Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 22 May 2023 00:55 - - {{hitsCtrl.values.hits}}

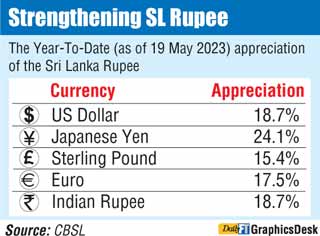

The Year to Date (YTD) appreciation of the Rupee against the USD is nearing 20% as of last week.

The Year to Date (YTD) appreciation of the Rupee against the USD is nearing 20% as of last week.

The Central Bank said during the year up to 19 May 2023, the Rupee appreciated against the USD by 18.7%. At the end of the previous week, the appreciation was 15.8%.

The USD average rate last week was Rs. 307.21 as against Rs. 313.21 in the previous week and Rs. 359.55 a year ago.

The Rupee has appreciated against other currencies too. Against the Japanese yen the Rupee has appreciated by 24.1%, by 15.4% against the Sterling Pound, by 17.5% against the Euro and 18.7% against the Indian Rupee.

The appreciation has caused mixed reviews from private sector analysts whilst some have questioned its rationale.

Some argued that there hadn’t been major foreign direct investments for the Rupee’s appreciation, though others cited robust workers remittances, tourism receipts and inflows to the Government securities market as key contributors.

According to Charts.lk foreign holdings of the Government Securities have increased by Rs. 20 billion to Rs. 150 billion during the week ending 19 May. Wealth Trust Securities said foreign holding in rupee bills and bonds was seen increasing for the 14th consecutive week to record an inflow of Rs. 19.76 billion for the week ending 18 May 2023.

Another reason for the appreciation last week was the absence of CBSL in mopping up Dollar liquidity. However in April CBSL bought $ 148 million from the market according to charts.lk. whilst year to date CBSL is estimated to have absorbed nearly $ 1 billion.

Other analysts said declining imports suggest a lack of demand for dollars as another reason. Sri Lanka’s imports in the first quarter of 2023 declined by 31.7% year on year to $ 3.85 billion. However imports in March spiked to $ 1.45 billion from $ 1 billion in February due to seasonal demand and the partial recovery in fuel imports. Last year imports declined by 11.4% to 18.3 billion.

An appreciation Rupee on other hand is seen as negative for Sri Lanka’s struggling exports as well as tourism whilst may impact inflow of workers remittances.

Exports are down by 8% to $ 3 billion in the first quarter. According to the CBSL the real effective exchange rate (REER 24) appreciated notably during March 2023, but remained largely below the threshold of 100 index points, indicating external competitiveness. Analysts opine given continuous appreciation the current REER may have turned uncompetitive for Lankan exporters.

Workers remittances are up 81% to $1.8 billion in the first four months of this year. Earnings from tourism are up 18% to $ 696 million as well.

Despite sharp appreciation of the Rupee, prices of imported items haven’t seen a corresponding decrease. Some attributed this to the “lagged” effect and local prices would be adjusted going forward.

In late April when YTD appreciation was 13% CBSL said an improvement in the forex liquidity in the domestic foreign exchange market was observed following the gradual relaxation and subsequent revocation of the mandatory forex sales requirement by licensed banks to the Central Bank from the converted export proceeds and workers’ remittances, and discontinuation of the daily guidance on exchange rates. Last week, CBSL lifted the 100% cash margin requirement on LCs for imports.