Thursday Feb 26, 2026

Thursday Feb 26, 2026

Friday, 28 August 2015 01:00 - - {{hitsCtrl.values.hits}}

Reuters: China has been so surprised by the global reaction to its currency devaluation that it is likely to keep the yuan on a tight leash in the near-term to head off a currency war that could spark a broader financial crisis, policy insiders say.

Internal calls for the yuan to weaken by up to 10% since the 11 August devaluation have faded as top leaders worry that market fears of such a move could fuel further capital outflows, signs of which have intensified in July and August.

Government economists and policy advisers say the People’s Bank of China (PBOC) will now try to stop the yuan weakening much past 6.5 per dollar, which is 4.5% below its pre-devaluation levels. On Thursday morning, the yuan traded as low as 6.4162 per dollar.

“The global reaction was bigger than expected,” said a senior economist at the cabinet’s think-tank.

“The global economy is very fragile … competitive currency devaluations could in turn affect China’s own economy - undermine its exports and investment.”

Indeed, when cutting interest rates and bank reserve requirements on Tuesday, the PBOC said currency fluctuations had caused a shortfall in liquidity.

That was seen as a signal that capital outflows had accelerated since the devaluation as market investors feared China would drive the yuan lower.

An influential economist at a top government think-tank said policymakers may have underestimated the global impact from the yuan devaluation, which happened when jitters about China’s slowdown had intensified due to a stock market plunge.

“You chose the timing as the economy weakened and the stock market plunged, sending out a wrong signal to foreign countries that you want to spur the economy through devaluation and leading to competitive devaluations,” said the economist, who last month discussed policy issues with Premier Li Keqiang. “This put us on the defensive; it looks like China is the trigger.”

Premier Li was quoted by state television as saying on Tuesday that there was no basis for continued depreciation.

China ran down its foreign exchange reserves by $340 billion from mid-2014 to the end of July, which some economists see as a proxy measure of outflows. No data is available yet, but analysts think the pace quickened after the devaluation.

The PBOC will count on its war chest of FX reserves – still the world’s largest at $3.65 trillion – to defend the yuan from selling pressure as foreign investors flee the country and domestic investors convert yuan into dollars.

The PBOC did not respond to faxed questions from Reuters about its yuan policy.

China tightly manages its currency, allowing it to trade within a two-percentage point band above or below a daily target set by the central bank.

On its own, the Aug. 11 devaluation, achieved by the PBOC setting its daily reference point nearly 2% lower against the dollar than the previous day, did not look like a massive move, and came with technical changes to make the exchange rate more market-determined.

But it stoked concerns about just how weak the Chinese economy really was and, coming days after poor trade data, sparked fears it was to prop up the struggling export sector.

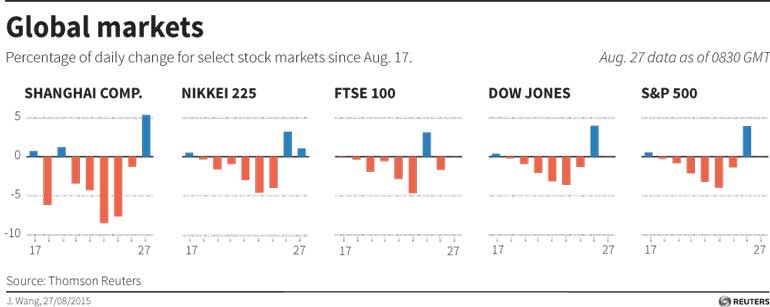

Countries including Vietnam and Kazakhstan followed suit with currency depreciations of their own, and the spillover fears roiled first markets in emerging economies and then major economies.

“The yuan is seriously overvalued from the trade perspective and it’s appropriate to let it depreciate,” said a researcher at the National Development and Reform Commission (NDRC), China’s top economic planning agency. “But the global impact is bigger than domestic impact.”

The NDRC economist expects that after a period of stability to restore calm the yuan would weaken further, especially if the U.S. Federal Reserve starts raising interest rates. But he believes the central bank will prop up the currency for now.

“The economy still faces big downward pressure. The 6.5 level should be an important bottom line.”

Cao Yuanzheng, chief economist at Bank of China, estimates that the yuan would have to weaken by at least 10% to have a meaningful impact on exports. And China’s status as the world’s largest trading nation – it overtook the United States in 2013 – means it needs to be aware of its influence.

“The renminbi is becoming an ‘anchor’ currency now. Its stability will have a big impact on other currencies,” he said.

While the PBOC still wants to free up the currency further, in part to enable the yuan to be used by the International Monetary Funds for its Special Drawing Rights (SDRs) unit of account, policy insiders say it understands the need for stability now.

“The central bank hopes to push market reforms, but they also worry that there may be sharp volatility and big pressure on the yuan in the short term,” said an economist at a top government think-tank. “If the yuan falls further, other currencies may fall more sharply.”