Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 21 March 2022 02:43 - - {{hitsCtrl.values.hits}}

A group of investors in Sri Lanka’s sovereign bonds has hired law firm White & Case LLP to advise on debt negotiations as the indebted island nation contends with a severe economic downturn and growing political unrest, said people familiar with the matter.

A group of investors in Sri Lanka’s sovereign bonds has hired law firm White & Case LLP to advise on debt negotiations as the indebted island nation contends with a severe economic downturn and growing political unrest, said people familiar with the matter.

The ad hoc group includes bondholders from BlackRock Inc. and Ashmore Group PLC, the people said. The group has yet to hire a financial adviser, said another person.

Sri Lanka is facing a balance of payments crisis as the country’s foreign-exchange reserves have declined by more than half since the beginning of the COVID-19 pandemic. The nation spends foreign exchange to import many of the goods it needs to power its economy.

Revenue from tourism, one of the country’s most important sources of foreign exchange, has declined in large part due to the pandemic. Meanwhile, remittances from Sri Lankans living abroad have dropped while a black market for foreign currencies has grown, economists say.

The Sri Lankan Government owed more than $ 16 billion to international bondholders as of April 2021, according to Government data. It also owed around $ 3 billion directly to China as well as to Japan, and around $ 1 billion to India.

Sri Lanka also has outstanding debt to institutional creditors such as the World Bank and the Asian Development Bank. In total, Sri Lanka’s public debt to gross domestic product ratio in 2021 hovered at just below 120%, according to International Monetary Fund projections.

The country’s leaders stated for months that despite the runoff in foreign-exchange reserves, it had no plans to restructure its debts.

Sri Lanka faces about $ 7.5 billion in domestic and foreign debt payments this year, according to the federal government’s 2022 budget. Roughly $ 4 billion of that includes payments on foreign debts, including the $ 500 million bond it has already paid in January and the $ 1 billion bond maturing in July.

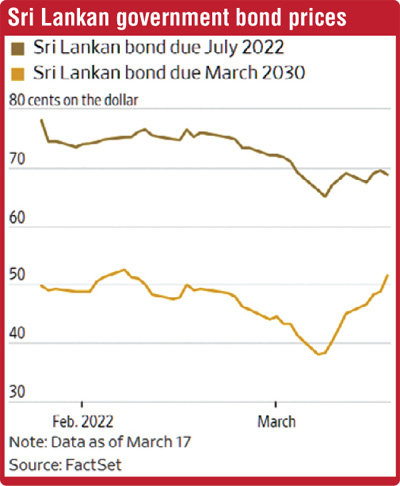

However, the country’s foreign-currency reserves totalled $ 2.31 billion as of February, according to central bank data, and analysts have questioned whether some of that total can even be used for external debt payments, such as swap lines from the People’s Bank of China. Sri Lanka’s debt has traded at distressed levels for months as the country’s reserves have progressively dwindled.

Sri Lanka is looking at alternative strategies to raise funds from investors to deal with its coming debt payments. Recently, Sri Lankan officials have met with bankers from Rothschild & Co. and Lazard to discuss financing proposals.

The country is also exploring a debt financing package that would be secured by remittances of foreign exchange into the country, according to one of the people familiar with the matter.

On Wednesday, President Gotabaya Rajapaksa announced that the country was in early discussions with the IMF and other creditors on a plan to manage the country’s debt burden, following a day of anti-Government protests against goods and fuel shortages and inflation in the country’s capital.

The IMF recently called the country’s public debts unsustainable, adding that pre-pandemic tax cuts plus the impact of COVID-19 had put the country’s financial wherewithal in jeopardy.

Depleting foreign-exchange reserves have recently led to severe shortages in Sri Lanka, given limits on the country’s ability to import essential goods, and has stoked inflation. Sri Lanka’s power grid instituted rolling blackouts in February amid persistent fuel shortages, worsened recently by the surge in oil and gas prices following Russia’s invasion of Ukraine.

In response to growing inflation and pressure on the rupee, Sri Lanka’s Central Bank announced in early March an increase in interest rates and devalued its fixed exchange rate, likely in a bid to curb the amount of currency entering the black market, analysts said.

(wsj.com/articles/sri-lanka-bondholders-tap-legal-adviser-for-sovereign-debt-negotiations-11647621564?st=iq66f2ry3j46jtd&reflink=desktopwebshare_twitter)