Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 5 October 2015 00:10 - - {{hitsCtrl.values.hits}}

By Charumini de Silva

With the new Government’s first Budget around the corner, the World Bank yesterday gave a wakeup call to policy makers urging to improve fiscal management, measures to boost Foreign Direct Investments and exports.

The perfect dose of recommendations was contained in the lender’s twice-a-year South Asia Economic Focus report released yesterday.

Striking a positive note, the World Bank said the newly-elected Government has shown commitment to carry out needed political and economic reforms but issued caution on several other fronts.

The World Bank is forecasting Sri Lanka to improve economic growth from 5.3% in 2015 to 5.6% next year. However this is lower than 7.4% estimated for South Asia, which the bank described as the fastest growing region in the world.

Noting that growth expectation in Sri Lanka is mainly due to higher public sector wages and disposable incomes, the World Bank however cautioned on the loose fiscal stance behind this strong domestic demand as it is also putting pressure on the external balance.

“Maintaining the growth momentum will require higher tax revenue, rationalised public spending and greater competitiveness,” the WB report said.

It said that sustained growth since 2010 has contributed to a significant reduction in poverty; yet many pockets of poverty remain.

“Public debt is rising, fiscal revenue is low, and the external current account is in deficit. Much needs to be done in order to attract FDI, improve external sector competitiveness and arrest declining fiscal revenues to adopt an export-led growth path and create the space to pursue counter-cyclical policy,” the World Bank emphasised.

Promoting inclusive growth by targeting disadvantaged areas and boosting social protection programs can hasten further declines in moderate poverty, the report pointed out.

It noted that the fiscal deficit for 2014 was 5.7%of GDP, up from 5.4%for 2013. This marked a slight reversal of the consolidation in the post-conflict period. The widening primary deficit and slowdown in growth led to a slight increase in public debt to 71.8%of GDP, while contingent liabilities were estimated at 5.4%of GDP by end 2014. “The low tax revenue, placed at 10.2%of GDP in 2014 remains a key macro-economic concern,” World Bank said.

It said Sri Lanka’s immediate challenges include managing currency pressure and raising revenue to reduce the 2015 fiscal deficit.

Structural challenges include increasing fiscal revenue and narrowing a persistent current account deficit linked to structural competitiveness issues in the export sector.

With the country approaching upper middle income status, borrowing terms are becoming more commercial, which could affect affordability.

“With limited national savings compared to national investment, Sri Lanka needs to attract FDI. Going forward, to sustain its high growth path it needs to increase growth in the manufacturing and export sectors,” the World Bank said.

On South Asia, the report said the region’s positive performance hinges on solid growth in services, domestic consumption, and a gradual rise of investments. Limited exposure to the financial turmoil and an improved external position has given most South Asian countries important policy space.

World Bank South Asia Chief Economist Martin Rama said: “While the region is now in a position of strength, structural constraints holding back export and investment growth do persist. To keep the momentum and accelerate job creation, governments should enact reforms easing infrastructure bottlenecks and paving the way to greater competitiveness.”

“Fiscal space remains limited while financial sector vulnerabilities persist,” he added.

Given India’s weight in the region, its performance greatly influences the projections for South Asia as a whole. Improved investor sentiment and resilience to external shocks are expected to increase India’s growth rate to 7.5% in fiscal year (FY) 2015 and further to 7.8% in FY2016.

“Thanks to low food and commodity prices, as well as a slowdown in the growth of administered prices, inflationary pressures have eased markedly in South Asia. Yet the pace of disinflation varies depending on the price index considered,” the report said.

Revisions to national accounts, together with new comparable data on purchasing power around the world, also raise questions regarding the measurement of prices in the region.

According to the report, South Asia could actually have cheaper prices, faster growth and bigger economies than previously thought.

However it noted that rapid growth has not yet translated into significantly higher Government revenue generation and improved fiscal balances.

Budget deficits are expected to remain at 6.5% of Gross Domestic Product (GDP) in 2015, the highest among all developing regions. Tax collection remains well below estimates, and has even deteriorated across major South Asian economies.

“Mobilising revenue is critical for the region to develop its infrastructure and deliver better social services, while creating a financial cushion to address potential shocks in the future,” World Bank South Asia Vice President Annette Dixon said.

He further said: “In some cases introducing and rolling out modern tax instruments holds the key to higher revenue, but containing exemptions and special regimes are crucial across most of the region.”

Many South Asian countries show potential for accelerated growth in the short to medium-term.

However, the transition in Afghanistan, the earthquakes in Nepal, and revisions to national accounts in Sri Lanka has resulted in all three countries experiencing slower growth than previously expected.

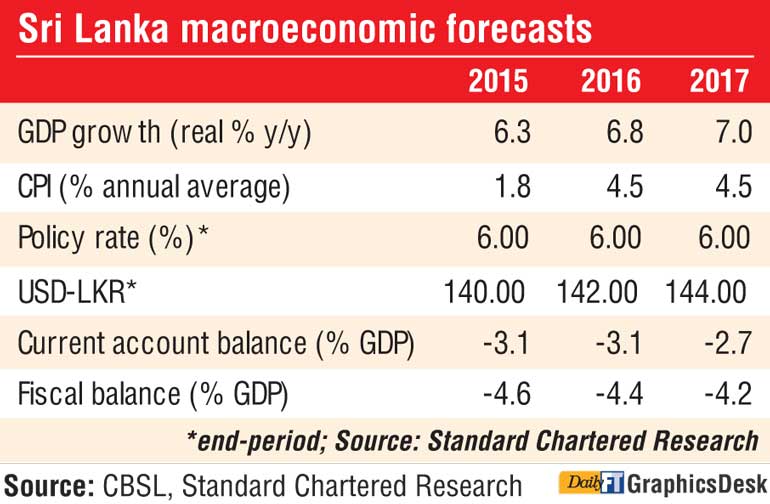

Sri Lanka’s economic growth in 2016 is expected to be higher at 6.8% from 6.3% this year, according to the Standard Chartered Bank (SCB).

