Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 12 April 2022 04:44 - - {{hitsCtrl.values.hits}}

BLOOMBERG: Sri Lanka’s unprecedented interest-rate hike has helped restore the Central Bank’s credibility, although it’s not enough to remove the risk of a debt default as a political crisis delays an International Monetary Fund (IMF) bailout, according to Citigroup Global Markets.

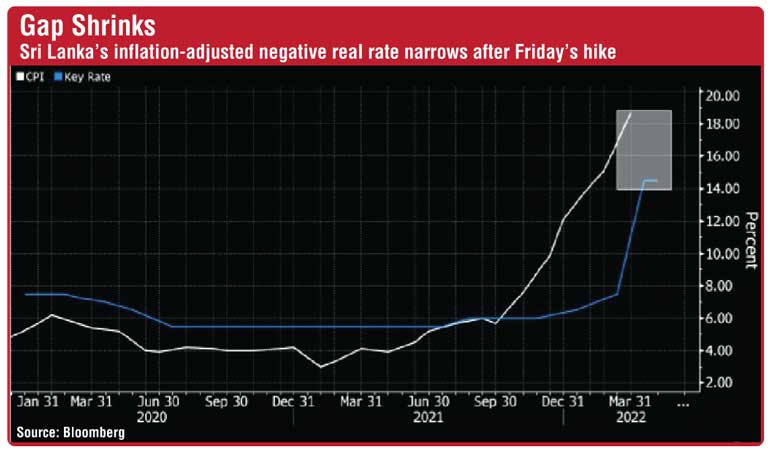

The Central Bank of Sri Lanka raised the key rate by 700 basis points on Friday, narrowing the negative gap in real interest rates, nominal rates adjusted for inflation to 420 basis points from 1,120 basis points previously.

“While this steep rate hike should help the rupee, stabilising it may require progress on bridge financing, alongside material progress to a Fund program,” Citigroup Hong Kong Chief Economist Asia Pacific Johanna Chua wrote in a report to clients. “We view risk of default as now very high.”

The IMF said over the weekend that it will hold discussions with senior Sri Lankan policymakers in the ‘coming days and weeks’ about a possible support program to help the nation overcome an economic crisis that’s pushed citizens to seek President Gotabaya Rajapaksa’s ouster after his Cabinet quit.

“The IMF may be reluctant to sign on to a program without more assurances of buy-in among stakeholders, including opposition parties,” Chua said.

“Under President Gotabaya, it will likely remain challenging to assemble broad political support for tough policies negotiated under the IMF.”

Coupon payments on 18 April may be in jeopardy given depleted reserves, she said, adding that $ 1.94 billion of reserves in March is not enough to cover swaps with China, India, and Bangladesh.