Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 26 May 2017 00:10 - - {{hitsCtrl.values.hits}}

The country’s external sector developments in February has been under severe challenge due to a multitude of reasons, including a deeper widening of the trade deficit and weak financial account, the Central Bank revealed yesterday.

Only managing a “modest” performance, the Central Bank said the external sector remained subdued with a widening of the trade deficit, a moderation in tourist earnings and a modest growth in workers’ remittances in February 2017. It said a considerable widening in the trade deficit (by 35.7% to $ 743 million) was observed in February with a decline in exports amidst increased imports mainly due to higher imports of fuel and rice. Earnings from tourism dipped with a marginal decline in tourist arrivals during the month, which could partly be attributed to the daytime closure of the Bandaranaike International Airport (BIA) for the resurfacing of the runway.

The growth in workers’ remittances in February remained below the expected level. Further, the financial account was adversely affected by significant outflows from the government securities market during the month. However, some foreign investments were observed in the Colombo Stock Exchange (CSE) with inflows to both primary and secondary markets during the month.

The pressure on the external account has been eased somewhat in subsequent months by improved export performance; a reversal of capital outflows with investments in the stock exchange and inflows to the government securities market as well as proceeds from the International Sovereign Bond of $ 1.5 billion and a syndicated loan of $ 450 million.

Exports

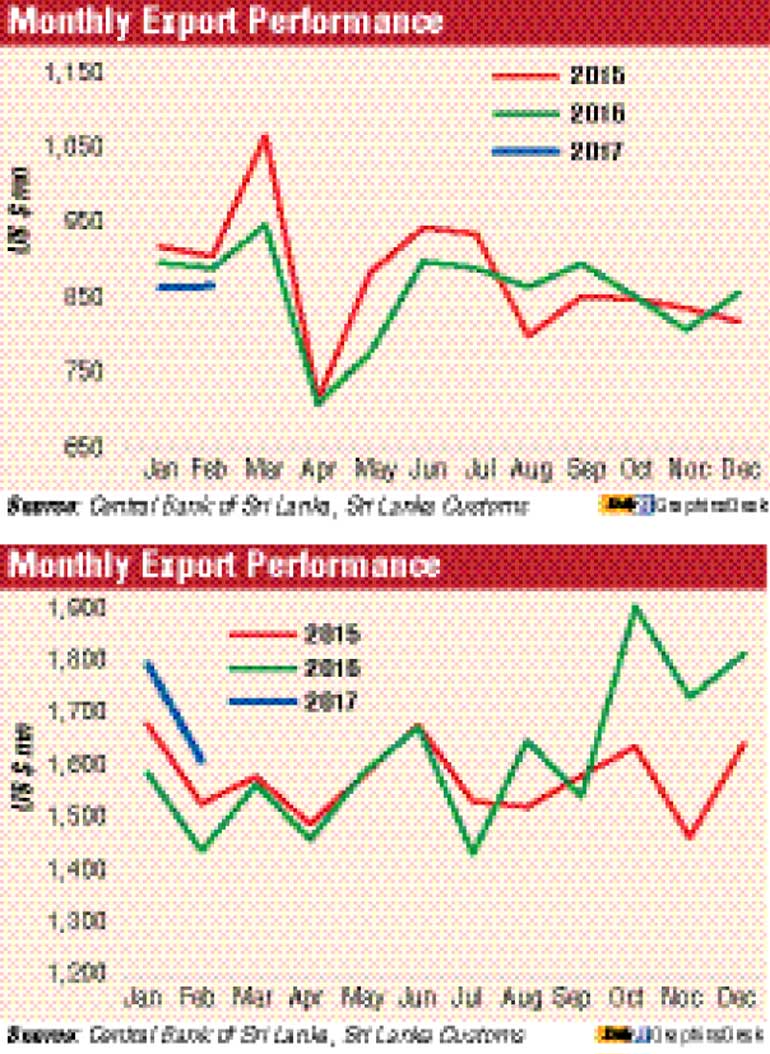

Earnings from exports at $ 868 million in February 2017 registered a decline of 2.7% from $ 892 million in February 2016, mainly due to lower industrial exports.

Earnings from industrial exports, which represent about 76% of total exports, declined by 6.5%, year-on-year, to $ 659 million in February 2017 mainly due to reduced earnings from textiles and garments. Export earnings from textiles and garments contracted by 14.5% to $ 396 million in February 2017, reflecting a significant decline in garment exports to the EU and the US.

Food, beverages and tobacco and gems, diamonds and jewellery also contributed substantially to the lower earnings from industrial exports.

However, earnings from machinery and mechanical appliances, petroleum products and rubber products showed an improved performance. Meanwhile, earnings from agricultural exports grew for the third consecutive month, registering an increase of 12.5% to $ 205 million in February 2017. Earnings from tea exports increased by 12.8% in value terms due to higher prices, in spite of a decline in the volume exported.

Earnings from spices showed a significant growth of 25.7% in February 2017 mainly due to the improved performance in cloves, nutmeg and mace, owing to significant increases in volume despite lower prices. In addition, earnings from seafood exports increased by 27.3%, year-on-year, in February 2017 mainly due to a 111.0% growth observed in seafood exports to the EU.

