Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 25 June 2021 04:17 - - {{hitsCtrl.values.hits}}

www.spglobal.com: Sri Lanka’s bunker market is likely to ride a wave of growth as it develops its Hambantota Port, among other initiatives, while also welcoming additional short-term demand due to India’s impending monsoon season, although some hurdles remain, industry sources said.

“Demand for bunker fuels is considerably good [in Sri Lanka] as compared to last month... we’ve seen bunker [volumes] rise from 1,100 mt to 1,500-2,000 mt/day,” a Colombo-based bunker trader said.

Demand at the main bunkering hub of Colombo has been increasing from around 20,000 mt in March to 26,000-27,000 mt in April to around 36,000 mt in May, a Colombo-based supplier said.

“Demand so far suggests that [June] volume should be steady from May.”

Oil price volatility, however, is a concern, the trader said.

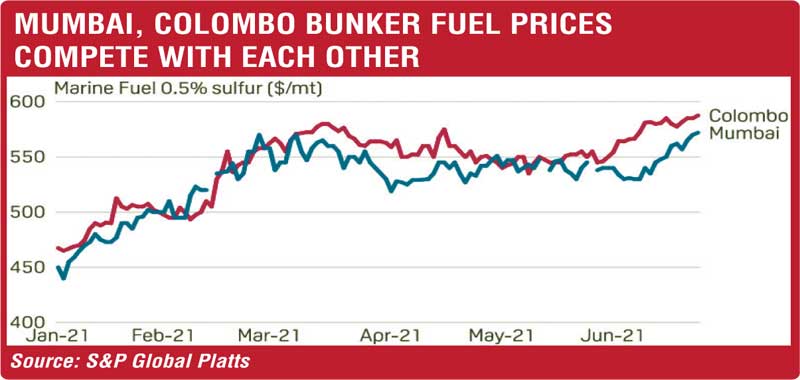

India’s bunker fuel prices are typically lower than those at Sri Lanka as the latter buys most of its bunker fuel from Singapore and Fujairah, making the fuel costlier.

According to Platts data, the Mumbai delivered marine fuel 0.5%S bunker averaged $ 547/mt over 1-23 June, lower than the same delivered grade in Colombo, which averaged $ 576.04/mt during the same period.

India’s summer monsoon, which usually starts in June and ends in September, will likely impede bunkering operations somewhat, industry sources said.

“Bunkering operations are smooth at anchorage, but OPL [outer port limits] deliveries have been suspended in Mumbai and most other western and eastern ports due to monsoon in India,” an Indian trader said.

The OPL deliveries will likely remain suspended until end-August.

“There have been no availabilities in the eastern ports of India due to which our inquiries are diverted to nearby ports,” the trader added.

A source at a refinery said that India’s Kochi Port “won’t be able to handle full supply” because of limited barge operations once the monsoon sets in.

“However, in the end it’s all about prices. Prices will determine whether ship owners and operators bunker at ports in Sri Lanka or India,” he said, adding that there could be a potential 5%-6% switch to Sri Lanka during this period.

A bunker supplier in India echoed a similar sentiment. According to him, some demand may go to ports such as Trincomalee and Hambantota in Sri Lanka.

Hambantota Port, located on Sri Lanka’s southern coast, is within 10 nautical miles of the main Asia-Europe shipping route and is in a strategic position on China’s Maritime Silk Road.

Platts reported previously, quoting the Sri Lanka Ports Authority, that the $ 1.5 billion port has eight tanks capable of storing a total 51,000 cu m of marine fuel.

In the week ended 18 June, Ceylon Petroleum Corporation said it had inked an agreement with the Hambantota International Port Group to develop the Hambantota Port as a strategic energy centre in Sri Lanka.

A separate storage terminal with associated facilities for both domestic and export purposes connected to the port via a pipeline is to be established by CPC, about 15 km away from the port, to boost its storage capacity.

HIPG awarded Sinopec Fuel Oil Sales Co. a tender in 2019 to provide marine fuel and other ancillary services to ships calling and passing through Hambantota.

“Sinopec with their vast resources guarantees the supply of VLSFO and MGO in Hambantota, enabling the port to service all vessels plying the principal sea routes in the Indian Ocean,” HIPG COO Tissa Wickramasinghe said in a statement on 14 June.

Transhipment of LPG and delivery for local consumption is also a part of the energy hub mix at HIPG, while Intertek Lanka Ltd. has also established a petroleum testing laboratory within the port to provide services to the energy hub, he added.

Meanwhile, the Colombo Port City Economic Commission Bill, which was recently passed, paves the way for the creation of a special economic zone in about 269 hectares of reclaimed land in the vicinity of the Port of Colombo.

The ‘Colombo Port City Special Economic Zone’ will be an international business and services hub with specialised infrastructure and other facilities to promote economic activity, including international trade, shipping logistic operations, and other services, according to a document seen by Platts.

The move appears positive, but “it’s too early to comment on its effect on bunker sales”, another trader said.

While the development of Hambantota Port is a move in the right direction for Sri Lanka to lift the country’s bunkering business, but for volumes to pick up, there is a need for a healthy amount of competition, another Colombo-based trader said.

“There is room for growth, but the price inelasticity is not helping,” a Colombo-based supplier said.

One of the Colombo-based suppliers, who had stationed a barge at Hambantota on hopes that bunker volumes will rise progressively higher there, had recently brought the vessel back to Colombo as the barge was not fully employed, market sources told Platts. (spglobal.com/platts/en/market-insights/latest-news/shipping/062421-sri-lanka-bunker-market-in-full-throttle-on-ports-progress-india-monsoons)