Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Saturday, 15 February 2025 01:34 - - {{hitsCtrl.values.hits}}

By Sadini Galhena and Anushan Kapilan

By Sadini Galhena and Anushan Kapilan

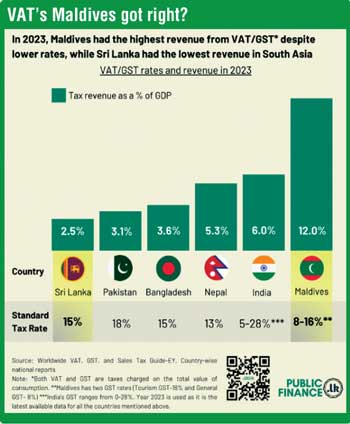

Sri Lanka has the lowest tax revenue collected through Value Added Tax (VAT) in South Asia while Maldives with a lower tax rate collects nearly five times more through its Goods and Services Tax (GST).

In 2023, Sri Lanka’s VAT rate was 15%, which generated Rs. 694 billion—equivalent to 2.5% of GDP—making it the lowest in South Asia. In contrast, countries with similar or lower VAT rates collected higher revenue. For example, Bangladesh, with a similar rate, collected revenue amounting to 3.6% of GDP, and Nepal, with a lower rate of 13%, generated 5.3% of its GDP from VAT in 2023.

The Maldives stands out with a Goods and Services Tax (GST) that raises revenue amounting to 12% of GDP, despite having a lower average rate of about 12% (8% for general GST and 16% for tourism GST). Although it is termed “GST,” the system functions similarly to Sri Lanka’s VAT by allowing businesses to charge GST on sales (output tax) and claim credits for GST paid on purchases (input tax).

VAT revenue...

Although the reported value of goods taxed under General GST and the Tourism GST rate is about the same, the Maldives secures twice as much revenue from its Tourism GST due to the higher 16% rate.

VAT/GST Revenue collection in the past

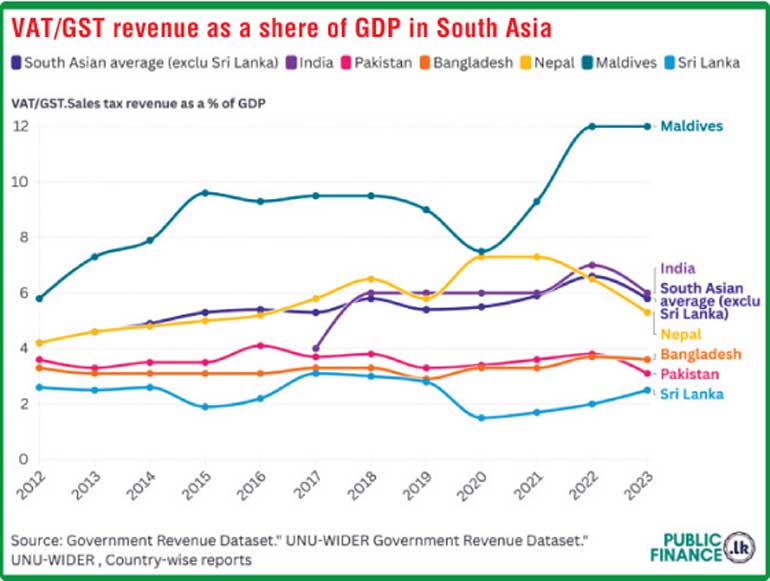

Sri Lanka’s VAT revenue has consistently remained low over time. In 2012, VAT revenue was 2.6% of GDP, dropping to 1.5% by 2020 until it picked up back to 2.5% in 2023. In contrast, the Maldives has seen its GST revenue steadily rise. In 2012, GST revenue accounted for 5.8% of GDP and increased to 12% by 2023.

