Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Tuesday, 12 January 2016 00:34 - - {{hitsCtrl.values.hits}}

By Charumini de Silva

Progressive Sri Lankan firms are disappointed over the alleged suspension or delay in Central Bank approving overseas investments of over $ 500,000 though the monetary regulatory urged caution whilst dismissing criticism.

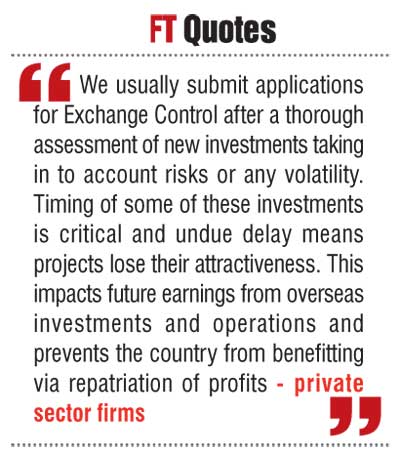

Private sector sources told the Daily FT that investments in viable projects as well as growth fuelling expansions abroad were being delayed as the Central Bank was dragging its feet over approval. They opined that firms usually submit applications for Exchange Control after a thorough assessment of new investments taking in to account risks or any volatility.

“Timing of some of these investments is critical and undue delay means projects losing their attractiveness. This impacts future earnings from overseas investments and operations. It prevents the country from benefitting via repatriation of profits,” sources pointed out.

Analysts said Central Bank’s action is apparently over the pressure on the rupee as well as lower reserves.

The Rupee depreciated by 9.03% in 2015 overall and 6.6% since September when greater flexibility was brought in to determine the exchange rate.

Yesterday the Rupee closed steady at 143.75/85 to the dollar on Monday. It hit an all-time low of 144.30 on 30 December.

Gross official reserves as at end 2015 were $ 7.3 billion and believed to be under pressure as $5 billion is expected to be repaid on foreign loans in 2016, according to Central Bank data.

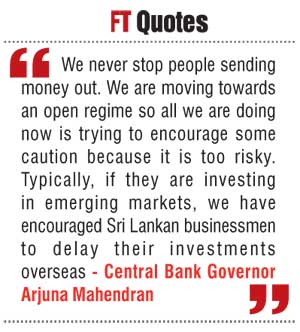

However Governor Arjuna Mahendran yesterday said Central Bank has ‘not prevented’ Sri Lankan companies investing overseas, but was trying to encourage some caution about global uncertainty.

“We haven’t stopped anything. What we have told them is to try and differ investing in overseas owing to the uncertainty worldwide,” Central Bank Governor, Arjuna Mahendran told the Daily FT.

Further clarifying his point Mahendran said the policy of the Government is to encourage free movement of capital.

However, as the foreign reserves are under pressure and a significant portion of capital is already flowing out of the country the Central Bank has appealed to local businessmen to differ their investments until the global situation gets more clarity.

The Governor confirmed Central Bank has received several applications from Sri Lankan businessmen to invest overseas.

“I would say that we have received close to about 100 applications and of that 30 to 40 have been approved. But that doesn’t mean the others are resisted. All we are trying to do is discuss with the investors to see whether they could take a little more time to  properly evaluate their projects and look for better opportunities in Sri Lanka.”

properly evaluate their projects and look for better opportunities in Sri Lanka.”

In 2014, Central Bank granted approval for 9 companies to invest $105.2 million and for 18 companies to borrow $248.5 million from abroad.

The Governor said key areas where investors were interested in investing on are hotels in the Maldives, hydropower generation projects in Africa and financial institutions in Bangladesh, Cambodia and Laos.

“We never stop people sending money out. We are moving towards an open regime so all we are doing now is trying to encourage some caution because it is too risky,” he pointed out.

Noting that the Chinese stock market fell by another 5% yesterday and Chinese currency went down by 3% he asserted that this would affect all the emerging markets.

Accordingly, Mahendran pointed out, it was way too risky for Sri Lankan businessmen to invest in emerging markets.

“Typically, if they are investing in emerging markets, we have encouraged Sri Lankan businessmen to delay their investments overseas,” he explained.