Thursday Feb 19, 2026

Thursday Feb 19, 2026

Thursday, 8 February 2024 04:38 - - {{hitsCtrl.values.hits}}

Group CEO Kasturi C. Wilson

Amidst the backdrop of relatively stable operating conditions in the economy, Hemas Holdings PLC (HHL) has demonstrated a steady performance in the first nine months of the financial year 2023/24, achieving a cumulative revenue growth of 10.3% amounting to Rs. 90.2 billion.

Amidst the backdrop of relatively stable operating conditions in the economy, Hemas Holdings PLC (HHL) has demonstrated a steady performance in the first nine months of the financial year 2023/24, achieving a cumulative revenue growth of 10.3% amounting to Rs. 90.2 billion.

Operating profits for the period mirrored the revenue growth, reaching Rs. 8.8 billion, while earnings experienced a 41.2% increase, posting a total of Rs. 4.5 billion.

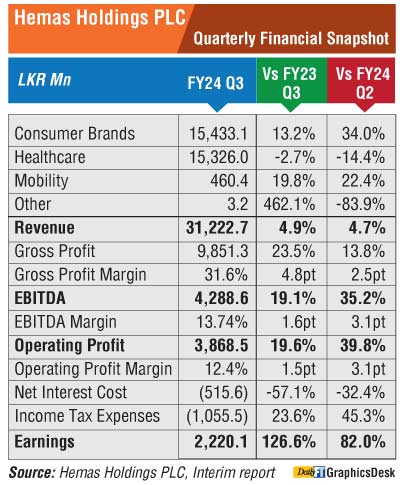

During the quarter, Group revenue witnessed a marginal increase of 4.9% standing at Rs. 31.2 billion.

However, Hemas said strong contribution from the Learning Segment due to seasonality effect and the positive impact of efficiency improvement initiatives resulted in operating profit and earnings registering growth of 19.6% and 126.6%, reaching Rs. 3.9 billion and Rs. 2.2 billion, respectively.

Hemas Holdings Group CEO Kasturi Wilson said during the third quarter, there was a surge in demand across the industry attributable to the festive season; however, it did not reach the anticipated levels due to increased pressure on purchasing power of the consumers.

“Despite these challenges, modern trade channels exhibited a higher offtake compared to general trade channels with improved footfall to supermarkets during the period. Prices exhibited a gradual stabilisation characterised by comparatively minimal fluctuations in comparison to the preceding quarters,” she said.

With the commencement of the pre-school season in January 2024 and the imminent commencement of the back-to-school season in February 2024, the stationery industry performance remained significantly influenced by seasonal stocking across both essential and non-essential categories. Under relatively lower prices, intense competition unfolded across all three segments: mass, value-for-money and premium. Consumers, amidst inflationary pressure remained price sensitive, resulting in a tendency to strategically phase out their purchases.

According to Wilson the challenges in the economic landscape of Bangladesh were worsened by the prolonged inflationary pressure driven by soaring food inflation, concurrent political turmoil, timed with the parliamentary election held in January 2024.

Hemas Consumer Brands Sector posted a cumulative revenue growth of 17.1% to reach Rs. 38 billion driven by the increased performance of the businesses amidst relatively stable operating conditions. Further to the revenue growth, improved product mix, cost-saving initiatives and lower finance costs resulted in the operating profit and earnings growing by 54.8% and 117.2%, reaching Rs. 5.7 billion and Rs. 4.1 billion, respectively.

The revenue for the quarter witnessed a growth of 13.2% to reach Rs. 15.4 billion while the operating profits reported a growth of 73.8% due to improved performance of the Home and Personal Care Business and the seasonality impact of the Learning Segment. Amidst the increase in operating profits, lower finance costs and the impact of reduced NCI, earnings for the period reached Rs. 2.1 billion posting a growth of 179.2% for the quarter.

During the quarter, the Home and Personal Care business strategically intensified its emphasis on the personal care segment, yielding a notable surge in market share and enhanced performance within the category. The heightened focus on target market segments coupled with increased concentration on value propositions, empowered Hemas to outperform the market resulting in volume-led growth for key categories, including baby soap, oral care, and shampoo. While both the general and modern trade channels experienced volume growth, the modern trade channel exhibited a superior growth trajectory during the quarter. Sustaining ongoing investments in the beauty space, ‘Prasara’ continued to witness significant traction in the market.

