Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 9 December 2016 00:48 - - {{hitsCtrl.values.hits}}

Rating agency Fitch said yesterday it has revised its sector outlook for Sri Lankan banks to Negative from Stable.

Rating agency Fitch said yesterday it has revised its sector outlook for Sri Lankan banks to Negative from Stable.

The revision was announced as part of Fitch’s latest assessment on Asia Pacific banking sector. Most of Asia-Pacific’s (APAC) banking sectors are facing a cyclical deterioration in asset quality in 2017, as a challenging economic environment continues to put pressure on borrowers.

“Fitch Ratings’ 2017 outlook on more than three-quarters of the banking sectors in the region is negative,” it said.

With regard to Sri Lanka Fitch believes operating conditions have become more challenging, as signalled by the downgrade and revision of the outlook on the sovereign rating to ‘B+’/Negative from ‘BB-’/Stable in February 2016.

Fitch expects rising macroeconomic pressure to strain banks’ credit metrics, in particular asset quality.

Following are some of the observations on Sri Lankan banking sector by Fitch.

Economic challenges: Fitch expects downside pressure on growth in 2017, and for real GDP growth to be around 5%. Sri Lanka entered into an IMF programme which commenced in June 2016, and could face a period of adjustment that could dampen economic performance in the short term. Sri Lanka also remains susceptible to difficult global conditions.

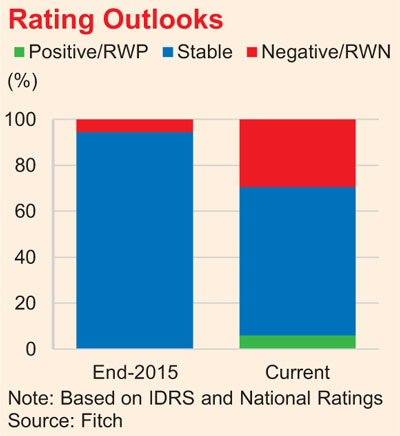

Negative ratings outlook: The negative ratings outlook on Sri Lankan banks largely reflects the impact of the negative outlook on the sovereign and Fitch’s approach of generally capping bank ratings at the sovereign rating. This is because bank credit profiles are sensitive to the sovereign’s credit profile, and also to risks stemming from the operating environment in the absence of a build-up of adequate loss-absorption buffers.

NPLs to rise: Fitch expects a deterioration in asset quality to become more apparent in 2017 in the aftermath of lending to more susceptible segments, and for bank NPL ratios to rise amid a more challenging environment. The decrease in the sector NPLs throughout most of 2016 has resulted mostly from a reduction in NPLs from gold-backed lending, and this is not expected to continue to mask incremental NPL formation for the sector.

Moderation in loan growth: The continued rise in credit demand throughout most of 2016 prompted a response from the Central Bank of Sri Lanka (CBSL) in the form of rate hikes and higher reserve requirements to curb credit expansion and inflation pressures. Fitch expects these actions to take effect and for lending to moderate in 2017 alongside higher interest rates and reduced consumption demand.

Pressure on capital: Fitch sees capitalisation as a significant issue facing the sector, stemming from thin capitalisation across state banks and diminishing capitalisation across most non-state banks. The CBSL could impose higher capital requirements, including those via the implementation of Basel III capital standards. Stronger capital buffers are desirable to counterbalance structural balance-sheet issues and to absorb unexpected losses. There has not been much Tier 1 capital-raising, and banks could face challenges in raising capital.

Manageable profit pressure: A potential increase in credit costs could offset the benefit of a possible improvement in net interest margin and result in a slight decrease in profitability.

Stable liquidity profile: Funding-cost pressures have risen and competition for deposits has increased. Banks’ liquidity should continue to be supported through a stable deposit base. Customer deposits comprise the bulk of banks’ funding, at about 68% of assets.

Outlook sensitivities were as follows:

Impact from sovereign rating: The ratings of state-linked banks are sensitive to changes in the sovereign’s propensity or ability to provide support. Sovereign rating action could result in similar action on the IDRs and VRs of Sri Lankan banks that are at the same level.

Rising risk appetite: Negative rating action could also result from pressure on bank credit profiles through an increase in risk appetite – such as sustained rapid loan expansion and/or rising exposure to more susceptible segments – unless it is counterbalanced through higher capital buffers and stronger risk management.