However, earnings from coconuts, minor agricultural products and vegetables exports declined in February 2017. On a cumulative basis, export earnings during the first two months of 2017 at $ 1,733 million, contracted by 3.2%, year-on-year, mainly due to lower exports of textiles and garments, food, beverages and tobacco, gems, diamonds and jewellery and rubber products. However, earnings from machinery and mechanical appliances, tea and spice exports increased considerably during the period concerned. The leading markets for merchandise exports of Sri Lanka during the first two months of 2017 were the US, the UK, India, Germany and Italy accounting for about 52% of total exports.

Imports

Expenditure on imports increased by 11.9%, year-on-year, to $ 1,611 million in February 2017, continuing the double-digit growth seen in imports for the fifth consecutive month. Higher expenditure incurred on intermediate goods contributed largely to this growth.

Expenditure on imports of intermediate goods increased in February 2017 by 25.3%, year-on-year, to $ 907 million, led by fuel imports. Import expenditure on fuel increased by more than twofold to $ 355 million driven by higher expenditure on refined petroleum imports, while import of crude oil and coal also increased, owing to increased thermal power generation due to prevailing drought conditions in the country.

Higher international oil prices and the depreciation of the rupee also contributed to the increase in import expenditure on fuel. In addition, expenditure on imports of raw materials of iron and steel, and gold also contributed significantly to the high growth in intermediate goods imports.

However, import of textiles and textile articles declined by 17.1% in February 2017 in line with the decline in textiles and garments exports.

Import expenditure on investment goods at $ 360 million declined in February 2017 by 2.5%, year-on-year, mainly due to reduced imports of machinery and equipment. Import expenditure on machinery and equipment declined by 5.9%, year-on-year, mainly due to the decline in imports of telecommunication devices.

Import expenditure on transport equipment also decreased by 4.8% led by road vehicles such as auto trishaws, commercial cabs and buses. However, import expenditure on building materials increased owing to higher iron and steel imports during the month.

Expenditure on consumer goods imports marginally declined by 0.7%, year-on-year, in February 2017 to $ 343 million. This was driven by the decline in imports of non-food consumer goods such as personal vehicles, home appliances and clothing and accessories. In contrast, expenditure on food and beverages increased substantially mainly due to the increase in rice imports. Rice imports increased to $ 36 million in February 2017 in comparison to a value of less than $ 1 million incurred for rice imports in February 2016.

On a cumulative basis, expenditure on imports valued at $ 3,410 million during the first two months of 2017 increased by 12.6%, year-on-year, led by import outlays on fuel, gold and rice. However, import expenditure incurred on textiles and textile articles, vehicles and machinery and equipment declined during this period.

India, China, the UAE, Singapore and Japan were the main import origins during the first two months of 2017, accounting for about 59% of total imports.

Trade balance

The deficit in the trade balance widened substantially to $ 743 million in February 2017 compared to $ 548 million in February 2016. The cumulative trade deficit during the first two months of 2017 increased substantially to $ 1,677 million from the $ 1,238 million recorded during the same period of 2016.

Earnings from tourism

Tourist arrivals in February 2017 at 197,517 recorded a negative growth of 0.1%, year-on-year, compared to 197,697 arrivals in February 2016. The marginal reduction in tourist arrivals can largely be attributed to the decline in tourist arrivals from China.

In contrast, tourist arrivals from India, the United Kingdom and Germany recorded an increase, while arrivals from France declined during the month. The cancellation and the rescheduling of some flights due to the resurfacing of the BIA could have had some impact on tourist arrivals in February 2017. However, a notable feature of tourist arrivals in the first two months of 2017 was the pick-up in the number of tourists from the region of Eastern Europe. As a result of the decline in tourist arrivals, earnings from tourism also declined to $ 338.9 million in February 2017.

Workers’ remittances

The moderation in receipts from workers’ remittances continued in February 2017. Receipts from workers’ remittances recorded a marginal growth of 2.6%, year-on-year, amounting to $ 568.7 million during February 2017. The low growth in workers’ remittances is expected to continue particularly with the adverse economic and geopolitical conditions in the Middle Eastern region.

Financial flows

The trend in net outflows from the government securities market continued in February with a significant net outflow of $ 255.9 million during the month. Further, long-term loans to the Government recorded a net outflow of $ 57.6 million with loan repayments during the month amounting to $ 149.2 million compared to a loan inflow of $ 91.6 million. However, foreign investments in the CSE recorded a net inflow of $ 57.2 million with an inflow of $ 14.2 million to the primary market and a net inflow of $ 43.0 million to the secondary market.

Overall Balance of Payment (BOP) position

The overall BOP is estimated to have recorded a deficit of $ 258.3 million during the year up to end February 2017, compared to a deficit of $ 534.0 million recorded up to end February 2016.

International reserves and Exchange Rate movements

Sri Lanka’s gross official reserves as at end February 2017 amounted to $ 5.6 billion, equivalent to 3.4 months of imports. Meanwhile, total foreign assets, which include gross official reserves and foreign assets owned by deposit taking corporations, stood at $ 7.8 billion, equivalent to 4.7 months of imports.

The Sri Lankan rupee, which depreciated by 3.8% against the US dollar in 2016, recorded a further depreciation of 1.8% this year up to 23 May 2017.

Reflecting cross currency movements, the rupee also depreciated against the euro by 8.0%, the Indian rupee by 6.7%, the pound sterling by 7.1%, the Japanese yen by 6.2%, the Australian dollar by 5.1% and the Canadian dollar by 1.7% during the year up to 23 May 2017.