Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 12 May 2020 00:25 - - {{hitsCtrl.values.hits}}

The Colombo Bourse’s miserable downfall yesterday may have been caused by its unnecessarily long closure for seven weeks by short-sighted market regulators and COVID-19 fear-stricken brokers when other regional markets were functioning, as well as the bond market and tea auctions in Sri Lanka.

“By leaving the CSE closed continuously not only we were merely prolonging the inevitable, but also forgoing opportunities to benefit from key global catalysts even in the current challenging environment,” analysts told the Daily FT.

For example during the month of April, most markets including Asian markets have benefited by way of record runs in many years with the announcement of quantitative easing and fiscal stimulus measures taken by the Federal Reserve and other central banks throughout the world, analysts pointed out.

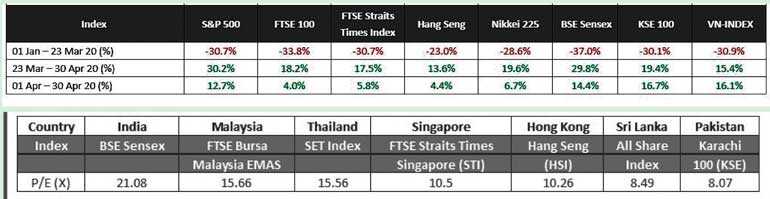

“These moves have once again increased the risk appetite of the investors towards equity as an asset class,” they added. (see table). Singapore dipped by 31% between 1 January and 23 March but gained by 17.5% from 23 March to 30 April and by 6% in April. India which dipped by 37% between 1 January to 23 March had gained by 30% between 23 March and 30 April and 14% in April, Pakistan figures were 30% decline and 19.4% and 16.7% gain respectively.

Vietnam was 31% dip and 15.4% and 16% gain.

It was pointed out that when the CSE last traded on 20 March the stocks were attractively valued compared to other markets and was one of the cheapest in the region. Sri Lanka’s Price Earnings Ratio then was 8.49 times as against the 10.26 in Hong Kong, 10.5 in Singapore, 15 in Thailand and Malaysia, 21 in India and 8 in Pakistan.

“Had the market been kept open, foreign investors would have entered or considered buying at the next available opportunity,” analysts argued.

Amidst local mayhem, foreign investors yesterday accounted for a net inflow of Rs. 0.6 million compared to a net outflow of Rs. 108 million on 20 March.

Analysts also pointed out that Foreign Institutional Investors (FIIs) have made a material contribution towards equity capital raising in the CSE over the last three years. During 2017 to 2019 the Banking Sector alone has raised over Rs. 70 billion in terms of Rights Issues with FII’s subscribing to over Rs. 17 billion (25% ) of the capital raised.