Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 7 September 2015 00:05 - - {{hitsCtrl.values.hits}}

Chief Operating Officer and Head of Research Danushka Samarasinghe

Investment Research Manager Asanka Ranasinghe

-Pix by Lasantha Kumara

By Himal Kotelawala

The current consumption-driven retail economy should continue to thrive, provided the new Government succeeds in implementing its stated policy on economic, education and infrastructure fronts, a leading stockbroker firm said last week.

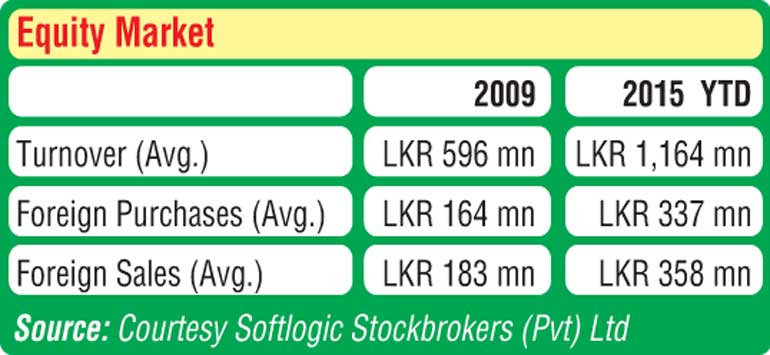

Presenting its findings vis-à-vis the country’s economy over the past five years and prospects for the future, Softlogic Stockbrokers Ltd. welcomed the new Government’s decision to allow the private sector to drive the economy, adding that things would gradually start to pick up once the electoral dust has settled and corporate players start to see some clarity in the country’s political atmosphere. Speaking at the presentation, Chief Operating Officer and Head of Research Danushka Samarasinghe said despite the equity market being volatile due to raised expectations following the change in government, over the next few years, with managed expectations and some sound corporate investment coupled with the advent of proper Foreign Direct Investments (FDIs), things will start to look up for the country.

“The common man’s economy is thriving, it’s active at 6+% growth. What is missing is corporate investment. We believe that the corporates would also enter this growth drive once they see some clarity in the political atmosphere.

They might want to see how the international markets will also settle down, but it’s just a matter of time. Maybe in a couple of months,” he said.

If the Government is successful in going to the International Monetary Fund (IMF) and renegotiating a loan to cover the country’s high cost commercial borrowings from the Chinese, that will also work in favour of the country, he added.

Commenting on the possibility of the Central Bank allowing the currency rate to drop, Samarasinghe said the rupee was expected to fall by about 2 to 3%, which, he hastened to add, is not necessarily a bad thing and that it is very unlikely that the rupee will actually crash.

“The entire expectation of the rupee to crash, that could be halted. We’re not saying it will be, but it could be. There will be a time when the West will see some sanity prevailing in the country, and there will slowly be infusion from portfolio markets. This will be sufficient to change that mindset,” he said.

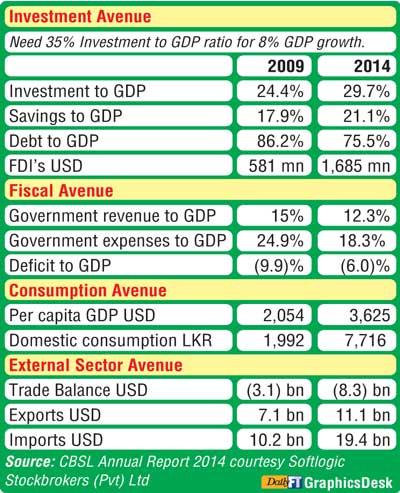

Presenting key observations over the past five years, Manager – Investment Research Asanka Ranasinghe, meanwhile, said that a majority of the FDIs from 2009 onwards were on the property side such as the Shangri-La hotel construction project.

“In 2009, FDIs were at $ 581 million; by 2014, it had only increased up to around $ 1.1 billion. It had not grown as expected due to certain mixed signals given to the investor community,” he said.

