Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 4 July 2023 01:10 - - {{hitsCtrl.values.hits}}

The Colombo stock market which bounced back in June achieving emphatic gains will open today after a five-day hiatus which many have said with renewed optimism from positive vibes from DDO.

The Colombo stock market which bounced back in June achieving emphatic gains will open today after a five-day hiatus which many have said with renewed optimism from positive vibes from DDO.

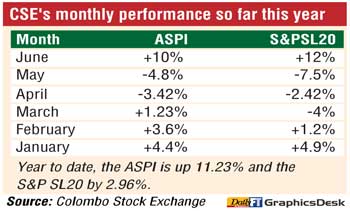

In June, the CSE reported double digit gains for both indices after suffering losses in May and April.

Asia Securities Research expects the Colombo stock market to re-rate post-DDO to drive ASPI to 12,700 levels in 2023.

It said the market is currently trading at 5.0x TTM PER, and we expect an upward adjustment to 7.0-7.5x PER by the year end.

Asia also said fixed income yields have been on a steady downward trajectory since 1Q 2023, which will make the fixed income market less attractive in comparison to equities.

“With the premium attached to risk free rates tumbling we expect a pickup in equity market turnover supported by increased fund flows,” Asia added.

Bartleet Religare Securities also expects declining interest rates to favour the equity market.

It said the market PE stands at 7.8x on projected earnings for 2023E trading at a 30% discount to 5 year average of 11.2x prior to the economic crisis. It said this reflects the uncertainty premium attached over Sri Lanka’s economic revival and debt restructuring.

“We believe the easing of uncertainty towards debt restructuring along with gradual reduction of interest rates will rerate market valuations closer to past average. However, we attribute an implied PE of 10x to reflect the implications of hard reforms,” Bartleet Religare said.

It said Sri Lanka is among the cheapest in terms of valuations in the region where forward PE (2023E) trades at a 55% discount to the regional average of 16.3x.

“While better performing economies are traded at premium multiples, we believe a justified multiple of 10x is fair for Sri Lanka as reflected by the frontier index which includes markets with weak macro fundamentals,” it said.

Bartleet Religare said it is maintaining its earnings forecast for 2023E, aided by the decline in interest rates, amidst debt re-profiling. “Our ASPI fair value remains unchanged for 2023E presenting a 22% upside potential,” it added.