Saturday Feb 14, 2026

Saturday Feb 14, 2026

Thursday, 31 December 2020 00:01 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

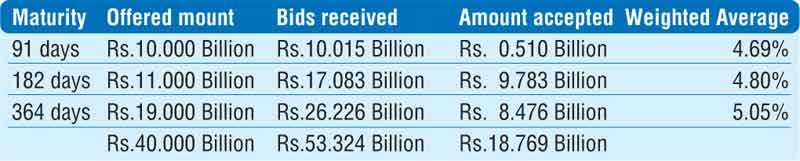

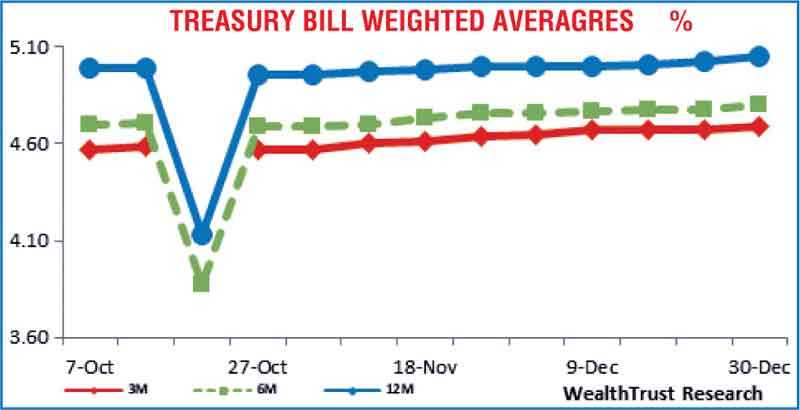

The weekly Treasury bill auction was undersubscribed yet again with the total accepted amount falling short of the total offered amount by Rs.21.23 billion or 53.08%. The weighted average rates of 4.69%, 4.80% and 5.05% were as per the stipulated cutoff rates for the 91, 182 and 364 day maturities, while the bids to offer ratio decreased to1.33:1.

The weekly Treasury bill auction was undersubscribed yet again with the total accepted amount falling short of the total offered amount by Rs.21.23 billion or 53.08%. The weighted average rates of 4.69%, 4.80% and 5.05% were as per the stipulated cutoff rates for the 91, 182 and 364 day maturities, while the bids to offer ratio decreased to1.33:1.

In the secondary bond market, yields decreased marginally yesterday, on the back of moderate activity. Limited trades of the 01.10.23, 01.12.24, 01.02.26 and 15.08.27 maturities took place at levels of 5.97% to 5.98%, 6.48% to 6.49%, 6.75% and 7.19% respectively against its previous day’s closing levels of 6.00/04, 6.47/55, 6.75/85 and 7.15/23. In the secondary bill market, February 2021 maturities changed hands at 4.67%.

The total secondary market Treasury bond/bill transacted volumes for 28th December 2020 was Rs.3.80 billion. In the money market, the overnight surplus liquidity continued to remain at a high of Rs.232.30 billion, while the call money and repo rates remained mostly unchanged to average 4.54% and 4.59% respectively.

Rupee remains mostly unchanged

The USD/LKR rate on spot next contracts was seen closing the day broadly unchanged at Rs.187.50/50 yesterday on the back of an equilibrium market. The total USD/LKR traded volume for 28th December 2020 was US $ 36.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)