Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 3 March 2017 00:00 - - {{hitsCtrl.values.hits}}

Norwegian Government Pension Fund Global which entered Sri Lanka in 2015 has more than doubled its investment by end of 2016.

Norwegian Government Pension Fund Global which entered Sri Lanka in 2015 has more than doubled its investment by end of 2016.

The Norwegian Government Pension Fund Global is a sovereign wealth fund, with a mandate to safeguard and administer the Norwegian Government’s revenue from the oil and gas sector. Valued at $ 890 billion, the Fund is one of the largest sovereign wealth funds in the world, currently holding about 1.3% of the world’s stocks.

On appointment by the Norwegian Ministry of Finance, the fund is managed by the Norwegian Central Bank through the Norges Bank Investment Management (NBIM). In 2015, the Norwegian Government pension fund made its first investments in Sri Lanka. NBIM has strict criteria for stability and high standards of business conduct when opening investments in a country. The fact that NBIM started to invest in Sri Lanka suggests that, the Sri Lankan investments opportunities and market standards have improved in the last years.

In 2015, the fund invested $ 31 million in Sri Lanka. NBIM has more than doubled its investment in Sri Lanka to $ 65 million by end of 2016.

The increase in investments is mostly a result of larger ownership in the companies they had already invested in.

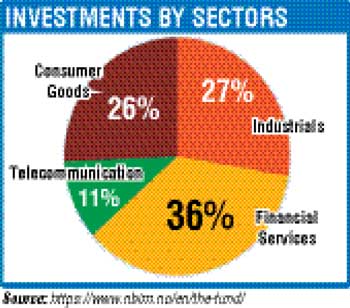

In line with the goal to reduce risks, the Sri Lankan investments are diversified across several sectors. The biggest investments have been made in the industrial and financial services sectors with 63% of the total investment.

At present 16% of the fund’s investments are placed in Asia. Japan is the biggest market with 9% of the fund’s total equity placements, while emerging economies such as China and India have respectively 2.7% and 1% of the equity placements. In comparison 0.6 % of the equity is placed in Africa.

The fund historically has invested most money in highly developed countries, therefore, 78% is placed in Europe and in North America. However, this is likely to change as the Norwegian Central Bank has indicated that they will shift more of their investments toward emerging economies in the future.

As one of the largest sovereign funds, the Norwegian Government Pension Fund Global has received global attention, and Norway has been put on the map as an international investor. The Fund is not only distinguished by its sheer size, but also by how it is administrated. NBIM conducts what they call responsible investments, meaning that all investments must be ethically justifiable. Firms that are deemed unethical by the fund’s Council of Ethics are excluded from the fund.

One of the fundamental principles of the Norwegian fiscal policy is the so-called budgetary rule. It statesthe Government may only spend the expected real return of the fund, estimated at 4% per year. This ensures that future generations will also benefit from the petroleum revenue.

It must also be noted that the Norwegian Central Bank is completely independent from the Norwegian Government, therefore, this fund is not used as an instrument of the Norwegian government’s foreign policy, or as a tool in foreign aid. The only mandate for the Norwegian Central Bank is to safeguard and ensure further growth of the fund. Therefore, the investments in Sri Lanka from the Norwegian sovereign wealth fund is an indication of the investor confidence and the potential investment opportunities that are available in the market.