Saturday Feb 21, 2026

Saturday Feb 21, 2026

Saturday, 23 July 2016 00:00 - - {{hitsCtrl.values.hits}}

Janaka de Silva

By D.C. Ranatunga

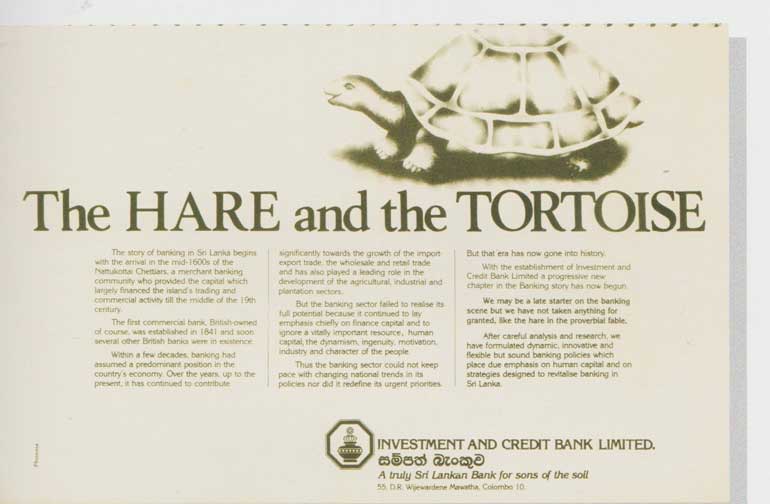

One morning nearly 30 years ago, readers opened the newspaper and saw an unusual advertisement re-relating the story of the race between the hare and the tortoise. We had heard the story as children and it had come down the generations. The odd thing was that it was an advertisement by a bank.

“We may be a later starter on the banking scene but we have not taken anything for granted, like the hare in the proverbial fable. We  have formulated dynamic, innovative and flexible but sound banking policies which place due emphasis on human capital and on strategies designed to revitalise banking in Sri Lanka.”

have formulated dynamic, innovative and flexible but sound banking policies which place due emphasis on human capital and on strategies designed to revitalise banking in Sri Lanka.”

My mind went back to the advertisement when I read about the recognition of Sampath Bank by the prestigious Business Magazine, ‘The Euromoney’ as the ‘Best Bank in Sri Lanka 2016’ and by ‘World Finance’ as ‘The Best Retail and Commercial Bank in Sri Lanka 2016’ coinciding with the bank’s 30th year. It has been a challenging journey over three decades, reaching the zenith among many hardships. Today the bank boasts over 225 branches throughout Sri Lanka, providing a superlative service covering a wide range of customers. It is also well-known for its innovative approach.

Incorporated as ‘Investment and Credit Bank Ltd.’ in March 1986, for the convenience of the average customer, the bank’s name in Sinhala from inception was Sampath Bank. When the Central Bank objected to the bank not using the direct translation of the English name under which it was incorporated, the name was changed to ‘Sampath Bank Ltd.’ in September 1987.

Having been invited to produce a publication to mark the 25th anniversary of the bank, I got an opportunity of delving into the history of the ‘Truly Sri Lankan Bank for the sons of the soil’. I met some of the pioneers responsible for the setting up of the bank. Most of them are no longer around.

Formation of the bank

What paved the way for the formation of the bank was a resolution passed at the working committee of the 13th Conference of the World Fellowship of Buddhists (WFB) in November 1980. The renowned Sri Lankan businessman Albert Edirisinghe (later he donned robes as Bhikkhu Ganegama Devamitta), who was presiding over the meeting held in Chiang Mai in Thailand, highlighted the tremendous hardships faced by Buddhists in the region in getting financial assistance from banks for entrepreneurial activities.

The resolution adopted by the Standing Committee recommended that one or more Buddhist countries should take steps to establish an international bank to provide capital to Buddhists for such activities “on lines which are inoffensive to man and nature as clearly enunciated in Buddhism”. The resolution was later endorsed at a conference in Colombo in June 1982 by participants of 17 countries followed by the 14th Conference of the WFB in August 1984.

The onus fell on Sri Lanka, as the mover of the original suggestion, to find ways and means of setting up the bank. A Standing Committee was formed and N.U. Jayawardena was invited to head it. Experienced banker and entrepreneur that he was, NUJ picked two senior bankers – Ernest Gunasekera and Janaka de Silva – to organise the administration and pick the staff.

Ernest G told me NUJ gave him a free hand, entrusting all banking matters to him. Both of them had one thing in common – both were from Tangalle. “Spending half an hour with him, one could learn a lot. I remember him telling us how he used to study the dictionary – one word a day, as he waited at the railway station during his student days at St. Aloysius College. He used to travel from Talpe to Galle by train,” Ernest G reminisced.