Consumer Brands International

Despite persistent inflation and the contraction in the value-added hair oil (VAHO) market, ‘Kumarika’ increased its market share marginally in the VAHO segment. Recent launches in the value-for-money verticals and the pure coconut oil market gained significant traction during the quarter, contributing over 10% to the overall revenue of the Bangladesh Business. The introduction of the personal care brand ‘Actisef’ a few years ago, as an initiative to mitigate single-brand concentration, has proven to be a substantial contributor to the top line.

During the quarter, ‘Atlas’ continued to focus on the East African market while increased focus in the Middle Eastern region resulted in repeat orders for ‘Kumarika,’ leading to a notable revenue contribution from the export segment.

Healthcare

Sri Lanka continued to face a web of interconnected health challenges, ranging from unresolved and persistent drug shortages, substandard medicines, unregulated importation, to the migration of healthcare workers. Amid reduced purchasing power, the pharmaceutical industry continued to witness a market shift towards low-quality, low-price variants, exerting pressure on volumes. Instability within the National Medicines Regulatory Authority (NMRA) resulted in delays in new product registrations and the acceptance of buyback orders by the Medical Supplies Division (MSD), amplifying challenges for the pharmaceutical industry at large.

The Healthcare Sector posted a cumulative revenue of Rs. 50.9 billion, a growth of 6.1% while the operating profit for the period stood at Rs. 3.7 billion with a degrowth of 4.2%. Despite the increase in revenue, the decline in operating profit is due to the one-off adverse impact from NMRA price reduction on distributor inventory and inflationary pressure on overheads. Consequently, earnings decreased by 6.8%, reaching Rs. 1.7 billion, despite the increase in revenue and lower net finance costs.

During the quarter, the Sector revenue declined by 2.7%, reaching Rs. 15.3 billion, while the operating profit contracted by 25.1%, amidst increased overheads to reach Rs. 1 billion. Attributed to lower finance costs resulting from working capital management initiatives and reduced interest rates, the earnings of Rs. 482 million posted a growth of 16.9%.

Pharmaceuticals

During the quarter, the Pharmaceutical Distribution Business witnessed volume-led growth outperforming the market in many key therapeutic segments. Multiple working capital initiatives resulted in approximate 50% reduction in finance cost for the Business arising from the combined effect of working capital base reduction and interest rate reduction. Over 20 new products were introduced to the market during the quarter in critical spaces including oncology, gastroenterology and cardiology.

The Pharmaceutical Manufacturing Business faced challenges with delayed registration of new products at NMRA for its primary focus area; Morison Branded Generics. Despite the slowdown in new registrations, the branded portfolio continued to deliver robust performance, with ‘Empamor’ reclaiming its market-leading position in volume terms.

Capacity utilisation levels at the ‘Homagama’ factory were maintained at over 50% with improved operational efficiencies.

Hospitals

Hospitals Business delivered strong performance for the period with double-digit growth in surgical revenue and in-patient revenue under elevated occupancy levels at both the hospitals. Increased focus on anchor specialties including nephrology, cardiology gastroenterology and orthopaedic segments yielded significant revenue growth in these areas.

Hemas Ambulatory Surgical Care was introduced during the quarter, a pioneering service designed to transform the way Sri Lankans experience surgical procedures. It adopts a unique patient-centric approach to improve convenience and cost-effectiveness, enabling patients to return home on the same day of the surgery and recover faster, better, and more comfortably.

Mobility

Despite the marginal recovery observed in merchandise exports towards the latter months of the quarter and the 6.3% growth in total throughput witnessed during the nine month period at the Port of Colombo, the Maritime Sector continued to witness challenges in both domestic and international spaces. The increased tensions in the Suez Canal have compelled vessels to redirect their routes around the southern tip of Africa, resulting in an extended journey duration of 10-14 days with many being rerouted via the Port of Colombo. Aviation space continued to witness challenges during the period in both passenger and Cargo verticals. However, both segments witnessed improved volume recovery during the quarter, with increased tonnage uplift for cargo, while the passenger vertical gained traction due to heightened student and labour traffic to Europe and the Middle East, respectively.

The Mobility Sector witnessed a marginal decline in cumulative revenue to reach Rs. 1.3 billion, while the cumulative operating profit and earnings stood at Rs. 751.2 million and Rs. 402.6 million respectively, posting a decline of over 35% due to the adverse impact of lower freight rates and the appreciation of the domestic currency.

During the quarter, the Sector posted a revenue of Rs. 460.4 million, a growth of 19.8% mainly due to increased volume from seasonal cargo. The revenue growth was fully translated to operating profits, recording a growth rate of 20.2% at Rs. 279.6 million, while earnings for the period reached Rs. 144.2 million at a growth rate of 53.4% with lower tax expenses.