Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 5 February 2016 00:00 - - {{hitsCtrl.values.hits}}

Reuters: China made its boldest overseas takeover move when state-owned ChemChina agreed a $ 43 billion bid for Swiss seeds and pesticides group Syngenta on Wednesday, aiming to improve domestic food production.

The largest ever foreign purchase by a Chinese firm, announced by both companies, will accelerate a shake-up in global agrochemicals and marks a setback for US firm Monsanto, which failed to buy Syngenta last year.

China, the world’s largest agricultural market, is looking to secure food supply for its population. Syngenta’s portfolio of top-tier chemicals and patent-protected seeds will represent a major upgrade of its potential output.

“Only around 10% of Chinese farmland is efficient. This is more than just a company buying another. This is a government attempting to address a real problem,” a source close to the deal told Reuters.

Years of intensive farming combined with overuse of chemicals has degraded land and poisoned water supplies, leaving China vulnerable to crop shortages. The deal fits into Beijing’s plans to modernise agriculture over the next five years.

“I was sent to the countyside at the age of 15, so I’m very familiar with what farmers need when they work the land. The Chinese have relied mainly on traditional ways of farming. We want to spread Syngenta’s integrated solution among smallholder farmers,” ChemChina Chairman Ren Jianxin told a media briefing.

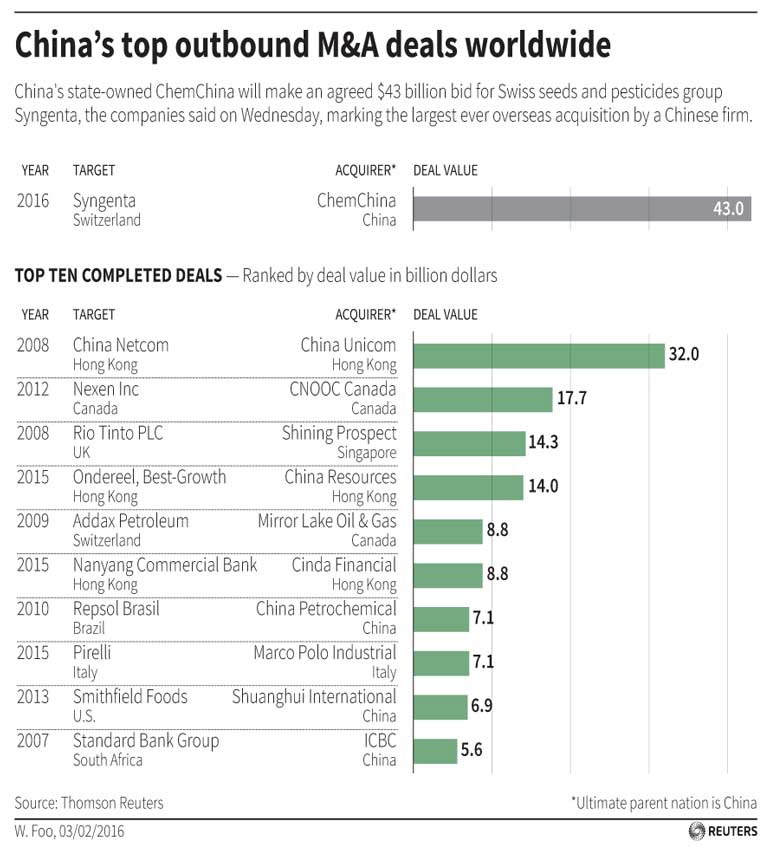

With growth slowing at home, Chinese companies are increasingly looking abroad for deals that can boost their business and help them diversify. If completed, ChemChina’s Syngenta purchase would be more than double CNOOC’s $17.7 billion buy of Canadian energy company Nexen in 2012.

ChemChina last year bought Italian tyre maker Pirelli and last month said it would buy German industrial machinery maker KraussMaffei Group for some $1 billion.

Shares in Syngenta rose on news of the deal, but at around 412 Swiss francs, were some way below the agreed offer price of $465 per share, equivalent to 480 francs, reflecting market concerns that the deal could yet stumble over regulatory hurdles and limited expectations of a counter-offer.

“Syngenta has never been valued so highly. Over the last few years the company has failed to demonstrate it can generate reasonable earnings on its own,” Patrick Huber, a fund manager at Mirabaud Asset Management told Reuters.

“We will definitely tender our shares at the offered price. I can’t imagine another bidder making a higher offer,” Huber said, adding that although US regulators may not block the deal, they could delay it.

Regulatory issues

Syngenta CEO John Ramsay, who described the ChemChina offer as “very appropriate and attractive”, said he saw no major barriers and noted that ChemChina – short for China National Chemical Corp – had secure financing in place.

A source with knowledge of the deal said the funding would come from a range of Chinese players, as well as HSBC and China CITIC Bank International.

“I think the overall regulatory approvals will not be very challenging,” Ramsay told Reuters, adding he expected antitrust regulators to acknowledge the limited overlap.

The Committee on Foreign Investment in the United States (CFIUS), whose mandate is U.S. national security, would not pose a major hurdle, Ramsay said.

Swiss regulators said their conditions were largely met by the terms of the deal, although they want Swiss retail investors to receive the ChemChina offer in Swiss francs and warnings to be given on foreign exchange risks.

Syngenta’s board would still have to consider any rival offers, Ramsay said, although there are tough financial penalty clauses for both parties if they fail to deliver on the deal.

In a hint of what may be in store for the enlarged group, Syngenta’s chairman said ChemChina will be on the lookout for more deals as China strives to improve its food supply.

“ChemChina has a very ambitious vision of the industry in the future. Obviously it is very interested in securing food supply for 1.5 billion people and as a result knows that only technology can get them there,” Michel Demare said.

Syngenta is already the largest supplier of crop chemicals, excluding seeds, in China with a 6% share of a fragmented market, the group’s chief operating officer Davor Pisk said.

Beijing is seeking to cut reliance on food imports amid limited farm land, a growing population and higher meat consumption. China’s combined consumption of pork, beef and poultry has grown by an average 1.7 million tons a year for the past decade, placing further stress on feed grain supplies.

Meanwhile, a global glut of corn and soybeans has depressed grain prices for the past three years, prompting US farmers to reduce spending on everything from equipment to seeds and pesticides. The cutbacks, along with pressure from investors to bolster profits, have sent many of the world’s largest agricultural companies scrambling to cut deals.

DuPont and Dow Chemical Co agreed in December on an all-stock merger valued at $130 billion in a first step towards breaking up into three separate businesses, a move that was seen as a trigger for further consolidation.

Syngenta was advised by Dyalco, the one-man business of former Goldman Sachs M&A head Gordon Dyal, alongside JP Morgan, Goldman Sachs and UBS while HSBC and China CITIC Bank International advised ChemChina.