VAT/GST Rate in the past

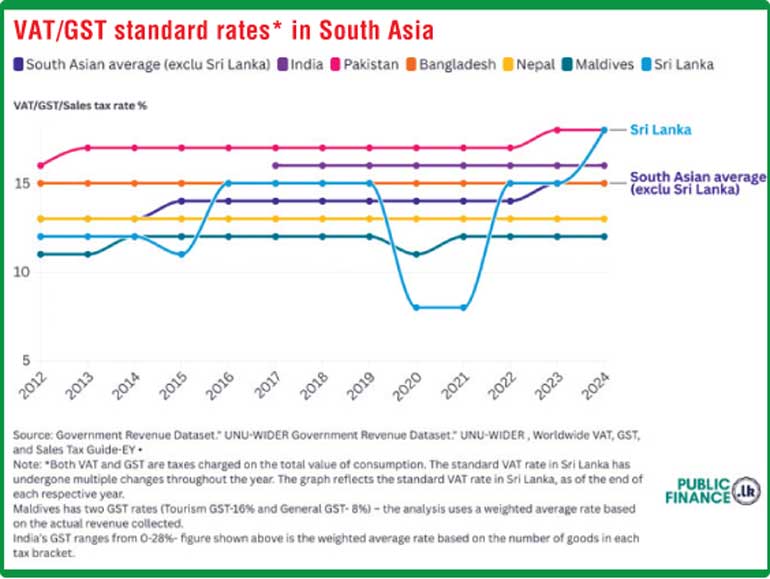

Since 2012, Sri Lanka maintained a VAT rate of 15% or higher in seven out of thirteen years. However, it dropped to 8% during 2020 and 2021, while other South Asian countries kept rates above 10% during that time. Sri Lanka only increased the rate back to 15% during September 2022. However, despite the change, VAT revenue as a share of GDP remained low at 2.5% in 2023. On the other hand, the average GST collection in Maldives has consistently remained around 12% since 2014.

Reasons for relatively Low VAT Revenue in Sri Lanka

Sri Lanka’s VAT revenue has remained consistently low mainly due to a limited tax base and a high VAT registration threshold. In 2023, the country had only 14,128 taxpayers, while the Maldives—with just a quarter of Sri Lanka’s population—had 25,025 GST-registered entities. Before 2023, Sri Lanka’s VAT Registration threshold stood at Rs. 300 million, compared to Rs. 103.5 million in Bangladesh and below Rs. 25 million in the Maldives, India, and Pakistan. Although Sri Lanka lowered its threshold to Rs. 80 million in October 2022 and then to Rs. 60 million in January 2024, it remains significantly higher than in neighbouring countries, limiting the number of businesses required to register.

VAT reforms in 2024

In 2024, Sri Lanka introduced major reforms to its VAT system to boost revenue. The VAT rate rose from 15% to 18%, exemptions were removed for 95 of 137 major items, and the registration threshold was reduced from Rs. 80 million to Rs. 60 million. These changes led to a striking 90% increase in VAT revenue in the first three quarters of 2024, from Rs. 504 billion to Rs. 958 billion. However, even with this growth, VAT revenue would only double to 5% of GDP—still below the levels in Nepal, India, and the Maldives.

Overall, this analysis highlights that while Sri Lanka’s VAT rate is now one of the highest in South Asia, its overall collection remains lower than in neighbouring countries, many of which have similar or smaller formal sectors.

Note:

*Both VAT and GST are taxes charged on the total value of consumption.

** The Maldives uses a dual-rate GST system with two different rates: 8% on General Goods and Services (G-GST) and 16% on Tourism Goods and Services (T-GST).

***India’s GST ranges from 0-28% for different types of goods.

The year 2023 is used as it is the latest available data for all the countries mentioned above.

Afghanistan is excluded from the analysis due to unavailability of data.

Bhutan will introduce GST in 2025.

Sources:

UNU-WIDER. ‘Government Revenue Dataset’. Version 2023 at https://doi.org/10.35188/UNU-WIDER/GRD-2023 [last accessed 23 September 2024]

EY. ‘Worldwide VAT, GST, and Sales Tax Guide’ at https://www.ey.com/en_gl/tax-guides/worldwide-vat-gst-and-sales-tax-guide [last accessed 23 September 2024]

Central Bank of Sri Lanka. ‘Annual Reports’ at https://www.cbsl.gov.lk/en/publications/economic-and-financial-reports/annual-reports [last accessed 23 September 2024]

Maldives Monetary Authority. ‘Annual Report’ at https://www.mma.gov.mv/#/research/publication/reports/ar/Annual%20Report [last accessed 23 September 2024]

Nepal Rastra Bank. ‘Annual Reports’ at https://www.nrb.org.np/category/annual-reports/?department=red [last accessed 23 September 2024]

Bangladesh Bank. ‘Publications’ at https://www.bb.org.bd/en/index.php/publication/publictn/0/2 [last accessed 23 September 2024]

State Bank of Pakistan. ‘Annual Reports’ at https://www.sbp.org.pk/reports/annual/index.htm [last accessed 23 September 2024]

GST Council. ‘Website of the GST Council’ at https://gstcouncil.gov.in/ [last accessed 23 September 2024]