It said a stable National Government since August 2015 is likely to boost confidence and accelerate implementation of economic reforms in Sri Lanka. “This should kick-start the recovery. We estimate 2015 GDP growth at 6.3% and 2016 growth at 6.8% on (1) rising consumption, (2) increased investment, and (3) an improvement in net trade,” SCB said in its global research for the fourth quarter of 2015 released on Friday.

Following are some of the highlights on Sri Lanka as contained in the SCB report.

Consumption is likely to be buoyant in 2015, driven by healthy remittance inflows, low inflation and rising wages. Private consumption, which represents 70% of GDP, should be the biggest contributor to growth.

The Government announced a salary hike for public servants, a pension increase for State workers, and a number of loan write-offs earlier this year. It also emphasised the need for private-sector companies to increase wages.

Salary increases and loan write-offs, along with a benign inflation trajectory, should be positive for consumer spending in 2015 and 2016.

Investment – which fell sharply in 2014 and H1-2015 – is also likely to rise, driven by increased public and foreign spending on infrastructure in a more stable political environment. In addition, rising private-sector credit growth should drive investment from H2-2015. Net trade is likely to improve given recent Sri Lankan Rupee (LKR) depreciation and the EU’s possible granting of Generalised Scheme of Preferences Plus (GSP+) status to Sri Lanka in Q1-2016. GSP+ allows duty-free access for Sri Lankan apparel exports to the EU and would likely boost exports. These developments are likely to outweigh the negative impact of fiscal cuts on public spending. External headwinds and a lack of economic reforms are key risks to our forecasts.

Headline inflation has stayed below 1% for the past six months, after the government cut electricity prices in September, and retail fuel prices and prices of essential commodities in January. Inflationary pressure is likely to increase from October on an unfavourable base effect, and m/m inflation has been on an upward trend since May. Even so, we expect it to remain contained at c.2% by December.

Policy: We expect no policy rate cuts for the remainder of 2015, despite low inflation, as external-sector vulnerabilities remain high. Sri Lanka’s vulnerability to external shocks has increased on (1) declining FX reserves, (2) a pick-up in import growth, (3) the Government’s high foreign borrowing, and (4) debt redemptions of $ 3 b over next 12 months. FX reserves fell c.28% y/y to $ 6.6 b in August 2015 (4.2 months of import cover). The Government subsequently announced reduced intervention in the FX market in order to manage the LKR and preserve FX reserves (see FX Alert, 9 September 2015, ‘LKR – gear up for (slightly) higher market volatility’).

External vulnerabilities, combined with political uncertainty until August 2015 and lower interest rates domestically, have led to significant FII outflows from the G-Sec market. FII ownership of G-Secs declined considerably to 8% on 9 September from 11.4% in January 2015, leading to outflows of more than $ 800 m. While the political environment has stabilised, external vulnerabilities persist and domestic rates remain low. As a result, we do not expect further interest cuts, which could exacerbate foreign outflows.

The Government has also announced measures to contain imports. It capped the loan-to-value (LTV) ratio for commercial vehicles at 70% (versus 80-90% previously) to curb vehicle import demand. A doubling of vehicle imports was the key reason for the widening of the trade deficit in H1-2015. We also expect additional import duties on vehicle and other consumption-related import items in the 2016 budget (to be announced in November 2015). These steps should rein in the widening trade deficit. Tourism income, which grew 15.6% y/y in H1-2015, is likely to remain strong with greater Government focus. We expect remittance inflows to improve only marginally in 2015 as low crude oil prices offset the benefits of political stability in H2.

We forecast that the current account deficit will widen to 3.1% in 2015 from 2.7% in 2014. The fiscal trend is positive, according to the Mid-Year Fiscal Position Report from the Ministry of Finance. Government revenue increased 14.5% y/y in January-April on higher domestic consumption and excise taxes on motor vehicles. We expect public spending to rise in H2-2015 but remain muted this year. Capital spending should rise in 2016, albeit from a low base, as the new government crystallises its economic policies and starts pushing for higher growth rates.

Politics: Parliamentary elections were held in August, and the United National Front for Good governance (UNFGG) emerged as the largest coalition party. A nationalist government was formed with the support of all political parties. UNFGG is likely to maintain a good working relationship with President Sirisena, as he collaborated well with the minority United National Party (UNP) government (which leads the UNFGG) in H1-2015. That said, given the coalition nature of the new government, we will monitor its resolve to undertake tough economic reforms.

Market outlook: We maintain our Negative outlook on T-bonds. Supply dynamics remain unfavourable, and foreign investor sentiment towards T-bonds is weak. Net issuance of T-bonds and T-bills has been high, and the continuing exit of FIIs has led to a bear steepening of the T-bond yield curve. We remain bearish on the LKR, as fundamentals remain weak; we forecast USD-LKR at 140.0 by end-2015.

Standard Chartered Bank has maintained its negative outlook on Sri Lanka’s Treasury bonds.

“Supply dynamics remain unfavourable, and foreign investor sentiment towards T-bonds is weak. Net issuance of T-bonds and T-bills has been high, and the continuing exit of FIIs has led to a bear steepening of the T-bond yield curve,” the bank said in its global research for the fourth quarter of 2015 released on Friday.