The early days

Recalling the early days when there wasn’t even a typewriter to begin work, the Convenor of the Standing Committee Palitha Kannangara said how Metropolitans gave a Brother typewriter. “The biggest hurdle to clear was the collection of funds to float the bank. Will you believe if I tell you that we sent out seven thousand letters to people all over the country? We appointed 151 agents to look for investors.” Joining him in the campaign to meet the agents was Premasara Epasinghe, sports journalist/popular cricket commentator turned bank executive.

The first General Manager, Janaka de Silva related how the initial lot worked under trying conditions with very limited resources. “We were challenging the existing banking system. We wanted to be different to the other banks. Our objective was to offer something new to the customers – something they had not experienced before. Our main slogans were ‘Innovation’ and ‘Customer Convenience’.”

It was an interesting story by the first employee, banker Kumar Weerasuriya. “NUJ interviewed me early afternoon one day at the Cambridge Place residence in his unique silk pyjama outfit,” he recalled. “He told me I will be paid double the salary but I will have to treble the amount I was used to. I knew it was going to be challenging to work in a bank that was just being set up.” Kumar W decided to join.

After the incorporation of the bank under the Companies Act, it received Central Bank approval recognising it under the Finance Act No. 65 of 1961 and as an authorised dealer under Section 4 of the Exchange Control Act No. 24 of 1953, with effect from 3 March 1987.

The first Board of Directors comprised N.U. Jayawardena (Chairman), Albert Edirisinghe, President’s Counsel Dunstan de Alwis, Attorneys-at-Law A.N.U. Jayawardena and Walter Wimalachandra and Company Directors Stanley William and Dr. Seevali Ratwatte.

Innovation to the fore

Discussing the bank’s philosophy, NUJ in his first statement at the end of 1987 said that the bank “must be innovative in its product range it offers the customers, it must remain dynamic in its operations, and it must be exemplary in its banking service.” Looking back, the bank has stood by these.

From inception, the bank offered a full service to the customers who straightaway found the longer hours that the bank was kept opened was a bonus. While the other banks were open from 9 a.m. till 1:30 p.m., Sampath opened at 9 and went on till 3 in the afternoon. Extended hours were nothing new in other countries. Janaka de S pointed out how in Hong Kong banks were operated in two shifts – 9 a.m. to 3 p.m. and again from 5-7 in the evening.

The bank was totally computerised right from the start, making it more efficient. All branches were to be computer-linked with head office. As the bank expanded, the concept of ‘uni-banking’ was introduced whereby a customer could transact business at any of the bank’s branches. It was yet another ‘first’.

Unique advertisements

Communications played a vital role in creating awareness of the ‘new style’ bank. The advertising campaigns handled by Phoenix Advertising were innovative. Phoenix Managing Director Irvin Weerackody recalled how one day he got a call from NIJ wanting to him see NUJ at his residence at 5 p.m.

“I was there sharp at 5 and I was ushered to the library. NUJ talked non-stop. It was like a gushing cascade. It was all about his vision for the proposed Sampath Bank. After holding forth for nearly 40 minutes, he abruptly shot at me, ‘how would you set about getting a campaign going?’ He was insistent,” Irvin W told me.

He continued: “I was no magician to produce rabbits out of top hats. But a rabbit came to my rescue. I asked NUJ for a piece of paper and sketched something that looked like a tortoise. For all I know, it may have looked like a frog! I wrote an instant headline: ‘The hare and the tortoise’. I told NUJ that’s the way I would like to start the campaign. ‘The idea was to say that although a later starter in the banking landscape, we would not take anything for granted like the proverbial hare’, I told him. He chuckled delightfully and approved with his characteristic gesticulation of the right hand. We had clicked,” he told me.

Sampath campaigns became the talking point. They were simple, inventive and catchy. I used them as examples during my lectures to university students doing Mass Communications. The advertisements about share issues, branch openings and services proved to be most effective.

‘The Challenge’

Once the groundwork was done, the rest followed. For the publication, ‘The Challenge’, we captured the success story with meaningful photographs, interviews and comments from the staff, customers, entrepreneurs who owed their success to the flexible terms given by the bank and institutions that benefitted from its CSR projects. How the bank progressed is recent history.

The final chapter in ‘The Challenge’ was an interview with the then Managing Director-designate Aravinda Perera who had by then completed 24 years with Sampath. I asked him about the future. He talked about the huge responsibility the top management had in ensuring that the corporate management is moulded into a single unit working together towards a single goal. “True leadership should emerge within the corporate management to take over from us. I am very keenly looking forward towards that because the baton has to be handed over in the future.”

The results and accolades received by the bank speak for themselves.