Monday Feb 16, 2026

Monday Feb 16, 2026

Wednesday, 19 August 2015 01:32 - - {{hitsCtrl.values.hits}}

Firm signs of the decisive victory by the United National Front for Good Governance (UNFGG) apparently failed to produce widespread cheer in the Colombo stock market yesterday.

Some analysts were puzzled by the overall unconvincing performance of the Colombo Bourse whilst others blamed it on quick profit taking.

The initial upturn witnessed in early morning trade failed to sustain itself.

Lanka Securities said the market closed with flat returns on Tuesday amid the prospects of a hung parliament as the ruling party manage to secure the lead in the General Election, defeating the opposition led by former President.

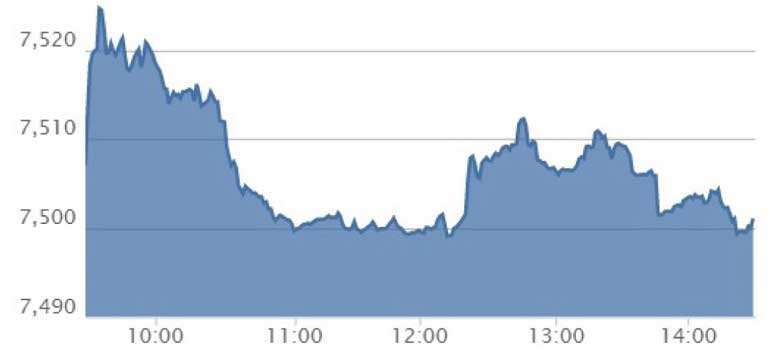

First Capital said the All Share Price Index (ASPI) reached an intra-day high of 7,526 during the first half hour and came down to a low before it jumped back to 7,508 level and closed at a weighted average of 7,499, gaining a mere seven points. It said JKH and SLTL weighed negatively on the index surpassing the positive contribution by Cargills.

SC Securities said with the conclusion of the general elections, the market projected mixed investor sentiment.

The Blue chip S&P SL 20 declined today, with the index losing 6.77 points or -0.16% to close at 4157.71.

“The broader market index closed in green whilst S&P SL20 closed in red with turnover crossing the Rs 1.5 billion mark,” NDB Securities.

Year to date ASPI Performance accounted to +2.0% while Blue Chip Index also projected a growth of +1.2% since this year’s beginning. Shares of 226 companies were traded today. Of these, 71 companies declined while 81 closed higher.

Reuters said shares ended at seven-month high on Tuesday on hopes that political stability after this week’s parliamentary polls would boost sentiment, but lack of an absolute majority for any party capped the gains.

Monday’s poll results showed the ruling United National Party (UNP)-led coalition was poised to win most of the seats, but could fall short of a majority in a 225-member Legislature.

“The market went up initially on election hopes, but short-term profit-taking slowed down the market,” Dimantha Mathew, a research manager at First Capital Equities Ltd., was quoted as saying by Reuters.

“Investors will wait to see how the government will be formed and whether the ruling party could form a stable government or will it be a hung Parliament,” Mathew said.

Reuters said a strong result for the UNP would likely help Ranil Wickremesinghe to continue as the prime minister of a centre-right government that would seek to revive stalled reforms to make the government more open and accountable.

Aides to President Maithripala Sirisena say he wants to form a broad-based national unity government, with his own loyalists from the Sri Lanka Freedom Party, that would be able to muster a two-thirds majority in Parliament to pass crucial constitutional reforms.

First Capital said in its market report said turnover and volumes improved while foreign participation stood at 21% recording a net foreign outflow during the day. Eight crossings were witnessed during the day led by DIAL trading 2 million shares at Rs. 11.90 and NTB trading 830,000 shares at Rs. 105.0.

SC Securities said Cargills Ceylon PLC which witnessed price gains of +6.76% to close at Rs. 175.20 along with other price gains in counters such as AHPL (Rs. 68.90, +5.19%), CCS (Rs. 419.80, +2.39%), CTHR (Rs. 146.60, +3.02%) and DIST (Rs. 309.90, +0.85%) mainly triggered the advancement in the Core Index.

Banking, Finance and Insurance Sector managed to record the highest turnover of Rs. 659.1m for the day, followed by the Manufacturing Sector and Beverage, Food and Tobacco Sector, with daily turnovers of Rs. 319.4m and Rs. 167.7m respectively.

Foreign investors were net sellers of a net Rs. 149.7 million worth of equities on Tuesday, extending the net foreign outflow to Rs. 1.23 billion so far this year.

NDB Securities said high net worth and institutional investor participation was witnessed in Nations Trust Bank, Dialog Axiata, Citizens Development Business Finance, Commercial Bank and Distilleries. Mixed interest was observed in Ceylon Grain Elevators, Textured Jersey Lanka and Access Engineering whilst retail interest was noted in Bairaha Farms, Three Acre Farms and Lanka IOC. Meanwhile, foreigners closed as net sellers mainly due to foreign selling in Commercial Bank.