Rs. 69.35 or 136% in recent weeks prompting CSE to inquire twice about unusual movement only to be told by the company it was clueless.

The first query was in mid-August last year whilst the latest was last Friday. Softlogic Life said “there is no undisclosed price sensitive information in relation to Softlogic Life Insurance PLC or any other reason which may have caused the aforesaid unusual trading activity observed by the Colombo Stock Exchange.”

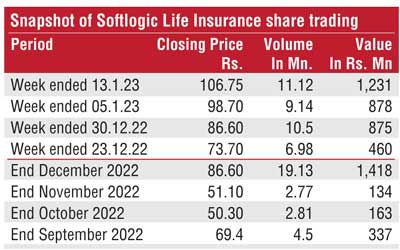

After peaking to Rs. 92.80 in third quarter and ending 30 September at Rs. 69.40, (the August climb triggered the first query by CSE), Softlogic Life Insurance has been the darling of retailers and select high net worth individuals. It closed last week at Rs. 106.75 after hitting a high of Rs. 120.25.

Since mid-December nearly 38 million shares of Softlogic Life Insurance, second in the industry, have traded largely on speculation of an impending sale of its controlling 51.72% stake by Softlogic.

This rumour or speculation stems from the unsubstantiated viability or financial concerns over parent Softlogic Holdings PLC itself.

This rumour or speculation stems from the unsubstantiated viability or financial concerns over parent Softlogic Holdings PLC itself.

In the first two weeks of the new year, the volume of shares traded is above 19 million in the entirety of December.

Last week 11.12 million shares of Softlogic Life changed hands via 8,486 trades for Rs. 1.23 billion. It hit a high of Rs. 120.25 before closing at Rs. 106.75 up by Rs. 8.05 from the previous week though on Friday the share price dipped by 5.7% or Rs. 6.50. In the week ended 5 January 9.14 million shares changed hands via 7,570 trades for Rs. 878.6 million. It gained Rs. 12.10 to close at Rs. 98.70.

December saw 19.1 million shares change hands via 16,686 trades for Rs. 1.4 billion. Price gained by 69.47% or Rs. 86.60 after hitting a high of Rs. 94.50 and a low of Rs. 48.20. In contrast in November only 2.77 million shares changed hands via 3,950 for Rs. 134.54 million. It closed at Rs. 51.10, up by Rs. 1.59.

Net Assets Per Share as at 30.9.2022 was Rs. 27.63 and excluding one off surplus was Rs. 25.50. As at 31.12.2021 were Rs. 28.24 and Rs. 26.11 respectively.

The public float of Softlogic Life is 10.23% held by 5,678 shareholders.

Apart from 51.72% held by Softlogic Capital PLC, Milford Ceylon Ltd., owns 19% and Dalvik Inclusion Ltd., 19%. Foreign shareholding is 37%.

Softlogic has had a meteoric rise as the second largest life insurer in five years from being fifth placed. The Company was previously known as Asian Alliance Insurance. Assets as at 30 September 2022 were Rs. 47.1 billion, up from Rs. 39.2 billion in FY21. Liabilities rose to Rs. 36.8 billion by end 3QFY22 from Rs. 28.6 billion in FY21.

In a disclosure to the market last month following various reports in social media platforms, Softlogic Life Insurance said the Company reported PAT 1,954 Mn for 9months as at September 2022 which is an impressive 39% growth compared with 2021 PAT of 1,410Mn. The Insurer boasts of a capital adequacy ratio of 291% which is more than the double the minimum requirement of 120% and is the second largest Life Insurer in the country with market share of 16.8% having registered 5 year CAGR of 25.5% versus market growth of 14.7%.

The combined regular premiums of the Company are the highest in the industry, whilst covering

around 1.5million Sri Lankan lives. The Company’s claim settlement record is aimed at settling more

than 80% of claims in one single day.

The Company maintains the highest standards of corporate governance and transparency with its

2021 Annual Report being awarded Silver Award for Overall Excellence, across all corporates in Sri

Lanka - Financial Reporting, in the league of corporate titans at the 57th Annual Report Awards

organised by CA Sri Lanka. The Company fully conforms to all regulatory aspects and has full independence and financial strength to grow and maintain its operations.