According to Ranasinghe, the controversial Expropriation Bill that was passed during the tenure of the previous administration as well as allegations of human rights violations also had a part to play in lower FDI targets.

The State was the main driver in determining investments, he said.

“It was State-driven investment expenditure, ports and highways as well as power plants. During the same era, it was giving some mixed signals to the investment community, especially the foreign investors,” he reiterated.

Elaborating on this, Samarasinghe opined that the previous Government had succeeded in laying the infrastructure that was necessary to achieve the much-publicised 7% GDP growth, which he said was, in fact, an accurate figure contrary to the scepticism expressed by some circles, though the common people did not really feel its effects.

“In hindsight, following the end of the war, the country needed some direction. The then Government had that State-driven direction. They laid the infrastructure, they had a plan, and to a certain extent, they succeeded. If they had just allowed the economy to grow on its own, there could’ve been chaos,” he explained.

The former Mahinda Rajapaksa Government was able to put some effort into developing certain sectors, said Samarasinghe.

“There could’ve been missteps, but they had it planned. They tried to boost certain industries like tourism, which they identified could grow automatically. Some say we did not achieve 7% GDP growth. We think we did. But the common people did not feel it. Those investments actually took place, and the multiplying effect was there. In that context, the country grew economically,” he said.

However, the private sector felt they were crowded out, said Samarasinghe.

“The State continued to invest and encroach on the private sector space. But even that gave the GDP a boost,” he said.

Since the change of government in January, even though nothing of significance happened in terms of investment or development projects, consumption reached unexpected levels, the speakers noted.

There were expectations from civil society, following the change in government and ideology, said Samarasinghe. Expectations were high for democratisation, civil liberty and more transparency, and for the private sector to come on board.

“We are right now in that scenario. The new Government tells us that they will allow the private sector to drive the economy, not the State sector. They can say that because the previous Government had laid the foundation for the private sector to continue,” said Samarasinghe.

Even with raised expectations for a private sector-enhanced economic prosperity, the Budget was not what the business community had expected. And then came the Parliamentary elections.

“Nothing much happened during this period. But something did happen. The State did not invest, the projects were slow, but consumption picked up, driven by the public or retail sector. Right now we’re experiencing 6%+ GDP growth with minimal State infusion,” said Samarasinghe.

Ranasinghe, meanwhile, noted economic development, infrastructure and education were three critical areas in which the Government could further develop the country.

“On the infrastructure front, we hope the Outer Circular Road and the Central Highway projects are continued. The concept of a Metropolitan City – that the Western Province will be converted to a metropolitan city – might drive the consumption angle of the economy,” he said.

Proposals on building housing schemes will also have a certain impact on consumption, he added.

On the flipside, however, this could see property prices rising in Colombo-centric areas. “We might witness the inflation level picking up. The challenge will be to keep it at a manageable level,” he said.

Investment in education – particularly spending 6% of the GDP on education – would help the country develop a skilled labour force, especially in the BPO and KPO sectors, said Ranasinghe, adding that it could also encourage more FDIs to come into the country.

“It’ll be an important element where we can compete with other countries when it comes to FDIs,” he said.

On the economic front, Ranasinghe said that certain aspects of creating development zones would address the problem of income disparity and have more room for income to be distributed among certain provinces and rural areas.

“On the positive side, on exports, if GSP Plus comes through and the fisheries ban is lifted, it’ll be a boost for the exporters,” he said.

The 45 mega zones on financial services, IT and agriculture, as envisaged in the UNP’s election manifesto, will help increase living standards of ordinary citizens, said Ranasinghe.

“Ultimately we’re expecting an increase in disposable income, standard of living and maybe income disparity to come down in the medium to longer term if these policies are successful,” he said.

Samarasinghe also believes that investment in education of utmost importance. “We’ll be able to attract more FDIs to the more knowledge-based industries and the service-oriented sectors,” he said.

Both presenters were hopeful that the economy would continue to grow over the next couple of years.

“Now that we have some modest levels of expectations, we might see a gradual upward trend. Overall, we are positive on the market,” said Samarasinghe.