Saturday Feb 21, 2026

Saturday Feb 21, 2026

Saturday, 25 March 2017 00:00 - - {{hitsCtrl.values.hits}}

By D.C. Ranatunga

Exactly 30 years ago today – 25 March, a new bank was born. ‘A Truly Sri Lankan Bank for Sons of the Soil’ it was claimed. The bank had two names – ‘Investment and Credit Bank Limited’ in English and ‘Sampath Bankuwa’ in Sinhala. At least till the Central Bank ruled that there can be only one name. Then it was decided to use Sampath Bank in all languages.

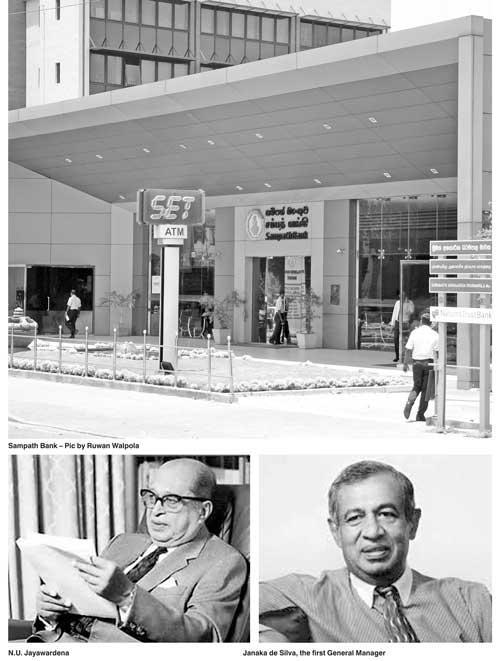

The bank was the brainchild of N.U. Jayawardena, seasoned banker and entrepreneur and one time Governor of the Central Bank.

The idea originated at a meeting of the Working Committee of the 13th Conference of the World Fellowship of Buddhists (WFB) in November 1980 held in Thailand. Well-known Sri Lankan businessman, Albert Edirisinghe (later Ven Ganegama Devamitta) was in the chair.

After a lengthy discussion on the plight of Buddhists in the Asian region in obtaining finances for business activities, the Committee passed a resolution calling for “the establishment of an international bank for the purpose of providing assistance and expertise to Buddhists for entrepreneurial activities on lines which are inoffensive to man and nature as clearly enunciated in Buddhism.”

Following President J.R. Jayewardene agreeing in principle to cooperate in setting up such a bank in Sri Lanka and the endorsement of the resolution by the parent body of the WFB in the following year, the stage was set to go ahead. N.U. Jayawardena (NUJ), who was chairing the Socio-Economic Standing Committee of the WFB, co-opted several experienced hands in banking and legal matters and set the ball rolling.

NUJ picked two experienced bankers, Ernest Gunasekera and Janaka de Silva, to attend to the administration including selecting staff. Both had contacts in the banking sector and identified personnel who would be useful for a new bank. Most of them were from Bank of Ceylon. While Ernest G refused a seat on the Board of Directors (he preferred to continue the assignment he had with an American bank, Janaka de S came in as General Manager. An eight-member Board was appointed with NUJ and Chairman.

Doing something different

I discussed the early days with Janaka when I was picked to do a coffee table book to mark the 25th anniversary.

“It was most challenging. We were challenging the existing banking system and we wanted to do something different. Our objective was to offer the customers something new – something they had not experienced earlier. Our motto was ‘Innovation’,” he said. “We wanted to offer full services to the customers for longer hours. The bank was to open at 9 in the morning and be open for business till 3 in the afternoon – one and a half hours more than the other banks and a ‘first’ for Sri Lanka.”

Information Technology (IT) being Janaka’s forte, he was keen to see that all operations were automated to the fullest possible extent. The bank was totally computerised right from the start. All branches were to be computer-linked with the Head Office. As the bank expanded, the concept of ‘uni-banking’ was introduced whereby a customer could transact business at any of the bank’s branches. It was a ‘first’ for South Asia.

Even in recruitment preference was given to youth. There were not going to be any peons.

Kumar Weerasuriya, who came to be well known in the financial sector, was the first to be recruited. He told me how NUJ wanted him to come to his residence at Cambridge Place one early afternoon, and how he was interviewed by NUJ “in his unique silk pyjama outfit”. NUJ told him that he would be will double the salary he was getting but would have to work treble the amount he was used to. Kumar W accepted the offer and started work on 1 January 1987 as Manager – Operations and Branch Manager – City Office.

Advertising campaign

The bank’s advertising campaigns were soon to become the talk of the town. They were so innovative. The man responsible was Irwin Werrackody, Phoenix Advertising Managing Director. He recalls his first meeting with NUJ.

“One day, early in the morning, the telephone rang. The voice at the other end asked, ‘are you so-and-so?’ When I said ‘yes’, the voice went on: ‘My dear chap, are you free to see me today at 5 o’clock at my house?’ It was NUJ at the other end. I was at his residence sharp on time and was ushered into his library. NUJ talked non-stop. It was like a gushing cascade. It was all about his vision for the proposed bank. After holding forth for nearly 40 minutes, he abruptly shot at me, ‘how would you set about getting a campaign going?’ He was adamant.

I was no magician to produce rabbits out of top hats. A rabbit, however, came to my rescue. I asked NUJ for a piece of paper and sketched something that looked like a tortoise. For all I know, it may have looked like a frog. I wrote an instant headline: ‘The hare and the tortoise’.

‘This is the way I would like to commence the campaign,’ I explained. The idea was that although a late starter in the banking landscape, we would not take anything for granted like the proverbial hare.

NU chuckled delightfully and approved with his characteristic gesticulation of the right hand. We had clicked.”

The introductory advertisement used the headline ‘The Hare and the Tortoise’. The text read:

1987 will witness the birth of a progressive new chapter in the banking story with the establishment of Investment & Credit Bank Limited. We may be a late starter on the banking scene but we have not taken anything for granted, like the hare in the proverbial fable.

We have formulated dynamic, innovative and flexible but sound banking policies which place due emphasis on human capital and on strategies designed to revitalise banking in Sri Lanka.

A series of ads followed explaining the services and products. Those introducing each branch were unique. Each had a catchy headline and an arresting picture. ‘Personally Yours at Chatham Street’ had a picture of the street. ‘Kiri-Peni’ with pots of curd announced the opening of the Matara branch. ‘In a Nutshell’ introduced the branch in Kurunegala with a heap of coconuts each cut into two. ‘In stream at Wattala’ depicted the Dutch canal. ‘Pettah – the Cradle of Businessmen’ featured leading businessmen of the past.

A happy man

NUJ was happy with the progress. He summed up the philosophy of the bank: “The bank must be innovative in the product range it offers the customers; it must remain dynamic in operations; and it must be exemplary in its banking service.”

In the Chairman’s Report 1986 he stated: “The wealth of a bank consists of satisfied customers, be they depositors, customers and borrowers. The bank acts on the principle of waiting on, instead of waiting for, and that the business success of a customer, apart from the elusive element of luck, lies in the combination of human capital with finance capital. The bank’s aim is to conjoin these two essential components together and develop creditworthy customers.”

Customers felt homely at Sampath. They felt it was close to their hearts. They considered it their bank and felt comfortable to walk in and transact business.

“Operations are fully computerised yet we do not lack the personal touch,” Sampath assured. The customers believed.

Over the 30 years the bank has jumped ahead of many others. That’s another story.